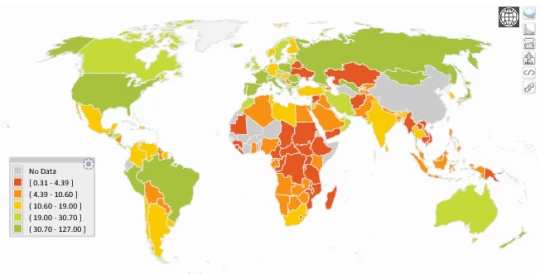

GPFI: 2011 Branch Penetration Map

The ascent of financial inclusion in the policy agendas of governments and international organizations has been swift, to say the least. Its rise has been accompanied by a torrent of financial inclusion data, from supply-side indicators of bank branch penetration, to demand-side measures of the usage of formal accounts, to wide-ranging data on finance at the firm level. Yet with all these different datasets floating around, it has often been difficult to arrive at a holistic understanding of the financial inclusion landscape in a particular country, or develop international standards of measurement and monitoring. With the release on April 21st of the G20’s Financial Inclusion Data Portal showcasing the ‘G20 Basic Set of Financial Inclusion Indicators’, we hope that that will change.

The GPFI Basic Set of Financial Inclusion Indicators data portal provides open data on access to and usage of financial services in 192 countries, bringing together data from a variety of sources. It allows users to understand better how individuals and firms use financial products and the accessibility of financial institutions in a given area. Users of the data portal can download the complete set, view aggregate statistics, or customize graphs, maps and tables to suit their needs. The effort is led by the G20’s Global Partnership for Financial Inclusion (GPFI) and it’s implementing partners (Alliance for Financial Inclusion (AFI), CGAP, IFC and the World Bank).

Let’s take Argentina as an example. Users of the Argentina country page will find aggregates for the ‘Basic Set’ indicators for the most recent year of data available. Beyond this snapshot, users can also view graphical representations of the five ‘Basic Set’ indicators: (i) individual accounts, (ii) individual credit, (iii) SME accounts, (iv) SME credit, and (v) branch penetration. Each graph compares the indicator’s value for Argentina with its regional average (in this case, Latin America and the Caribbean) and the income group average (in this case, Lower Middle Income countries). For instance, users will learn that while 31 percent of adults in Argentina have formal accounts, over 96 percent of SMEs have accounts. The page also illustrates the change in bank branch penetration over time for Argentina, using a dynamic map. Some users may want to view the data behind the graphs for themselves: each graph contains a link to download the data that went into making the graph.

Users can also break down the data by individual indicators or topic. The home page contains a link to each of the five ‘Basic Set’ indicator pages. Each indicator page not only describes the indicator, but also contains graphs of the indicator along with figures broken down by income, gender and size of firms (where applicable). The page also displays all indicators for which we have open data available under that particular indicator category or topic.

Open data on the ‘Basic Set’ provides useful tools for policymakers, private sector leaders and academics to design and reform policies to advance the financial inclusion agenda. But we know that financial inclusion has many dimensions that are not covered by the Basic Set, which is why the Alliance for Financial Inclusion (AFI) and the GPFI sub-group on financial inclusion data and measurement is currently developing an ‘Additional Set of Financial Inclusion Indicators’ to provide a more complete assessment of the financial inclusion landscape globally. The ‘Additional Set’ will improve our understanding of the regulatory, institutional, and enabling environment related to the use and provision of financial services.

The GPFI highlights that this data aims to facilitate country-led actions to address financial inclusion and develop their own financial inclusion strategies. The ultimate goal is that countries collect their own data, taking into account their unique contexts and priorities in the realm of financial inclusion and development. The GPFI data portal is meant to motivate, not substitute for, these efforts.

We hope many users will take advantage of the Basic Set website and the database to delve deeper into the financial inclusion landscape both globally and nationally. We encourage you to view and download the data on the GPFI Basic Set website or customize it to suit your needs directly from the data portal.

Related links:

Join the Conversation