Precious metals prices continued their three-month long uptrend amid the COVID-19 pandemic. Demand for gold has been buoyed by safe-haven buying and global policy support in response to the pandemic. Silver and platinum have benefited from a rebound in industrial activity following an easing of containment measures. Precious metals prices are expected to average 13% higher in 2020 relative to 2019 on expectations of strong demand due to heightened global uncertainty and ultra-low real interest rates. Upside risks to this outlook include a second COVID-19 wave causing a sharper-than-expected global slowdown. On the downside, a stronger U.S. dollar could push prices lower.

Precious metals prices strengthen amid uncertainty and robust demand

Source: World Bank

Note: Last observation is June 2020.

Gold

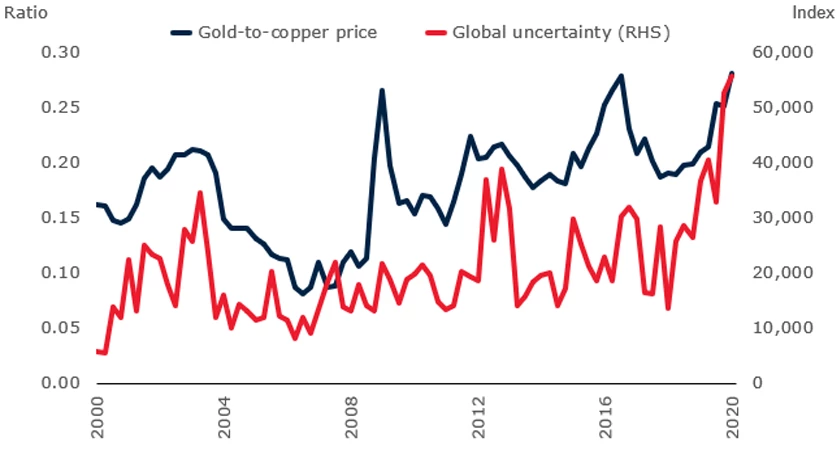

Gold prices continue to edge higher, reaching an all-time high of US$1,902/toz on July 24. Gold prices benefited from strong demand for safe-haven assets following record-high global uncertainty and widespread negative economic data arising from the COVID-19 crisis. The gold-to-copper price ratio—a barometer of global risk sentiment—reached a 40-year high in April.

Record-high global uncertainty in 2020Q1

Source: Bloomberg, World Bank, World Uncertainty Index (Ahir, Bloom, and Furceri, 2018; available at https://ssrn.com/abstract=3275033.

Note: “Global uncertainty” refers to the GDP-weighted World Uncertainty Index (WUI), which covers all economies. The index is computed by counting the word “uncertain” (or its variant) in Economic Intelligence Unit country reports. A higher (lower) number indicates higher (lower) uncertainty. Last observation is 2020Q1.

Moreover, central banks around the world have aggressively eased monetary policy, and governments have implemented fiscal stimulus at unprecedented pace and scale to mitigate the pandemic-induced global recession. Long-term U.S. real interest rates have fallen to negative levels and the amount of government bonds in negative yielding territory has risen.

Gold prices continue to rise in June as real interest rates decline

Source: Bloomberg, Federal Reserve Bank of St. Louis, World Bank

Note: The interest rate is the 10-year U.S. Treasury inflation-indexed security with constant maturity (not seasonally adjusted). Last observation is June 2020.

Silver and platinum

Silver and platinum prices rebounded strongly after a collapse in mid-March. Silver prices jumped to US$22.9/toz on July 23, a seven-year high. Industrial activity is gradually recovering following a relaxation of lockdown measures in several countries. Silver is widely used in various industrial applications, such as in electrical and electronics. Demand for platinum, however, has not recovered as fast as silver due to weak automotive demand. The auto sector, the largest consumer of platinum, has been hit hard by the pandemic with widespread plant closures.

Silver and platinum prices staged a remarkable recovery

Source: Bloomberg, Haver Analytics, World Bank

Note: Last observation is July 23, 2020.

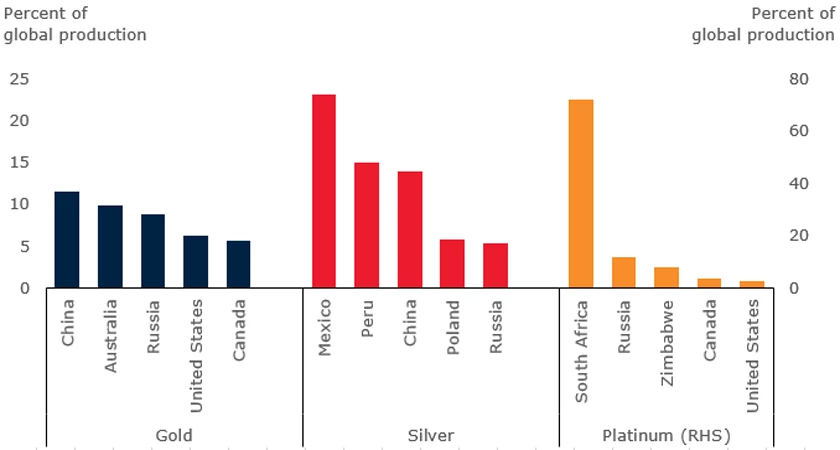

Supply disruptions have also supported silver and platinum prices. Silver production has been heavily affected by mine shutdowns due to COVID-19, particularly in Latin America. Mexico and Peru together account for almost two-fifths of global production. Meanwhile, mine closures in South Africa, the world’s largest producer of platinum, and an explosion at a large smelting plant unrelated to the pandemic have significantly reduced its supply.

Top precious metals producers in 2019

Source: Metals Focus, Silver Institute, World Bank, World Bureau of Metal Statistics, World Gold Council World Platinum Investment Council.

RELATED

Roller coaster ride for metals amid the COVID-19 pandemic

Agricultural raw materials prices weaken amid COVID-19

Mixed results for fertilizers amid COVID-19 panic

Join the Conversation