The ICP blog series explores ideas and issues under the International Comparison Program umbrella – including innovations in price and data collection, discussions on purpose and methodology, as well the use of purchasing power parities in the growing world of development data. Authors from across the globe, whether ICP practitioners or researchers making use of ICP data, are encouraged to submit relevant blogs for consideration to icp@worldbank.org.

Earlier this summer, new data published by the World Bank showed that the Gross Domestic Product (GDP) of India had recently surpassed that of France, and that it was on track to overtake the UK economy too. Many news outlets jumped upon this new ranking of India’s economy, now sixth from top. But most media articles did not mention that the World Bank’s other measure, which compares GDP across countries using purchasing power parities (PPPs), has placed India ahead of both France and the UK for the last 25 years.

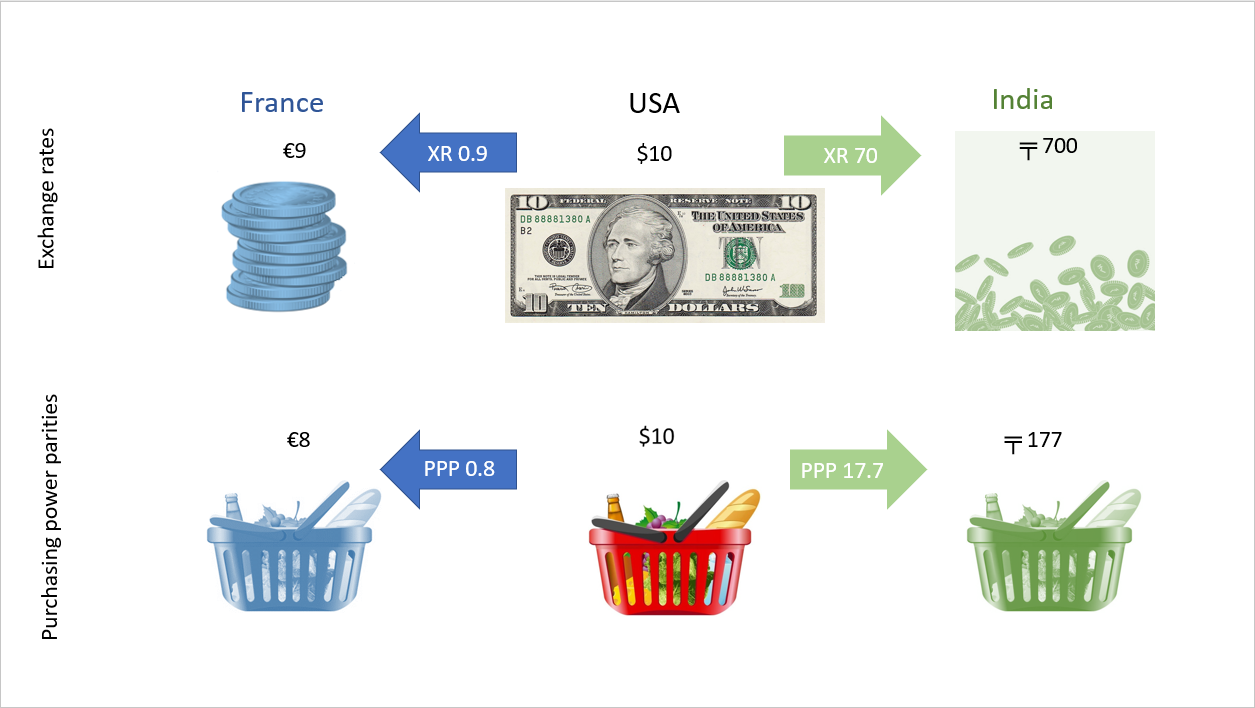

July’s data release showed national GDPs quoted in US dollars using market exchange rates (commonly abbreviated to “Xr”). But these exchange rates do not take into account the relative cost of goods and services in a country. For the purpose of estimating the relative cost of living and sizes of the world economies, the International Comparison Program (ICP) compares the prices of common goods and services across the globe, applies appropriate expenditure weights, and calculates purchasing power parities for nearly 200 countries across six regions.

The resulting PPPs show that a basket of goods costing $10 in the USA would cost 8 euros in France, and 177 rupees in India. But when market exchange rates are used, a $10 bill provides 9 euros in France, and around 700 rupees in India.

A basket of goods and services in India, as measured through the ICP, is relatively cheap compared to the same basket in the USA and France. Someone exchanging $10 for rupees at a bank or money exchange in India would be able to buy around four baskets locally with her ╤ 700, while her ten-dollar bill would buy just one such basket in the USA.

Thus, when we compare India’s whole economy with that of France by calculating GDP in PPP international dollars, rather than using US dollars from market exchange rates, we find that India’s economy surpassed that of France in 1993 and is now well over three times as large. And we also find that India's economy is the third largest in the world under PPP terms, higher than Japan, Germany and the United Kingdom, all of which it lags in exchange rate terms.

Join the Conversation