As I mentioned in my previous blog, a renewed focus on Anti Money Laundering and Combatting the Financing of Terrorism (AML-CFT) regulations in Australia, the UK, and in the USA are impacting banks and MTOs.

Three effects on the remittance markets are observed. First, Banks stopped offering low cost remittance services. Second, banks closed accounts of MTOs. Two major banks, the Commonwealth Bank and the National Australia Bank, have closed already the accounts of MTOs in Australia. Recently, Westpac announced that it will close the bank accounts of MTOs serving Somalia by the end of this month. And third, small MTOs also closed since they could not any longer operate without bank accounts.

These developments in the remittance markets increase remittance prices, reduce competition and encourage the use of informal channels.

The closing of bank accounts has affected remittance costs in the Pacific Islands.

The cost of sending remittances from Australia to the Pacific Islands, such as Fiji and Samoa, is high, above 10%. Sending remittances through banks is more expensive than through MTOs.

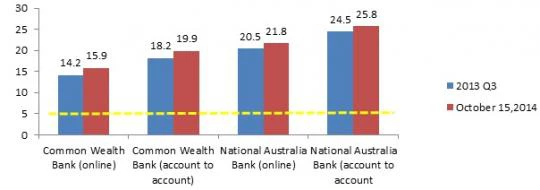

Most large banks continue to offer remittance services through online and account-to-account operations. However, the costs of sending remittances using these banks have increased. Their costs are far higher than the 5% target of the G20 (see figure 1).

Figure1. Remittance costs of major banks which closed bank accounts of MTOS have increased costs of sending AUD 200 from Australia to Fiji

Source: Remittances Prices Worldwide database. Third quarter 2013

No data was reported for these banks in the Third quarter 2014 in this database

Send Money Pacific. Updated on October 15, 2014

There has been less competition in the remittance markets. According to a paper prepared jointly by the Pacific Financial Technical Assistance Centre (PFTAC), Pacific Financial Inclusion Programme (PFIP), the Pacific Islands Forum Secretariat (PIFS) and the World Bank Group (WBG), “the number of agents across the Pacific able to send and receive remittances from Australian money transfer providers has since decreased by some 50-60% from its former six thousand odd, and continues to decline.” It also seems that Australian banks are using their market position when closing the bank accounts of MTOs to eliminate competition since these companies operate in the same remittance markets.

The closing of the bank accounts will encourage the use of informal channels in Somalia. According to the Australia 2011 Census, there were 5,687 Somalia-born people in the country. About 49.1% were aged 25-44 years. Westpac was the last bank to service MTOs transferring remittances to Somalia. The account closure will impact migrants’ families living in Somalia who rely on remittances for their living expenses. Since Somalia does not have alternative channels to send remittances, migrants will use informal channels. It will be more difficult to track and monitor suspicious activity of these informal channels.

Join the Conversation