The Gulf Cooperation Council (GCC) states comprising of Saudi Arabia, United Arab Emirates, Bahrain, Qatar, Kuwait & Oman, have gained a unique status from the perspective of migration and the international mobility of labor. What makes the Region distinctive is the fact that migrant population forms a majority of inhabitants.

While the finding of oil resulted in substantial wealth creation for these countries, Governments understood that oil wealth must be used to build a strong post-oil economy. This led to Gulf countries launching ambitious large-scale modern infrastructure projects. A major requirement for implementing this plan was the availability of work force. This was addressed by importing both skilled and unskilled workers from the developing countries, particularly Asia.

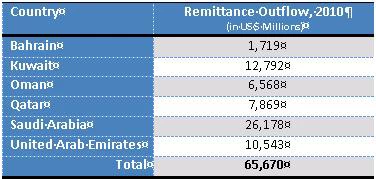

Adding to this uniqueness is the kafala (sponsorship) system followed across the GCC, which would mean that the migrants would still retain strong ties in their home countries. This has resulted in the Region being one of the major contributors of remittances to Developing Countries. These Migrant Remittances which the workers send back to their home countries serve as a significant source of capital for development. According to IMF, the outward remittance from GCC is estimated at US $65.6 Billion in 2010 (ref: Table 1: Remittance Outflow from GCC, 2010). The Gulf – South Asia corridor is considered to be the second largest market for remittance flows after USA – Latin America.

Table 1 - Remittance Outflow from GCC, 20101

A significant portion of the remittance flows, from the Region, are channeled through Remittance Houses, also called Exchange Houses. These remittance houses offer a cost effective, safe and convenient mode to these migrants to send money back home. Thanks to the intense competition, remittance market in GCC is one of the matured in terms of competitive pricing and technology adoption. For reference, the normal market price, in GCC, for sending average principal size of USD 350 is around 1.9 % of the send amount only.

Future Outlook

The GCC states continue to diversify their economies into various new sectors including tourism, finance, infrastructure etc, in order to reduce the dependence on oil. A rough estimate of value of the ongoing projects in the region stands at $452b . Apart from these ongoing projects, most of the GCC states have announced major plans for converting their countries into world class hubs. $1.5 trillion worth of investments were planned for the second decade of the millennium in the region . Some of the noteworthy projects include Saudi Haramain Railway ($10b), UAE Etihad Rail ($10b), Gulf Railway ($19b), Qatar 2022 Fifa World Cup ($67b), UAE Al Maktoum Airport ($50b), Qatar New Doha Airport ($11b).

Impact on Remittance Flows

This infrastructure spend would mean that the outlook is good for renewed labor migration and consequently, for worker remittance flows. Three other contributing factors to this are

1. Send Country Initiatives – Central banks in the region have pursued legislations to promote financial inclusion and bring most of the population under the purview of formal banking channels. The initiatives run by the regulators are without loosening controls on the remittance players thereby boosting the customer confidence in using these institutions. For reference, the transparency in terms of transaction fee and exchange rate is high and hence the remitters are well informed.

2. Recipient Country Initiatives – There is renewed focus from the recipient countries like India, Bangladesh, Pakistan, Philippines etc. to encourage migrants to remit money through formal channels like exchange houses and banks.

3. Formalizing Wage Payments – There is a focus in the GCC towards formalizing the wage payment methods. UAE recently implemented the Wages Protection System (WPS), by which salary disbursals are done through electronic channels. The success of UAE’s WPS has resulted in other Gulf States planning similar mechanisms. Consequently, such systems will also help in diverting remittance flows to formal channels.

All these factors combined with the changes in the technology used for money transfer support the projection of remittance flows growing 14% to reach $75b in 2011.

1From Migration and Remittances Factbook 2011 and extrapolations from known sources.

Join the Conversation