To advise governments on how to get from here to there, Laurence Carter, Senior Director of the World Bank Group’s Public Private Partnerships Group, and other leaders from around the world shared their ideas during high-level strategy sessions.

Developing Asian infrastructure

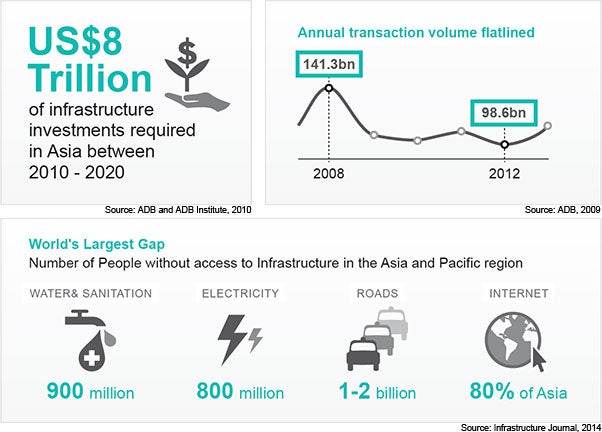

To initiate a conversation on infrastructure project opportunities throughout Asia and how to bring them to completion, Carter and two other speakers detailed the global context as well as specific, promising approaches to develop a strong pipeline of PPP projects. For background, Carter mentioned that the levels of private participation in infrastructure in the region are low, explaining that the total amount of infrastructure investment is also low worldwide. As a partial remedy, he suggested that we need to encourage the development of expertise and management – rather than focusing solely on the flow of money – from the private sector.

Standardized contractual language would also be a step forward, Carter suggested. Because major issues recur in PPPs, template text that could be tailored as required would help streamline the process. At the request of the G20, the World Bank developed a first set of such standardized PPP contracts which have been shared with various private sector players in Singapore. He proposed calling them the “Singapore Principles.” In addition, to support PPPs, the World Bank Group encourages a joint approach among development partners. Carter gave four examples of how the World Bank Group and other multilateral development banks can provide support, including

- Offering a fiscal impact tool;

- Providing disclosure guidelines on the PPP process, contract, and performance;

- Distributing information about project pipelines (a project being implemented by the Asian Development Bank); and

- Professional certification on PPPs (an innovation of the Asian Development Bank, European Development Bank, Inter-American Development Bank through its Multilateral Investment Fund, Islamic Development Bank, and World Bank Group, delivered by APMG and funded by the Public-Private Infrastructure Advisory Facility).

Regional perspectives on developing a PPP pipeline

Cosette Canilao, Executive Director, Private Public Partnership Center of the Philippines, shared some of the key success factors for PPPs in the Philippines, emphasizing the critical role of political support and the importance of developing local capacity. Furthermore she emphasized how the Philippines enacted an executive order to ensure they could hire experienced PPP advisors, and she talked through the process that preceded this development. Throughout her remarks, she underscored the crucial role the national PPP unit plays in bringing together the different stakeholders. This has resulted not only in past success but in an ambitious ongoing PPP program: the country is launching 14 projects in sectors including airports, water, toll roads, and tourism.

Throughout the question and answer session, the moderator, Lee Seng Chee, Partner, Capital Projects & Infrastructure, PwC Singapore, fielded several questions about the need to develop appropriate government support mechanisms. The panel also stressed the importance of ensuring at the outset that PPP projects have a balanced approach between the risk transferred and government support mechanisms, and the role that permitting, standard contractual clauses, experienced advisors, and other elements of the process play in the development of a more robust PPP pipeline. For more information about Singapore’s infrastructure capabilities, visit IESingapore’s website.

Join the Conversation