Photo: Pixabay Creative Commons

Solar power is experiencing a surge in popularity across the globe. It prevents carbon emissions, helps diversify the power generation mix, reduces dependence on fossil fuels, and can increase off-grid energy access.

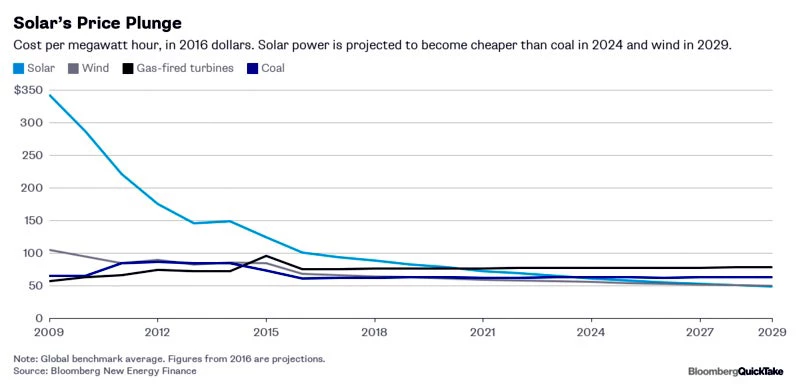

With falling costs of solar photovoltaic (PV) technology, advancing storage technology, and grid integration, prices for solar PV electricity have been falling rapidly around the world and solar is now in many countries price competitive with traditional energy sources and has become particularly attractive for developing countries.

In addition to direct or indirect government support through public financing or fiscal incentives, many countries have introduced regulatory and pricing policies such as targets and quotas, feed-in tariffs (FiTs), and competitive auctions, which have spurred some of these developments:

1. Renewable energy (RE) targets have been used by almost all countries to scale up the RE share in the energy mix. They are a crucial policy signal for investment and are increasingly included in nationally determined contributions (NDCs) submitted under the Paris Agreement.

2. To achieve RE targets many countries require utilities to get specific amounts or percentages of their electricity sales from RE. These quota systems exist in many different variations worldwide and are often supported by tradable RE certificates. The RE support system in Chile—a solar PV leader in Latin America with 2.11 GW installed capacity in 2017—uses this approach alongside with auctions and other incentive mechanisms, and mandates severe penalties for non-compliance by utilities.

3. Feed-in tariffs (FiTs) set by the regulator and similar instruments used to be the preferred regulatory mechanism globally to boost deployment of solar PV through private investment as they provide a stable and predictable policy environment. FiT guarantee the purchase of generated RE under long-term contracts at a tariff set by the regulator and are often combined with facilitated grid access and dispatch. In Germany, FiTs were a key element of the RE incentive scheme for many years and led to the major growth of solar PV ( 42.39 GW installed solar capacity in 2017). Based on the German Renewable Energy Law, the system guarantees RE producers an attractive fixed return on investment that now decreases at regular intervals over a period of 20 years. It mandates priority grid access and dispatch and is financed by consumers through their electricity bill.

4. With solar PV maturing and markets growing, price discovery through competitive auctions with long-term contracts has become the most rapidly expanding way to procure utility-scale solar PV for fixed quantities.

Here are some trends related to solar auctions:

- Competitive solar tenders have decisively contributed to rapidly declining solar PV prices across the globe. In Saudi Arabia, an October 2017 auction resulted in a new record low for solar PV with one bid at 1.79 US cent/kWh. Solar prices are, however, not fully comparable because of country-specific factors and different parameters of each auction.

- While tender schemes open up flexible and innovative design options (e.g. time blocks, storage components), the quality of the design and implementation is crucial to the success of competitive tenders. In Chile, an energy auction in November 2017 received the lowest price for solar in the region with 2.15 US cent/kWh after the tender process was amended in 2015 (Law 20,805) and a longer contract term (20 years) and different sized hourly blocks of energy supply (day, peak, night, 24 hours) were introduced.

- Many countries have adopted parallel “price-finding” mechanisms for different market segments. Germany has kept its FiT scheme for smaller PV installations and recently introduced competitive bidding for projects above 750 kW to reduce costs, control speed of deployment, and dovetail grid-expansion.

- Many successful solar PV programs—tender-based support schemes and others —are also combined with standardized project documents that ensure a speedy and transparent process and bring down transaction costs.

- Examples on the country-level are the standard bidding documents and contracts developed for Argentina (RenovAr); Australia; and the REIPPPP program for solar tenders in South Africa(see recommendations for tender documentation and contracts).

- Successful global programs like the World Bank’s Scaling Solar Initiative, have resulted in low-cost reliable solar energy in Sub-Saharan Africa (e.g. 6.02 US cent/kWh tariff in 2016 in Zambia), and include fully developed templates of bankable project documents. Other global standardization initiatives, such as the Global Solar Energy Standardisation Initiative, are currently developing standardized solar contracts and guidelines that aim to simplify and streamline existing best practice.

The RE section of the PPP in Infrastructure Resource Center for Contracts, Laws and Regulations (PPPIRC) offers links to best practice examples for solar policies and legislation, bidding documents, as well as sample and standard contracts. This section is currently being updated and feedback or suggestions are welcome at ppp@worldbank.org.

This blog is the first in a series that will discuss and explore legal and regulatory issues around PPPs and Climate Change.

Related Posts:

Guarantees light the way for clean energy through renewable auctions

More than a technicality: The engineering foundation of Scaling Solar

Renewables, solar, and large size projects trending in new data on private participation in infrastructure

Why Zambia’s 6 cents is more significant than Dubai’s 3 cents

Join the Conversation