In many countries, central governments have devolved the responsibility of infrastructure service provision to the sub-national level, which is essential for economic growth. Along with this devolution of provision responsibility comes the requirement to raise revenues, enhance efficiencies, improve commercial viability, and reduce a dependence on external financial support — including central government guarantees.

However, central governments are increasingly unwilling or unable (due to limitations of fiscal space) to guarantee sub-national borrowings. This new paradigm is testing the sub-nationals’ ability to raise financing to fulfill newfound responsibilities in infrastructure service provision.

Perhaps this is a blessing in disguise. Historically, easy access to sovereign guarantees has created perverse incentives for not pursuing more sustainable financing solutions. This dependence has also tainted the way that sub-nationals are perceived by the markets, by making them seem like reactive agents of development. This in turn has limited their access to finance and therefore their ability to develop. This approach must evolve, because whether the focus is climate change, massive migratory movements, or basic infrastructure needs, the struggle to advance the global fight against poverty and unsustainable development may be won or lost primarily at the local level in developing countries.

Change isn’t easy, but rapid urbanization places growing demands on governments in the developing world to deliver essential infrastructure services to an ever-increasing number of people in cities. City budgets alone are usually unable to meet these demands, and sub-nationals’ weak creditworthiness is a major constraint when it comes to raising other sources of finance. Many cities are beginning to view the market as a potential source of much-needed infrastructure financing.

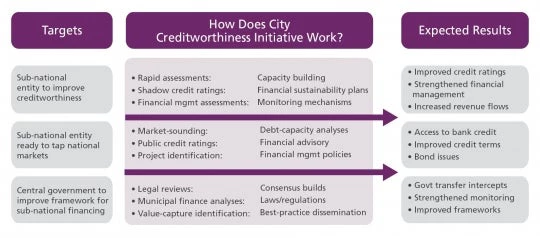

To understand and weigh the various options that exist for tapping this source of finance, city officials may need specialized advice. The World Bank, in partnership with the Sub-National Technical Assistance (SNTA) Program, the Rockefeller Foundation, and the Korean Green Growth Trust Fund, responded to this need with the creation of the City Creditworthiness Initiative.

Of course, financing without guarantees cannot guarantee access to finance. But it promises the beginning of more pragmatic and forward-looking planning at the local level; more proactive approaches to revenue-raising; and a sharper focus on sound financial management practices. This enhances the ability of local government officials to meet infrastructure needs. All local governments, regardless of their size or capacity, can step forward to take on this challenge.

Join the Conversation