Picture of blurry cars driving on street at night in Bangkok, Thailand

Picture of blurry cars driving on street at night in Bangkok, Thailand

Financial repression is not a new topic, but the striking amount of new debt taken on by governments to support their economies in the wake of the COVID-19 crisis has made the issue ever more relevant. Financial repression occurs when governments channel funds to themselves that in a deregulated market environment would go elsewhere. It usually aims to provide cheaper loans to companies and governments, reducing their burden of repayments by lowering returns to savers. Policies involved can include capital controls, caps, and preferential tax treatment.

One form of financial repression is accessing funds from “captive audiences” such as pension funds, banks, and insurance companies—which are compelled in some fashion to channel funds toward government at low interest rates. The topic is included in the latest World Bank Macro Financial Review, and a new World Bank report does a deep dive into pension issues specifically.

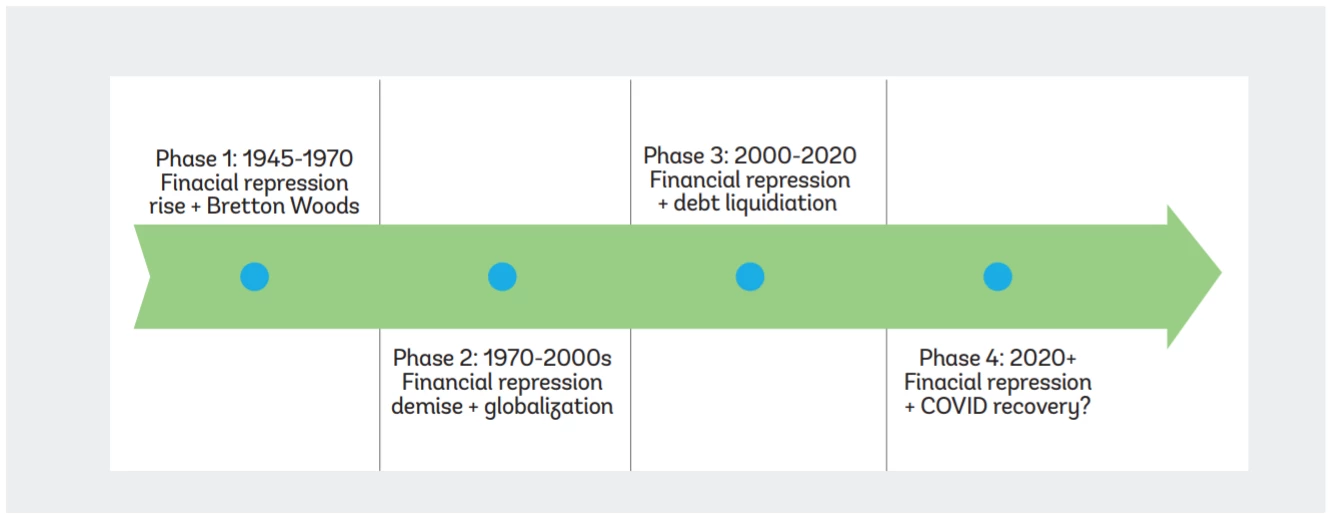

The tools for implementing financial repression today are somewhat different from decades ago. (Figure 1) In an era of cross-border capital mobility, interest rate caps and large-scale capital controls are expected to be less effective. Policy makers today may be more inclined to enroll pension funds—as well as insurance companies and banks—as captive audiences in lieu of more traditional repression methods.

At the same time, pension funds have grown as populations worldwide have aged, and their assets have consequently expanded. This makes them a more “attractive” target in the short term, despite increasing the challenge of worldwide aging which raises the risk of reducing retirement income over the long term.

Figure 1: Historical Use of Financial Repression as a Policy Tool

Financial repression through domestic captive audiences may be stealthier than taxation, but its distributional consequences need to be considered. By using rather technical and opaque means of channeling funds to the government, financial repression is less subject to scrutiny and opposition from the public as well as special interest groups than taxes are. Yet the distributional consequences of financial repression are as real as those of taxation.

Low or negative interest rates in post-crisis advanced economies have benefited governments, indebted non-financial companies, and some banks, but produced net interest income losses for other banks, insurance companies, and pension funds. They might also imply a transfer away from older households that hold fixed income assets to younger, more indebted parts of the population. In emerging markets, using pension funds as a captive audience may be less regressive than other forms of taxation because it affects only formal sector workers. Again, each instrument of financial repression entails peculiar distributional consequences that merit attention.

Policy experience both in advanced and emerging economies has shown that financial repression represents a complex trade-off, with costs and benefits. Policy makers need to consider a plethora of factors, including financial depth and size of the economy, income level, demographic factors, and the maturity profile of pension obligations, as well as the structure and governance of the pension system.

More research is needed to develop a model that allows us to estimate the relative impact of using pension funds versus other financial repression policy measures, but four high-level principles should be taken into consideration:

- First, accessing sources of public pension savings is less harmful than private ones. In the wake of the Global Financial Crisis, several European countries used public pension reserve funds to address financial and macroeconomic difficulties. Given these are government assets—set aside to cover future pension payments which the government will have to cover anyway—the impact is less direct than in defined contribution (DC) schemes, where individuals bear the impact of lower returns through lower retirement incomes. Defined benefit (DB) pension funds, which employers still provide in some countries, were also affected. When investment returns are too low for too long, the cost for sponsors to support the scheme becomes unaffordable, triggering a shift to DC arrangements and/or the closing down of schemes altogether.

- Second, temporary financial repression measures are less harmful than permanent ones. Governments accessing pension funds to manage emergency situations, such as a global pandemic, are less likely to harm citizen welfare than those who use financial repression to finance ongoing budget deficits. Drastic and permanent measures such as the renationalization of pension assets should be avoided. A clear time horizon and exit strategy of financial repression can curb distortions in the financial market and help reassure pension beneficiaries that their interest will be honored.

- Third, if funds are extracted via financial repression, they should be used specifically to support inclusive economic growth and sustainable development. Some governments have managed to deploy access to lower-cost capital from domestic pension savings to meet these goals—which our paper argues can be the most beneficial form of financial repression if (and it is a big if) done well. The current drive by pension funds to introduce environmental, social, and governance (ESG) factors into their investment strategies can be an opportunity to “leverage” these precious sources of long-term, domestic capital. Channeling funds to projects through dedicated financial instruments such as labeled, green, or sustainable bonds which link the cost of capital to development results may also be a way to secure a long-term benefit and support a sustainable recovery after the COVID-19 crisis—trading some short-term return for long-term benefits.

- Fourth, good governance is essential. Lessons from countries where pension fund assets have been successfully channeled toward long-term development suggest that funds should be subject to clear transparency and accountability rules.

Pension funds should be allowed to pursue their primary goal of ensuring retirement security for their beneficiaries. However, under certain circumstances—such as a pandemic-induced crisis with rapidly escalating debt loads—pension funds can play more of a command role as captive audiences. Yet this should only be done in exceptional circumstances and for a short period of time, preferably using public pension funds rather than individual pension accounts. If done in a targeted way, using pension funds for financial repression can result in citizens benefiting in economic growth and recovery over the long term in return for a short-term reduction in investment returns. At worst, this policy depletes pension savings without delivering welfare gains. We hope that our four core principles will help governments opting for this mechanism to have the best chance of positive results.

Join the Conversation