Muslim woman using laptop computer while sitting in cafe, flare sun.

Muslim woman using laptop computer while sitting in cafe, flare sun.

Bringing financial access points—such as bank branches, mobile-money agents, and ATMs—close to people is a way to reduce barriers to financial inclusion. The poor distribution of these services often leaves individuals, especially those living in remote areas, with restricted or no access to financial services. To help address this challenge, many authorities have been using traditional tools to monitor and track financial access, such as through country-led, demand-side financial inclusion surveys and supply-side supervisory templates. But these tools have limitations.

Geospatial technology can allow policy makers to paint a fuller picture of the factors limiting financial access and help them design appropriate solutions , according to the report Leveraging Geospatial Technology for Financial Inclusion. The recently launched report, which draws on insights and lessons learned through the Financial Inclusion Support Framework (FISF) program, provides guidance to financial sector authorities and related stakeholders on benefits and methodologies for mapping and analyzing the distribution of financial access points.

Geospatial technology is already deriving insights in areas such as health, urban planning, and disaster resilience. The report shows that such technology can be also leveraged for the financial sector to map existing financial access points and assess the distribution of financial services by regions in a more granular way—allowing authorities to identify gaps in existing coverage more clearly and with higher precision. It can also help authorities prioritize gaps, taking into account policy objectives, and design appropriate policy interventions at the regional and local levels, in light of their specific context. As a result, policies can be better targeted to improve access to financial services, particularly in underserved areas.

Beyond the basics in Pakistan

Most financial sector authorities already collect data on financial access points with some type of spatial dimension—for instance, through postal codes, districts, or regions. Even without precise locations, such data can be utilized for geospatial mapping to provide useful insights for financial inclusion policy making.

In Pakistan, for example, authorities sought to improve financial connectivity through strategic expansion of access points as part of the National Financial Inclusion Strategy. The World Bank Group provided support on this front by undertaking a geospatial mapping of financial access points in the country and identifying priority areas for expansion.

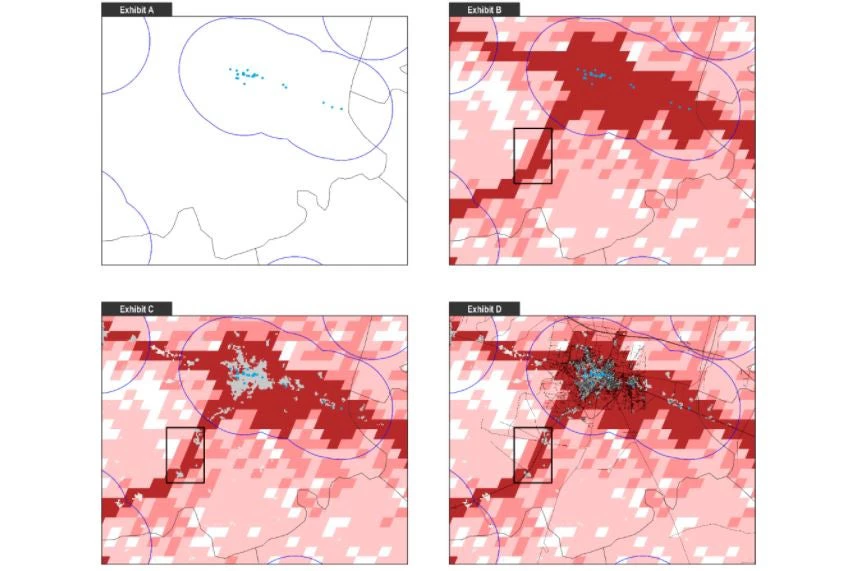

The illustration below shows how this was undertaken in the subdistrict of Sheikhupura, in the province of Punjab. Exhibit A plots bank branches in Sheikhupura as blue dots, with five-kilometer radiuses to represent the area of reasonable access for each branch. This serves as a starting point since it highlights areas with no reasonable access as gaps in existing financial infrastructure.

Not all gaps are equal, however. Some may represent areas with uninhabitable land or very low populations. Ultimately, it is people, not land, that are the focus of policy. Hence it makes sense to identify gaps with populated settlements. For this purpose, Exhibit B and Exhibit C also include geospatial data on settlements—distinguishing between rural areas, low-density urban clusters, and high-density urban clusters—and population density, respectively. These maps identify highly populated settlements (highlighted by the black box) with no reasonable access to financial access points. These gaps may be a priority target for policies related to financial inclusion and access.

Exhibit D depicts an example where physical connectivity to roads is considered, to further narrow target areas for potential expansion of financial access points in Sheikhupura. Policy makers can further refine priority areas by considering additional geospatial data often available publicly, such as on poverty, economic activity, natural disasters, and physical infrastructure.

Identifying Priority Gaps in Sheikhupura, Pakistan

In addition to improving targeting of gaps such as those in Sheikhupura, geospatial data allow for evidence-based policy making to boost access to financial access points and financial inclusion. They can help determine the correct mix of policy interventions. This includes differentiating between areas requiring supply-side expansion (new mobile money agents, for example), demand-side interventions (financial literacy programs, for example) and infrastructure investments, such as building roads and expanding mobile signal coverage.

In addition, authorities can use geospatial data for monitoring and evaluation purposes, especially to track progress on targets around financial access. Regulators can also leverage geospatial technology as a supervisory tool to assess financial institutions’ compliance with requirements related to improving access such as expansion regulations or targets. Lastly, geospatial data can be used as a public good to create an enabling environment for financial inclusion and innovation. This can be done by making geospatial analysis and reports public or, in some cases, sharing anonymized financial-sector geospatial data with the broader financial sector, possibly through an Open Data Initiative.

Join the Conversation