The investment of pension fund assets has moved from an obscure topic for actuaries, to an issue which raises political attention at the highest level.

This is for the simple reason that it directly touches the social and economic livelihoods of people.

Since the 2008 global financial crisis, developed economies have been looking for additional sources of long-term capital to fill the gaps which bank and government balance sheets can’t fill. This is a search that has engulfed the developing world for much longer if not for as long as they exist. Younger developing economies are starting to see their pension funds grow, side by side with an increasing awareness of the impact which productively invested assets can have on economic growth both today and tomorrow. If invested for the aligned intensions of social impact and financial return, pension funds can improve people’s lives today and secure their income in future. However, this isn’t a general phenomenon – applying only to larger funds which have invested in the intellectual capacity of their Trustees, and in countries which have understood and embraced the strong relationship between the macroeconomic performance and asset performance.

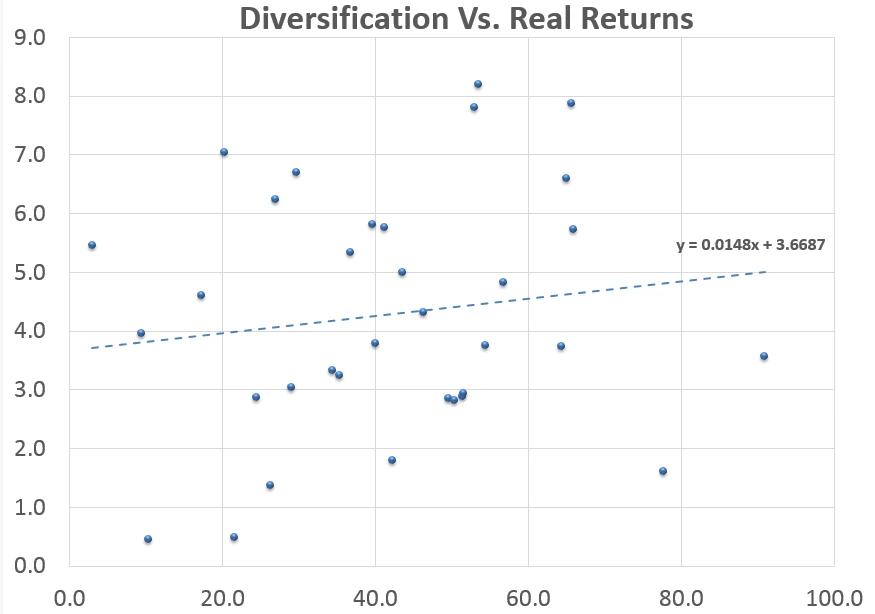

Redirecting pension investments from short-term assets (government paper, bank deposits) to investments with a long-term impact is key to delivering, not only improved, but sustained returns. Private equity (PE) - equity capital not quoted on a public exchange – is one such asset class. PE investment is increasingly in vogue as such capital is the foundation of all economies, and indeed leads to the development of robust stock markets. If structured with pension investors’ risk-return consideration in mind, it can deliver the diversification benefits which these investors need. If properly targeted, such investments will be vital in meeting the Sustainable Development Goals, considering that 15 of the 17 SDGs have a focus on growth, development and sustainability (the last two being on implementation and capital resource origination). Active participation in investee companies by shareholders such as pension funds will be vital for ensuring a future sustainable and shared economy. In turn, for this to work optimally, requires conscientious and capable Trustees.

Despite these potential gains, implementing this goal remains a challenge. PE managers have been criticized as operating within only a “5-7 year” horizon, though the view of long-term money is changing. Delivering profits for the financial firm rather than fulfilling fiduciary obligations towards pension fund members has also been a barrier, although this is beginning to change. What is becoming obvious is that fiduciary responsibilities aren’t a static mandate and can be influenced by the agent. Environmental, social and governance gains are also increasingly bringing “triple bottom line" considerations into investment, with social destruction (such as detrimental labour relations) understood to harm investments in both the short and longer-term.

What is needed is a philosophical change by pension fund trustees – the guardians of our societies’ systemic capital and the key strategic decision makers. They need to understand the role PE can play in the economy as a whole and over time, linking long-term money to macroeconomic and asset performance, smoothing returns over time and making sustainability their driver, thereby avoiding unsustainable economic imbalances. They also need to understand the strategic position they hold in the economy, and appreciating how systemic their decisions can be.

The Government Employees Pension Fund (GEPF) of South Africa is an example of a fund which made such a leap. GEPF took the investment horizon out to 50+ years (beyond a generation) and implemented a portfolio with a social impact today, which simultaneously delivers financial returns. The fund is investing across the continent in education, health, affordable housing, transport and communication – taking a lead and partnering with government(s) to meet society’s needs.

Other funds around the region – from Botswana to Ghana to Namibia to Nigeria – are also leading lights, which are shifting their philosophy and practice in this direction. Regulators are working with them to ensure that such investments are packaged and managed transparently and securely. Together these funds can help to deliver the UNGC Africa Strategy, which is gathering increased attention across the continent and putting Africans in the driving seat of change.

Good governance will be vital in achieving these goals. Decisions are dependent upon an appreciation of the macro/asset performance relationship, pension fund trustees understanding their role in the economy, changing the way they think about risk, building resources and sound ethics.

We will be discussing these key principles at the forthcoming 7th World Bank Global Pensions and Savings Conference and would welcome your thoughts.

Key Takeaway Principles

- Pension Funds Gains Tied to Macroeconomy

- Direct Real Economic Impact

- Influence of Performance

- Pensions are Systematic Owners of Capital and Strategic Decision Makers

- Long Term View is Obligatory

- Invest for Growth, Employment and Poverty Reduction

- Benefitting Members During Productive and Retirement Years

- Capacity and Skills Required on Trustees

- Understanding New Risk

Join the Conversation