The race to net-zero emissions is on. Governments should look to a key private sector player - multinational enterprises - to accelerate their decarbonization strategies. While countries are increasingly committing to shift their economies to net-zero emissions by 2050, it is unclear how global reduction targets will translate into business-specific actions. A new report from the World Bank’s investment climate unit shows that climate change mitigation efforts could be fundamentally compromised if multinational enterprises (MNEs) do not significantly step-up their decarbonization actions. Fortunately, some MNEs are putting in place strategies to decarbonize their supply chains. MNEs are also playing an increasingly central role in climate action through “green”1 investments and by supplying low-carbon technology. Governments can and should do more to encourage MNEs to decarbonize their supply chains, facilitate green investments, and support a shift to a low-carbon industrial structure.

MNEs’ carbon emissions are high, but climate commitments are low

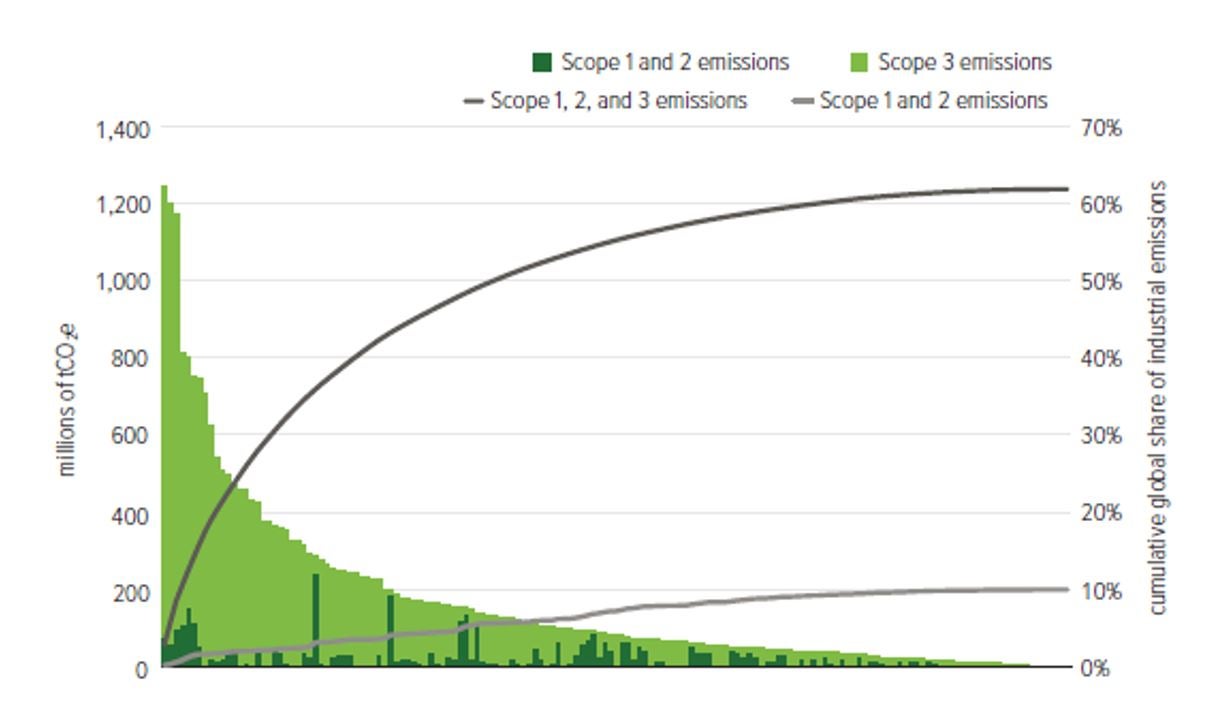

A small number of large MNEs account for a majority of global carbon emissions. New analysis suggests the direct activities and supply chains of 157 large MNEs jointly account for up to 60 percent of global industrial emissions (Figure 1). While 10 percent comes from MNEs’ direct activities (or Scope 1 and 2), their supply chains (or Scope 3) account for another 50 percent of global emissions. This finding is comparable to other analysis tracing the emissions from industrial carbon producers (Griffin 2017; Ekwurzel et al. 2017). The emissions are driven by MNEs in the energy sector (37 percent of global industrial emissions), followed by industrials (15 percent), transport (7 percent) and consumer goods and services (2 percent).

Figure 1: Global Emissions of the Supply Chains of 157 Large MNEs, 2021

(Each bar represents one MNE, while the lines show their cumulative shares of global industrial emissions)

Most of these 157 MNEs are insufficiently committed to decarbonize production and supply chains (Figure 2). MNEs are increasingly putting in place strategies to decarbonize their supply chains, and one in four of the 157 MNEs have committed to net-zero GHG emissions by 2050. More committed MNEs tended to be in consumer goods and services (facing consumer pressure for reform) and headquartered in high-income countries (experiencing more regulatory pressures). Yet overall, few MNEs have a long-term strategy (20 percent), a medium-term strategy (13 percent), or a short-term strategy (5 percent). None of the MNEs had a capital allocation strategy that aligned to net-zero emissions by 2050. The lack of short-term plans to decarbonize production and supply chains raises credibility concerns about the realism of many MNEs’ long-term commitments.

Figure 2: The Climate Commitment of 157 Large MNEs to Climate Action

MNEs’ clear opportunity to play a central role in climate action

Yet, MNEs can help domestic firms decarbonize by providing access to more advanced, low-carbon technology. MNEs’ production is less carbon-intensive than domestic firms. Analysis of the World Bank’s Enterprise Survey also suggests that firms that interact more with MNEs (via licensing, supply linkages or joint ventures) are more likely to engage in “green” target-setting, monitoring and decarbonization (Figure 3). MNEs can thus be an important part of the solution.

Figure 3: The Effect of MNE Links on Green Business Practices

(percentage increase in likelihood firms adopt a ‘green’ business practice, by type of MNE links)

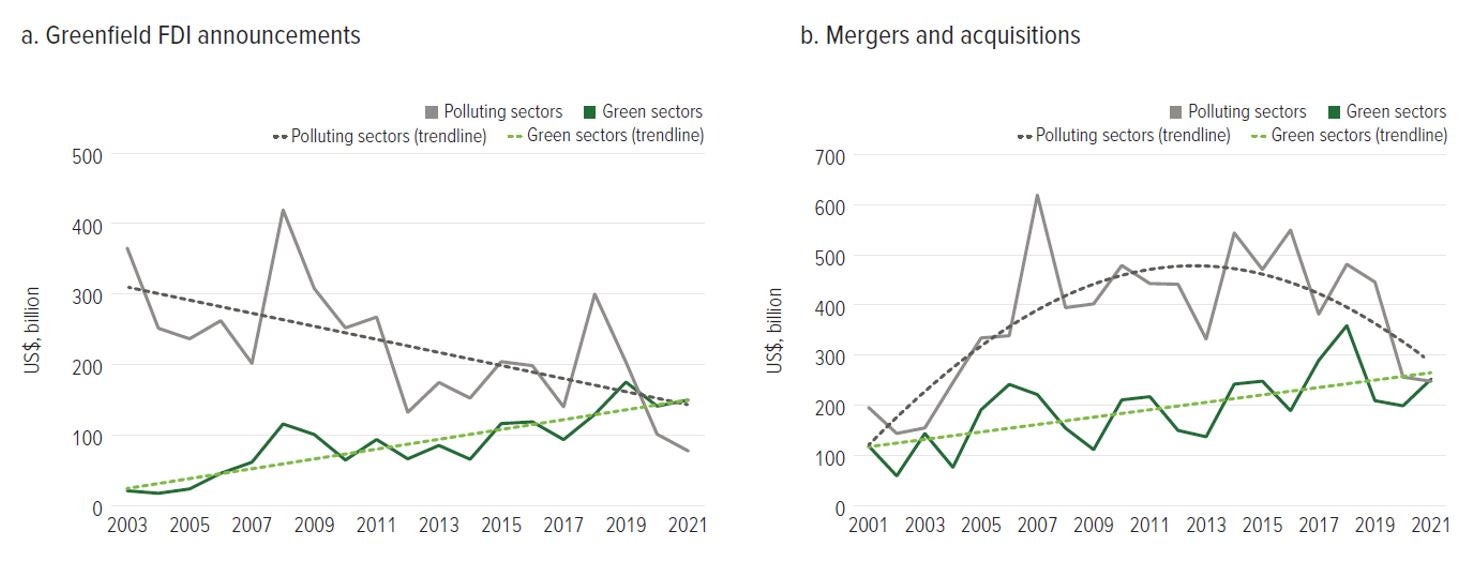

Evidence from foreign investment around the world suggests that MNEs can be an important new source of finance for investments in climate action (figure 4). In fact, global foreign direct investment (FDI) announcements in green sectors are on the rise - with a 700 percent jump between 2003 and 2021. Foreign investment in polluting sectors has declined by 80 percent over the same period. Green FDI has also overtaken FDI in polluting sectors. As a ratio, green and polluting FDI’s share shifted from 5-to-95 percent in 2003, to 66-to-34 percent in 2021. The report shows this dynamic is taking place in both high-income and development countries. Clearly, MNEs can play a huge role in financing the climate transition.

Figure 4: Green versus Polluting Global FDI Announcements, 2001–21

A challenge and an opportunity for developing countries

Countries can and should do more to shape the behaviors of MNEs in their climate change mitigation plans. This report introduces a new framework (“the 5Ps”) that shows how various policies can shape MNEs’ impact on climate change. The 5Ps are patrolling (monitoring emissions), prescription (laws and regulations), penalties (taxes), payments (incentives and fiscal support), and persuasion (corporate commitments and information. These tools can encourage MNEs’ to reduce emissions-intensive production, help MNEs shift their supply chains to lower-carbon production methods, and facilitate a shift toward a low-carbon industrial structure by attracting green FDI and phasing out dirty sectors (Figure 5). Jointly, these can help to limit MNEs’ carbon-intensive production, while helping to attract green investment and receive new low-carbon technology. If done right, this can significantly accelerate decarbonization strategies and shift countries to a low-carbon industrial structure.

Figure 5: Instruments to Improve MNEs’ Effect on Climate Change (the “5Ps” Framework)

Endnotes: 1) We refer to “green” investment in line with the European Union taxonomy for Sustainable Activities (European Commission, 2020) which identifies sectors and technologies that accelerate a net-zero emissions future. Examples include electricity generation from renewable energy, afforestation, and manufacturing of products that help the transition to a low-carbon economy (such as batteries and electronic vehicles), or which uses low-CO2 technology to produce traditionally high-CO2 products (like steel and cement).

Join the Conversation