Aerial view of big grain elevators on the sea. Loading of grain on ship. Port Ukraine. Cargo ship

Aerial view of big grain elevators on the sea. Loading of grain on ship. Port Ukraine. Cargo ship

One year after Russia’s invasion of Ukraine, the surge in global food prices that the war triggered has subsided. But there are still reasons for worry: Prices remain elevated, and new shocks could send them soaring again.

Food prices shot up when Russian forces blockaded Ukraine’s Black Sea ports, halting shipments of cereals from one of the world’s biggest exporters. Many countries reacted by curbing or stopping food or fertilizer exports in an effort to protect domestic food supplies. Those measures were counterproductive and only drove prices higher, briefly threatening a food crisis in developing countries that depend on imports of food.

Now, many of those measures have lapsed, and high prices are mainly a reflection of broader global inflation. In January, the average price of corn was 31 percent higher compared with January 2021, and the price of wheat was 14 percent higher. Rice prices were 2 percent lower.

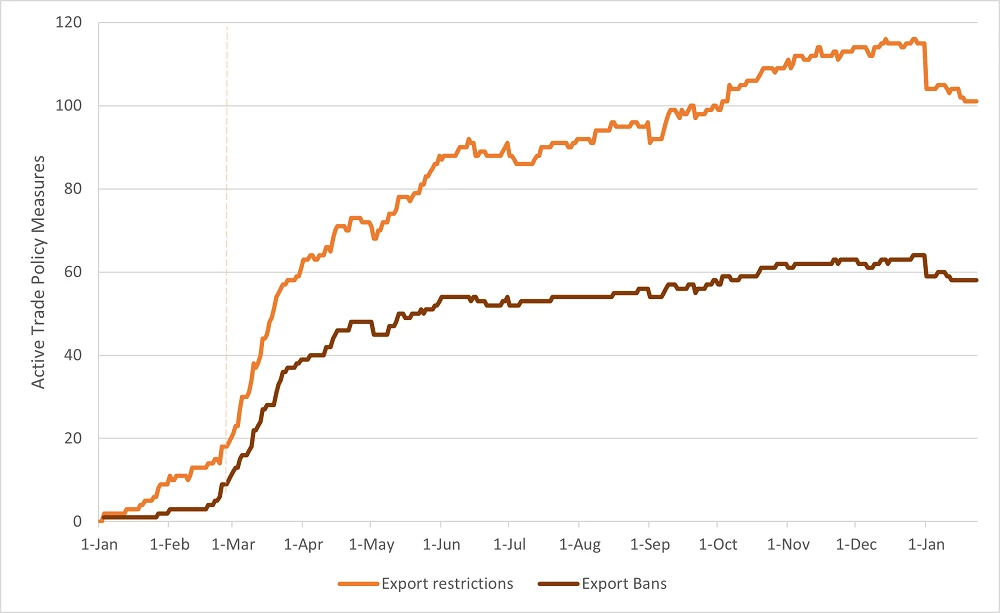

Nevertheless, the number of remaining restrictions is troubling. One year after the outbreak of war on February 24 last year, 101 export restrictions -- including quotas, licenses, and outright bans – remain in place, suggesting that, contrary to WTO principles, the limits have not all been temporary. Those restrictions cover more than 11 percent of 2022 food trade. Export bans alone cover up to 3.8 percent of global food trade. Countries with a small share of food exports account for most of the remaining restrictions, but even those should be lifted to ease lingering price distortions.

Figure 1: Food export restrictions and bans have leveled off but remain elevated.

The examples of wheat and corn illustrate the dynamic. In the first half of 2022, bans imposed by Russia -- which supplies almost a third of the world’s wheat -- and other exporters covered 34.5 percent of global wheat shipments and accounted for a quarter of the 52.7 percent increase in prices. Bans on exports of corn covered 5.2 percent of global shipments and accounted for more than three quarters of the overall 16.7 percent increase.

The picture has improved since the middle of last year. On July 22, an agreement involving Ukraine, Russia, Turkey, and United Nations enabled grain shipments from three Ukrainian ports to resume. Russia and other key producers removed export restrictions, and good summer harvests helped damp prices. The European Union and Australia have increased shipments, making up for lower Canadian exports.

The US Department of Agriculture forecasts a 5 percent increase in world food trade in the 12 months ending on June 30. One the other hand, the USDA predicts a 4.5 percent contraction in shipments of rice, another key staple, as reduced exports from Vietnam, Thailand, Pakistan, and the United States more than offset an increase from India.

Nevertheless, further trade policy measures could alarm commodity markets, generating bigger price increases. In September 2022, India banned exports of broken rice – used primarily as animal feed -- and imposed a 20 percent duty on exports of other grades of rice to boost supplies and damp local prices following below-average rainfall in key producing areas. India’s ban covers 5 percent of global exports of rice and is expected to increase global prices by 2 percent, while bans imposed by other exporters could raise prices by another 2.3 percent. Further restrictions by India could raise world prices of rice by between 4.3 percent and 12.1 percent. Should exporters such as Thailand and Vietnam respond by banning exports, that could result in a multiplier effect that pushes up prices by up to 20 percent.

Similarly, a ban by one the top three exporters of corn or wheat could drive up prices by 44 percent and 8 percent , respectively. Further increases in prices of key staples will hurt low and lower-middle income countries that are highly dependent on imports.

How can such scenarios be avoided? Here are three steps:

- Exporters should refrain from stockpiling goods and banning, taxing, or otherwise restricting exports. Emergency restrictions, if deemed necessary, should be targeted, transparent, proportionate, temporary, and in keeping with WTO rules.

- Food importers should permanently reduce or eliminate import tariffs and other taxes to ensure adequate supply in good times and bad; a permanent reform reduces uncertainty and is likely to attract new exporters into the market.

- International organizations should better cooperate to provide real-time information on trade policy changes and their implications for global production and trade. Greater transparency on the evolution and impact of trade policy actions, and on the global supply of food staples, would reduce uncertainty and lower the risk of escalating measures and countermeasures.

In a crisis such as this one, global cooperation and communication are key. The World Bank and other international organizations, such as the World Trade Organization, provide forums for dialogue along with needed research and policy advice.

Join the Conversation