Global Performance of Public Assets Management

Global Performance of Public Assets Management

Government balance sheets allow governments and citizens to understand the fiscal impact of government policies in the immediate and long term. They help inform how decisions made today may have an impact on inter-generational equity. Despite the important role they play, Government Balance Sheets are not produced in most developing countries. Only 30% of 165 jurisdictions worldwide were surveyed in a 2021 report on the accrual basis.

Governments and development partners often rely on estimates of assets and liabilities in the absence of balance sheets. Even in some countries where governments produce balance sheets, the use of that information in financial decision-making is limited. While the debate over the need for migration from cash to accrual-based accounting has evolved over the past two decades, questions continue to emerge.

A recent publication, Public Net Worth: Accounting, Government, and Democracy, will very likely prompt governments worldwide to prepare balance sheets. We share three reflections on why stronger government accounting is needed globally:

1. Government accounting is a key crosscutting aspect of public financial management (PFM), but it is underrepresented in reforms

Government accounting is a building block on which governments function and is the enabling mechanism for the entire budget cycle – raising revenues, incurring expenditures, and budget evaluation. Accrual basis accounting information should be at the heart of PFM systems. Sound government accounting enables governments to gain credibility-based results using taxpayers’ money.

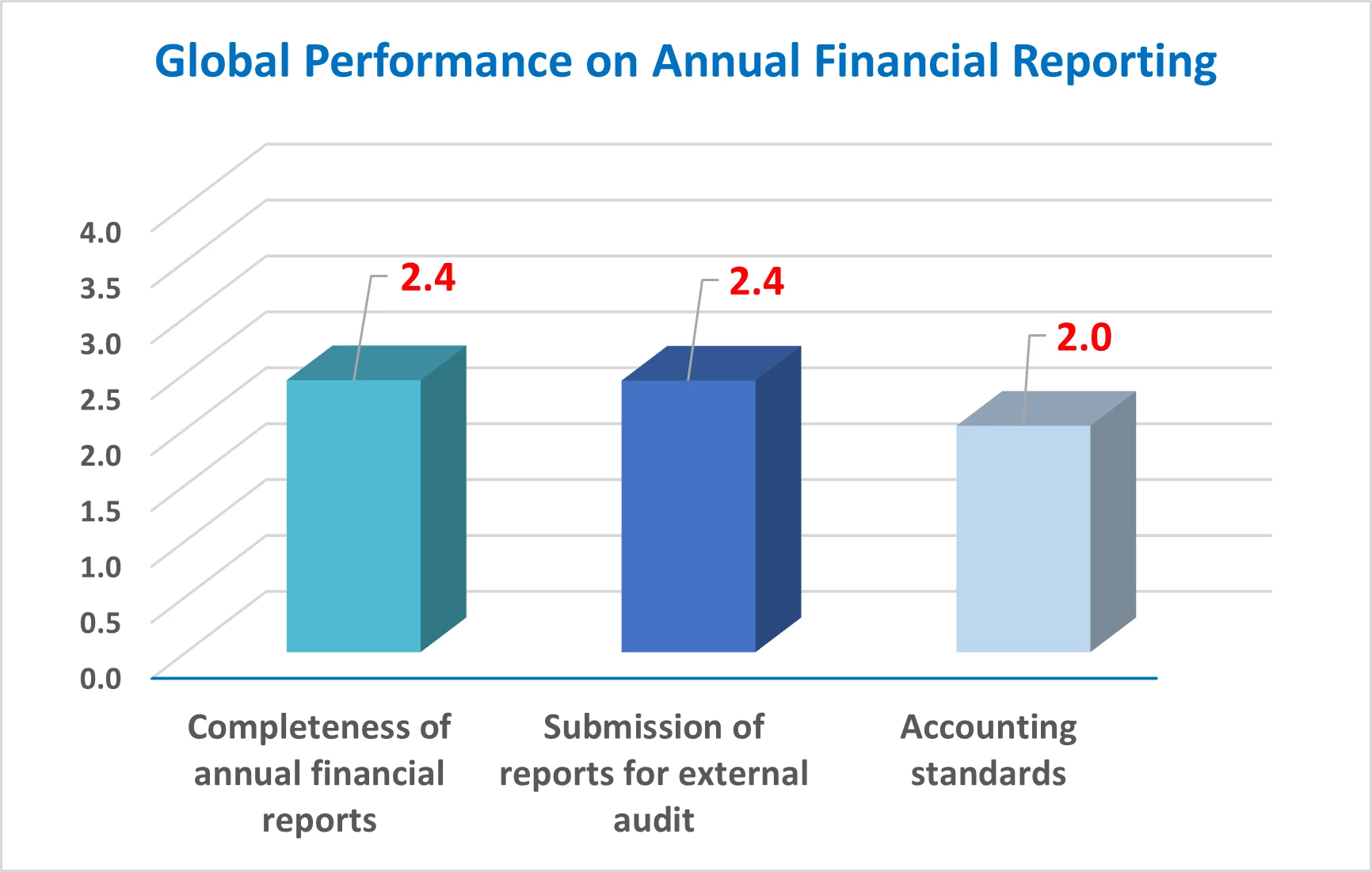

From a broader perspective, government accounting, due to its technical nature, shouldn’t be susceptible to extraneous factors and political economy issues . However, the below chart shows PFM indicators relating to annual financial reporting under-perform as noted in the 2022 PEFA global report on public financial management. All three dimensions – completeness, timely submission to audit, and compliance with accounting standards – score much lower, indicating there is potential for improvements.

2. Governments should know and manage their assets better

In the absence of audited accrual basis balance sheets, the incentives for ensuring that asset registers are up to date tend to be limited. The IMF’s public sector balance sheet database is based on a ‘best-efforts compilation’ rather than drawing from audited balance sheets since Balance Sheets do not exist in most countries.

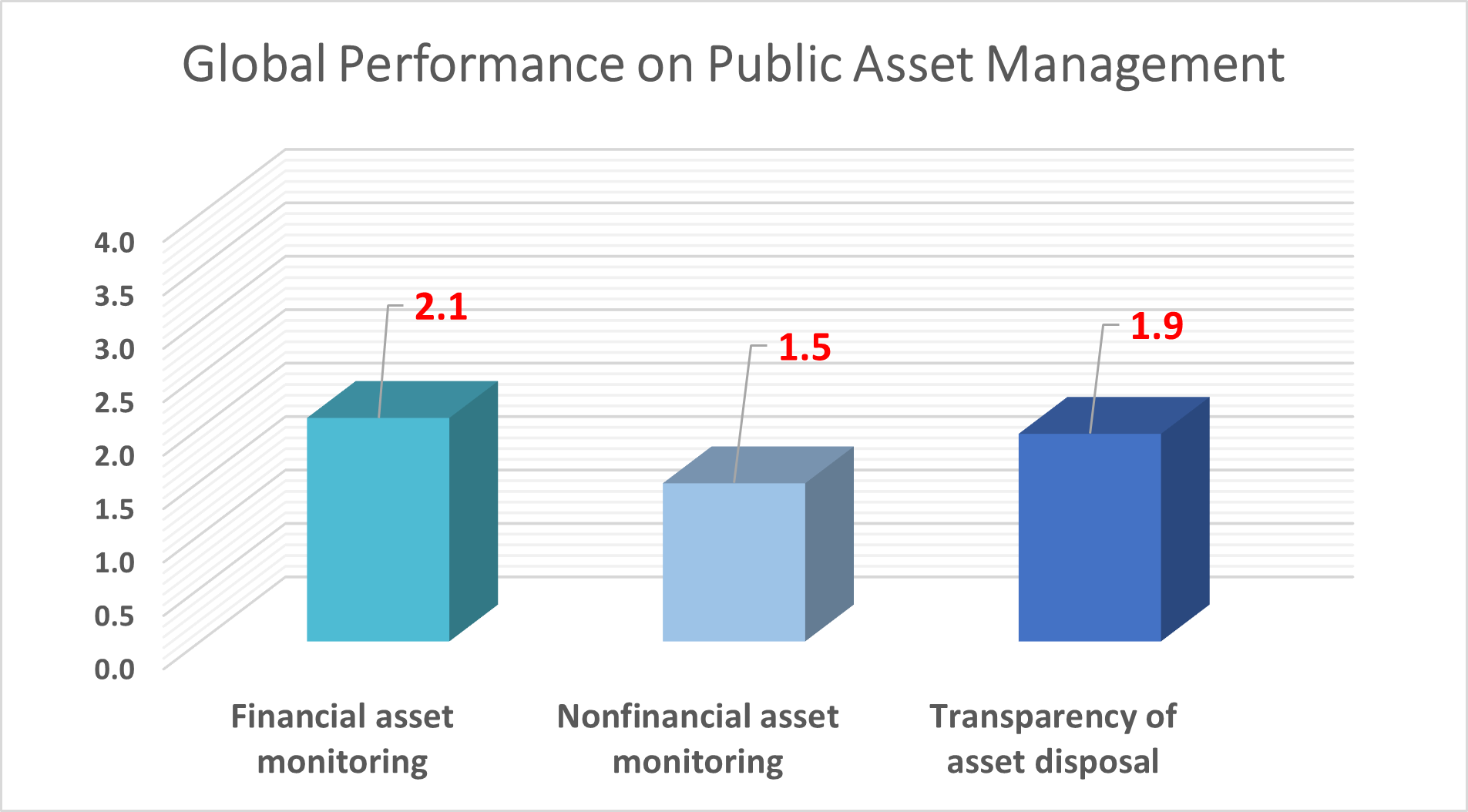

The Public Net Worth book rightly argues that improvements in government asset management can be a game changer. Lower scores on PFM performance depicted in PEFA indicators relating to public asset management (financial asset monitoring, non-financial (fixed) asset monitoring, and asset disposal) reinforce the urgent need for strengthened asset management by governments.

Accrual basis financial statements are the first step towards more effective management of assets as they encompass the entire cycle of asset management, including creation and acquisition, accounting, custodianship, maintenance, depreciation (where applicable), and audit.

3. Improved debt management is critical for fiscal management in developing countries

Many countries in the developing world are facing risks of debt distress, so improved debt management practices are critical for their fiscal management. Government balance sheets developed on an accrual basis present debt comprehensively, and credibility is enhanced when financial statements are audited by the respective Supreme Audit Institution.

A recent report, A Sum of Parts: Sovereign Debt Measurement and Reporting, established the significance of financial reporting on debt management distinct from a statistical approach. It states that “From the specific analysis of indebtedness to the financial relationships between governments, fiscal debates are strengthened when informed by accrual basis accountancy and financial reporting frameworks. Further, financial statements based on credible accounting standards would require all debt, including pension liabilities and debt of controlled entities, to be included in the financial statements, presenting a more holistic picture”.

While more countries are moving towards adoption adoption of accrual International Public Sector Accounting Standards (IPSAS), the Public Net Worth book comes at the right time to accelerate actions toward governments preparing more credible balance sheets.

Join the Conversation