Instant payment systems like FPS/IPS are revolutionizing the way we send and receive money, making transactions quick, easy, and hassle-free. Photo: zeljkosantrac from Getty Images Signature

Instant payment systems like FPS/IPS are revolutionizing the way we send and receive money, making transactions quick, easy, and hassle-free. Photo: zeljkosantrac from Getty Images Signature

This blog delves into the dynamics of fast/instant payments, the urgent need for inclusivity, and the concerted efforts by AfricaNenda and the World Bank to help financial ecosystems evolve across Africa to boost access to finance, help close gaps in financial inclusion, enable governments to disburse funds at times of crises, and bring transparency to international remittances.

Fast/instant payments systems (FPS/IPS) underpin inter-operable payment services that enable real-time receipt of funds in payee’s account on a 24/7/365 basis. They are growing globally, driven by technological advancements that offer speed, efficiency, and accessibility and are transforming the way people, businesses, and governments make and receive payments. For example, FPS/IPS support usage of easy-to-remember aliases—such as mobile phone numbers or email addresses—instead of traditional payment addresses such as account numbers and bank identifiers. Further they support use of new payment processes such as “request to pay” and the use of quick response (QR) codes to enable use of mobile apps for initiating and accepting payment requests and integrating payments seamlessly with applications used for underlying business and social interactions. Furthermore, FPS/IPS provide essential, society-wide, public and private services. Therefore, when designed to be open, interoperable, and inclusive, they qualify as Digital Public Infrastructures.

Pix, the Brazilian FPS/IPS—which in just one year of operation outpaced all other payment methods—and PromptPay (the FPS/IPS in Thailand)—forecasted to generate an additional economic output equivalent to as much as 2 percent of the country’s GDP—are examples of the transformative potential of FPS/IPS. By offering convenient user experiences, lowering costs and expanding the market of providers, these systems can simplify access to and usage of digital payments, and digital financial services in a broader perspective. When characterized by an inclusive design - the enablement of a wide array of use cases and channels, and the participation of diverse payment service providers - FPS/IPS can therefore play a key role in driving financial inclusion, especially in those segments of the population that are typically unserved by traditional financial services.

By establishing inclusive infrastructures and an enabling legal and regulatory environment, African countries can draw substantial benefits. Inclusive FPS/IPS can level the playing field between banks and non-bank payment service providers, fostering competition and innovation to meet the evolving needs, habits, and demands of users.

FPS/IPS can also play a role in facilitating more affordable and efficient cross-border payments in Africa. According to the latest World Bank Remittance Prices Worldwide (RPW) data (2023), the cost of sending a person-to-person (USD 200) transfer to sub-Saharan Africa is estimated at 7.39 percent of the value sent, the highest than any other region, with the global average being at 6.18 percent.

AfricaNenda, the World Bank, and the UN Economic Commission for Africa launched the second edition of the State of Inclusive Instant Payment Systems in Africa (SIIPS) report that explores the evolution of both the supply and the demand side of fast/instant retail payments and highlights the challenges and opportunities shaping Africa's payment landscape.

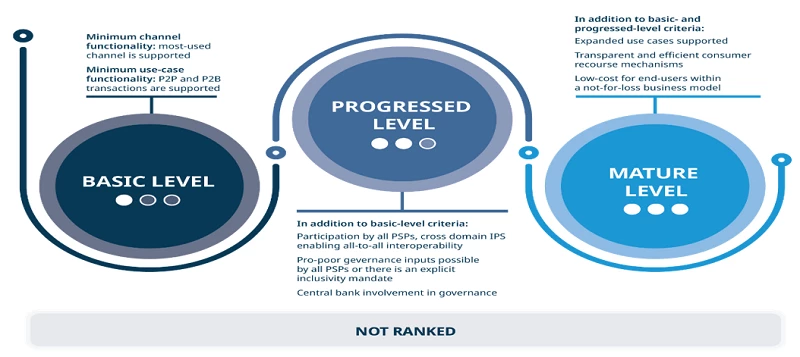

Adopting an expansive interpretation of FPS/IPS (including central infrastructures and multilateral arrangements), there are 32 live systems identified in Africa—29 domestic and three regional cross-border systems—facilitating nearly 32 billion transactions valued at approximately USD 1.2 trillion in 2022. The Inclusivity Spectrum, outlined in the 2023 SIIPS report, identifies three levels based on functionality, governance, and customer centricity. Most live FPS/IPS in Africa are either unranked or have reached only a basic level of inclusivity, due to the minimum set of functions and use cases available and system participation not opened to all PSPs. Nonetheless, with the commitment of all public and private sector stakeholders, they can evolve into more mature inclusive systems.

FPS/IPS Inclusivity Spectrum

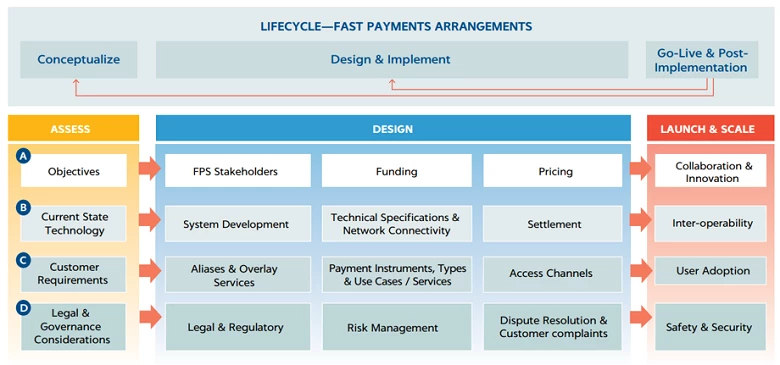

The World Bank's Project FASTT (a multi-workstream initiative sponsored by the Bill & Melinda Gates Foundation), is a parallel initiative that aims to drive global adoption of fast/instant payments across low- and middle-income countries. The overall project and the elements of the FPS/IPS Development Lifecycle Framework developed under it inform World Bank technical assistance and FPS/IPS financing.

FPS/IPS Development Lifecycle Framework

AfricaNenda and the World Bank share a common vision to build a financial ecosystem that empowers individuals and businesses and fosters sustainable economic growth across the African continent. For both AfricaNenda and the World Bank, inclusivity is pivotal in shaping payment systems that cater to diverse needs.

With their respective initiatives, AfricaNenda and the World Bank are committed to supporting African nations and regional bodies on this journey to shape a future where FPS/IPS are inclusive, accessible, and instrumental in widening financial inclusion across the continent.

Join the Conversation