Although the World Bank collaborates with international agencies that work with external debt and debt-related statistics (the Bank for International Settlements (BIS), the International Monetary Fund (IMF), the Organisation for Economic Co-operation and Development (OECD) and others), the World Bank has the international mandate to collect external debt data, and we maintain comprehensive external debt information.

Debt Data Collecting at the Bank: A Brief History

Published for many years as World Debt Tables (see the 1982 edition here) and then as Global Development Finance, the Bank’s flagship debt data publication was renamed in 2013 as International Debt Statistics (IDS). The primary objective of the DRS is to support the Bank’s assessment of its borrower’s creditworthiness. The data collected through the DRS are a vital resource for:

- Analyzing the volume and trends in external financing to developing countries

- Setting an international standard on which developing countries can base their own debt management and measurement systems

- Facilitating cross country comparisons of debt stock and flows

An important feature of these debt statistics is that they are long-time series data and topical in nature. DRS reporting requirements are continuously updated to reflect changes to borrowing instruments or debt restructuring that resulted from periodic debt crises. Furthermore, the Bank has responded to demands for higher frequency data. The Quarterly External Debt Statistics (QEDS) database was developed jointly with the IMF and provides high frequency, quarterly data for 111 high income and developing countries, disaggregated by debtor type, maturity and borrowing instrument.

Similarly, the Public Sector Debt (PSD) database addresses the demand for comprehensive data on public sector debt. Also developed in partnership with the IMF, this PSD database features detailed quarterly public sector debt data and allows users to query and extract data by country, group of countries and specific public debt components.

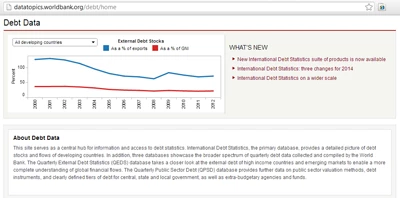

As part of the Bank’s Open Data Initiative, the Bank modernized the IDS debt data dissemination which now features new online tables, a debt data dashboard and an ebook – all helping to improve the user’s digital experience. We can all appreciate this

To learn more about IDS’s major features and changes for the 2014 edition, click here.

The Many Uses of Debt Data: Inside and Outside of the Bank

IDS is the third most downloaded publication from social media reading sites such as ISSUU and Scribd. Online audiences reading on these channels—particularly Scribd—continue to grow every year (a combined audience of 29,000 users in 2013). Both platforms offer a browser-based reading experience with embeddable readers for sharing books online.

- Disaggregated debt data are used as input to the Bank’s country macroeconomic projection models (RMSM-X)

- The Bank’s Development Prospect Group uses debt data in its global forecast models

- The Bank and the IMF refer to debt data for their debt sustainability analysis work for low-income countries

- International aid agencies and financial institutions in their programs to measure and monitor external debt

- Economists, statisticians, data specialists, third party data distributors, financial analysts, researchers, journalists, academia, development practitioners and other professionals in their work

Join the Conversation