Access to finance is a major, long-standing obstacle faced by micro, small, and medium enterprises (MSMEs) in Nigeria. In 2014, only 6.7% of enterprises reported having a loan or active line of credit (LoC). MSME loans averaged about 5% of total commercial bank lending by volume and were equivalent to only 2% of banking-sector assets. Even today, the private credit-to-GDP ratio remains low and concentrated in the oil and gas sector and large, “blue-chip” conglomerates. Although MSMEs are the backbone of the Nigerian economy, limited access to finance severely constrained their growth.

In establishing the Development Bank of Nigeria (DBN), the government recognized that the existing development finance institutions (DFIs) had failed to meet this challenge sustainably. The Ministry of Finance requested the World Bank’s support in launching the Nigeria Development Finance Project to create a more sustainable path. The Bank provided a $500 million International Bank for Reconstruction and Development (IBRD) loan to support the DBN’s establishment and mobilized support from four other development partners,1 which provided a combination of equity, debt financing, and technical assistance, bringing the total approved commitments to over $1.3 billion. Operational since 2017, the DBN has earned a reputation for being even-handed, highly responsive, and innovative among its 28 Partner financial institutions (PFIs). Key project achievements include the following:

- Wholesale funding to PFIs amounting to the naira equivalent of $1.4 billion.

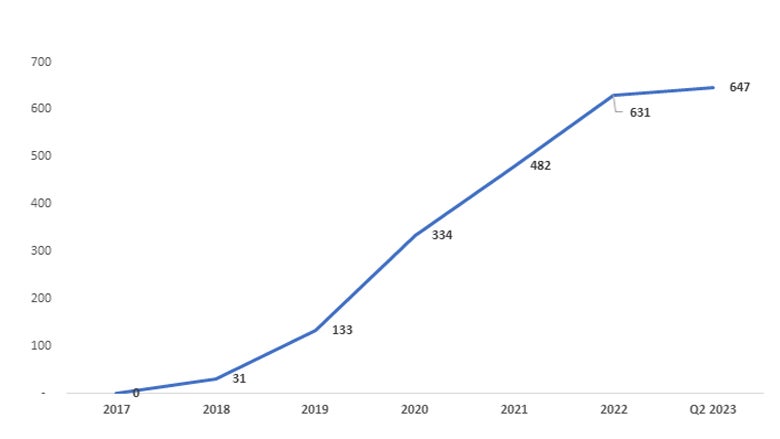

- On-lending to 321,867 MSMEs, of which 66% are women-owned, and 12% are first-time borrowers.

- Support over 28,000 MSMEs with guarantees equivalent to $195 million through its wholly owned subsidiary, Impact Credit Guarantee Limited, established in 2020.

- Technical assistance facilitation to PFIs by external experts to build their MSME lending capacity.

Figure 1: Cumulative number of MSMEs reached

Figure 2: Cumulative loan disbursements (N'bn)

Figure 3: DBN PFIs loan portfolio by key sectors

Figure 4: DBN PFIs loans by geography (amount)

The DBN improved the DFI landscape, mainly driven by two key success factors:

- Sound corporate governance. In 2017, the DBN was registered as a public limited liability company under the Companies and Allied Matters Act and licensed by the Central Bank of Nigeria as a wholesale DFI. The DBN’s founding documents enshrine its wholesale mandate, focus on MSMEs, financial sustainability objectives, and independent corporate governance, despite the government being the largest shareholder. Board and executive management positions are appointed via a fully transparent, competitive selection process based on professional qualifications and experience. Independent non-executive directors are always in the majority to ensure that decisions leverage their expertise. The World Bank and EIB also have observer status to lend further confidence to the DBN’s independence. This framework ensures that the DBN remains focused on channeling wholesale funds to eligible PFIs for on-lending to MSMEs.

- Financial sustainability. The DBN does not rely on government budget allocations and operates based on financial sustainability. It provides longer-term loans and risk-sharing facilities to PFIs to expand their outreach to MSMEs. Its pricing is risk-based and reflects the operating cost and risk assessment of each obligor. The DBN also facilitates external expert capacity-building support to PFIs and MSMEs. Further, it maintains a lean and efficient operating structure comprising highly skilled professionals to deliver the greatest impact. As a result, it benefits from a low cost-to-income ratio and has maintained a positive financial return since its inception, including zero percent nonperforming loans on its LoC facility. In July 2023, the DBN issued the first series of bonds under its N100 billion domestic bond issuance program to increase MSME lending. The N20 billion medium-term bond, maturing in 2028, was issued at a 14.4% interest rate and was oversubscribed by N23 billion, showing its ability to attract funding from Nigerian investors reflective of the market’s confidence in the institution.

While the DBN has made inroads in improving MSME financing challenges, more remains to be done. A recent IFC-financed study estimates that the unmet demand for MSME credit alone is equivalent to $32.2 billion. To address this funding gap, the DBN will need to scale up its existing operations. It will also need to develop new products and services to address market needs, including digital financial services and fintech. Lastly, the DNB will need to expand its collaboration with impactful stakeholders by strategically aligning with both development partners and private sector players to bring further awareness to its mandate, develop new solutions, and strengthen the resilience of its balance sheet amid the challenging macro-financial landscape, while continuing to deepen its impact on the MSME financing market.

1The African Development Bank (AfDB), European Investment Bank (EIB), German Development Bank (KFW), and French Development Agency (AFD).

Join the Conversation