The informal sector is a large part of employment in African cities. The International Labour Organization estimates that more than 66% of total employment in Sub-Saharan African is in the informal sector. With a pervasive informal sector, city governments have been struggling with how best to respond. On the one hand, a large informal sector often adds to city congestion, through informal vending and transport services, and does not contribute to city revenue. Furthermore, informal enterprises are typically characterized by low productivity, low wages and non-exportable goods and services. On the other hand, the informal sector provides crucial livelihoods to the most vulnerable of the urban poor.

Policy reactions to the informal sector typically vary between two extremes: some focus on punitive and regulatory measures to enforce formalization or evict vendors outside the city, while other approaches focus on unleashing the untapped entrepreneurial potential of the informal sector. Recent World Bank research in Greater Kampala finds evidence that both policy options may be unlikely to produce positive impacts. Instead, our findings suggest a more varied interpretation of Greater Kampala’s economy.

Are informal firms tax dodgers?

Commonly, city governments perceive the informal sector as a regulatory issue. From this perspective, informal traders are seen as purposefully evading taxes, consequently withholding revenue from the city and unfairly competing with formal, tax-paying businesses.

However, little empirical evidence suggests that Greater Kampala’s informal sector is motivated by tax evasion. Our survey data shows that 69% of the city’s informal enterprises are below the lowest company income tax threshold. City governments also collects annual trading licensing fees. However, firms which operate in a trader’s market, produce handicrafts or are based at home are exempt from requiring licenses. The majority of Greater Kampala’s informal sector work is in trading and services. These firms will typically operate either in a trader’s market, from home or will trade from the street, with no physical premises. This means that most informal sector firms are either exempt, or ineligible for a trading licence. City policies focused on increasing regulatory compliance are therefore unlikely to yield increased revenues commensurate with the effort to enforce firms to formalize.

Most informal firms are below the lowest tax threshold

Does the informal sector have hidden growth potential?

Another perspective of the informal sector, made famous by Hernando De Soto, is that it is a cache of untapped entrepreneurial potential. There is no denying the entrepreneurial spirit of Ugandan firms. In 2014, Uganda was the third highest ranked nation in the Global Entrepreneurship Monitor (GEM), with 28% of adults owning or co-owning a new business. However, the GEM shows that Uganda also suffers from some of the highest business discontinuation rates in the world.

In Greater Kampala, the data suggests that only a small section of the informal sector has the potential to grow. While it is impossible to predict the growth trajectory of firms, our analysis suggests that only 18% of informal enterprises possess some of the main characteristics usually associated with firm growth. Nearly a quarter of firms in the informal sector stated that they had started their business out of a lack of any other opportunity to generate income, and this figure was higher among traders. Further, 39% of firms had no concrete plans to expand their business, and only 13% of firms had started their business due to market size opportunity. Firm growth exists for some informal businesses; however, the evidence suggests that, for the majority, informal work is more connected to eking out a subsistence livelihood.

What matters to the informal sector? Location, location, location

What has been less discussed in the literature is the spatial aspect of the informal sector. Informal vendors and transport providers are typically criticized for inflaming city congestion or hampering access to formal businesses. Often, policy solutions have been to ban street vendors or to re-locate them outside of the city center.

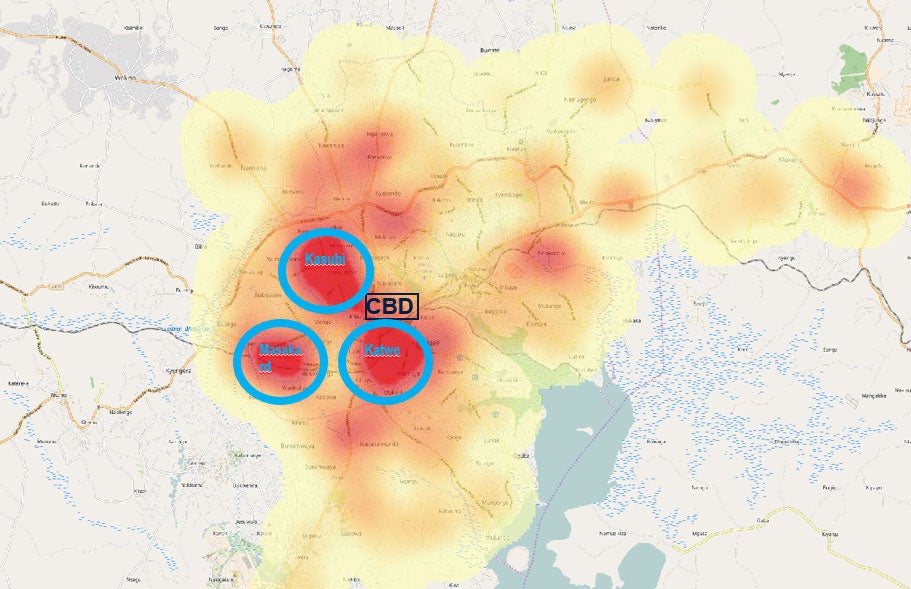

However, mapping firm density in Greater Kampala showed that there were three visible clusters of informal firms: Katwe, Kasubi and Masaka. These clusters are situated near the Central Business District (where customers would be) and in close proximity to low-income housing. These findings suggest that proximity to population densities and housing matters a lot when informal firms choose to operate. This was corroborated by the survey findings which showed that 97% of informal firms sell directly to individuals or households, rather than to other businesses. Also, that 84% of firms sell to customers within a 30-minute walk. This means that decisions affecting informal enterprises’ access to customers should be taken in close dialogue with informal sector representatives, if they are not to negatively impact the urban poor.

Informal firm density in Greater Kampala

What does the research mean for city policy? Putting the pieces together.

Research into the informal sector in Greater Kampala has several policy lessons, which may be interesting also for other African cities. Firstly, the informal sector is not black and white: it is not simply a regulatory issue and it is not a major reservoir of entrepreneurial talent. Put simply, most informal firms don’t make enough to pay tax and a majority of firms are unlikely to grow. However, the informal sector does provide a livelihood for many of the urban poor.

What we do know is that the nature of the informal sector is local – informal firms need to operate close to workers’ homes and near high foot traffic. For policies to be sustainable and pro-poor, the spatial reality for these firms must be taken into consideration. Our report, therefore, calls for city governments to transition “From Regulators to Enablers” that have a positive relationship with the informal sector. The report calls for city governments to invest in infrastructure that protects informal sector enterprises’ access to customers, such as vending stations near transport stops, public markets and serviced working premises. Dialogue between city governments and informal sector representatives will also be critical to ensuring that the location and design of such infrastructure is viable and feasible.

Join the Conversation