Less than six years ago, policymakers were concerned about a credit boom in central and eastern Europe (see, e.g., Enoch and Otker-Robe, 2007). Now, as the Eurozone debt crisis has taken center stage and bank deleveraging has picked up speed, they worry about a massive credit crunch across Europe, with potentially damaging spillover effects around the world.

How did we get here? How big is the problem? And what is the way forward?

The 2008-09 Crisis: From credit crescendo…

A combination of complex global and domestic factors including structural global imbalances, incentives supported by economic policies and implicit government or supra-national guarantees, and industry practices allowed massive amounts of easy credit to flow from domestic and international sources to doubtful parts of the private sector such as risky mortgages and real estate projects, triggering unsustainable credit booms and asset bubbles across the world. (Much has been written on the topic. See, for example, Brunnermeier 2009, or Obstfeld and Rogoff 2009).

Many financial institutions were operating with smaller capital buffers (i.e. higher leverage) and also relied heavily on an unsustainable model of short-term wholesale funding to finance the rapid growth of longer-term credit, while national supervisors missed deficiencies in banks’ ability to identify and manage the risks they were taking. As a result, many institutions—some of them too important to fail—were not able to absorb large solvency or liquidity shocks that could hit them either individually or systemically.

At the same time, growing volumes of cross-border capital flows created increasingly complex and interconnected financial systems, but effective mechanisms for cross-border supervisory coordination and burden sharing were largely absent to address the risks and failures of cross-border banking groups.

…to credit crunch

The flaws in business models and the larger financial infrastructure became painfully clear when the booms faded and the bubbles popped in 2007. With various degrees of delay, financial institutions around the world got into trouble and governments had to step in, burdening public finances and making countercyclical fiscal responses more difficult to protect the economy against shocks down the road. This essentially tied the fates of sovereigns and banks even closer together, particularly in Europe.

Regulators around the world responded by launching extensive reforms to create more resilient financial systems. Banks started to deleverage as part of a process of cleaning up their balance sheets and sought more stable sources of funding such as retail deposits. Deleveraging was achieved through a combination of reduced lending, sales of non-strategic assets, or exit from riskier businesses subject to tighter capital buffer requirements. They also started to boost capital cushions to ease solvency concerns and to prepare for the phasing-in of tighter Basel III capital requirements over 2013-19.

The Euro Area Crisis and Western European banks: Shrinking “yes”, imploding “no”

While some degree of bank deleveraging was necessary, concerns have recently surfaced about excessive and disorderly deleveraging by many banks in Western Europe that could trigger a massive credit crunch and hurt the broader economy. The anxiety over a crunch became particularly acute as the Euro area crisis deepened, which reinforced the negative feedback loop between banks, sovereigns, and the real economy in the context of stricter bank regulations (Figure 1 and discussion below).

Reluctant to raise fresh capital to boost their buffers in a weak valuation environment, many banks announced plans to meet the required ratios by retaining earnings, managing their risk-weighted assets (RWAs), reassessing the models they use to generate risk weights, and shrinking their balance sheets. Moreover, many banks have started to focus on their “core” marketsand abandon activities and locations that require higher capital or that do not offer profitable opportunities going forward, including due to an adverse regulatory environment.

Taken together, these factors have synchronized bank behavior. Essentially, bank plans to scale back are sound on an individual level, but are jointly problematic. For example, massive bank asset-shedding could generate “fire sales” and trigger an illiquidity-insolvency spiral and exacerbate the feedback loop mentioned earlier. Some market participants expect a deleveraging of about €2-3 trillion for the European banking system as a whole over the next two years.

Figure 1. Sources of Deleveraging

A number of factors have played a role in synchronized deleveraging of Western European banks: Sovereign risks on bank balance sheets have lead to solvency concerns, making regulatory compliance more difficult and heightening counterparty risks. This, in turn, puts banks under pressure to shrink balance sheets, including by selling sovereign holdings to boost capital buffers. As a result, both banks and sovereigns have difficulty raising funding. Borrowing costs have reached all time highs for peripheral euro area sovereigns, to levels deemed by the market as unsustainable, and spilled over to the core Eurozone sovereigns and banks. Banks have been unwilling to lend to each other to support loans to the private sector, and dollar funding to support trade financing has been scarce since the summer. Instead, banks prefer to park excess cash at the central bank, forcing weaker banks to borrow at central bank penalty rates, even though the ECB recently flooded the market with liquidity.

Banks have also been refocusing their business strategies across locations and activities in an effort to meet the tighter capital and liquidity requirements under the Basel framework. This process of adjustment is expected to accelerate as national (e.g. Sweden and Austria) and international regulators impose additional requirements to strengthen banks’ balance sheets and reinstate confidence in their banking systems.

What are the global consequences of Western European bank deleveraging?

The impact of Western European banks’ deleveraging is being transmitted through various financial linkages to the rest of the world, including via local subsidiaries, cross-border lending, and trade finance. Although the growth of foreign claims of Western European banks on the rest of the world has already slowed down since 2008, an accelerated and disorderly retrenchment can still be dangerous.

In particular, where global banks have systemic importance and support private sector credit, sales or scale down of non-core, non-domestic businesses affect host economies and could destabilize their financial systems, triggering attempts by host authorities to ring-fence subsidiaries. Such policy responses could be mutually harmful, with negative consequences for the banking group.

A credit crunch would harm corporate prospects, slowing growth, triggering a rise in non-performing loans (NPLs) and corporate failures, and increasing unemployment. This could affect especially those countries that lack well-developed capital markets and alternative sources of stable non-bank financing.

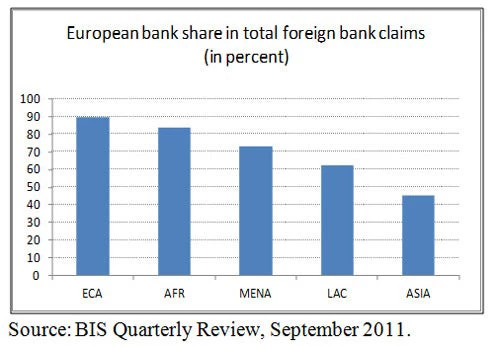

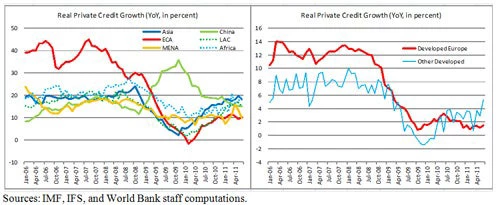

Eastern Europe in particular is already experiencing a tightening of credit standards and a sharp slowdown in lending given strong links with Western European banks and an over-reliance on non-deposit funding to finance credit expansion (Figures 2 and 3). Only the largest companies have been able to deflect some of the impact by relying on bond market financing.

Although the risks and exposures differ, there is evidence of similar trends across Asia and Latin America as euro-zone problems produce ripple effects through various financial channels. A recent lending survey by the Institute of International Finance suggests that these regions are also facing a tightening of credit standards, as funding conditions in international markets deteriorate and concerns about rising risks and non-performing loans increase.

Figure 2. Emerging Market Linkages with Western European Banks

Figure 3: Evolution of Credit Growth

(Click on image to view a larger version of the figures.)

Certain areas of banking are expected to be hit harder than others. These include bank assets that require higher capital but are less profitable, including infrastructure finance. Trade finance is another area that some banks, notably French banks, are retreating from. Large European banks account for one third of global trade finance, but reduced access to US dollar funding makes operating this business more difficult and will affect many regions (Figure 2). Riskier lending to small and medium-sized businesses demand higher capital levels and is therefore also expected to be affected.

The Way Forward: No silver bullets, but manage the process carefully

As the financial crisis went global, it has become clear that greater policy coordination among regulators and policymakers and effective cooperation and information exchange between home-host authorities are essential. Actions by national or regional regulators to strengthen bank capital, where they are not well coordinated or communicated, create regulatory uncertainty and potentially conflicting rules, lead to an uneven playing field across jurisdictions, and affect banks’ incentives to lend.

Given the need to increase dependence on more stable and local sources of funding, policymakers should strive to develop capital markets to reduce the private sector’s reliance on bank financing to support economic activity. Recent measures taken by some national authorities to achieve greater self-reliance at parent and subsidiary levels increase the urgency of developing markets to mitigate the negative consequences for credit availability and economic recovery.

Although the deleveraging trend aims to make banks safer, supervisors should carefully monitor the buildup of new risks. For example, there are indications that banks may be purchasing asset guarantees to structure their asset portfolios and lower risk weights; such actions to manage RWAs may create linkages across institutions and could leave systemic risk intact if they are too concentrated. National and global regulators should accelerate their efforts to monitor and assess developments in the non-bank and shadow banking sector, which were previously less- or unregulated and had been a source of systemic risk. Indeed, there are claims that hedge funds and insurance companies are willing to bid for bank assets as they are sold off.

Finally, the recent actions by the ECB to expand its lender of last resort function to the banking system is a crucial step to encourage banks to maintain lending to the economy and reduce the risk of a massive credit crunch. For these actions to bear fruit, however, markets need assurance that the EU rescue plan announced on October 26, 2011, is implemented swiftly, including by ensuring that the obstacles for the European rescue funds to play their role as an effective firepower against contagion are addressed. This is a crucial element to help reinstate market confidence and ease lingering concerns over sovereign exposures and the health of the European banking system.

Further Reading:

Rapid Credit Growth in Central and Eastern Europe: Endless Boom or Early Warning?, Charles Enoch and Inci Otker-Robe eds, Palgrave MacMillan, 2007.

Join the Conversation