More than 1.3 billion women are excluded from the formal financial system. These women – the overwhelming majority of whom reside in developing countries – lack the basic financial tools critical to asset ownership and economic empowerment. Even something as simple as a deposit account provides a safe place to save and creates a reliable payment connection with family members, an employer, or the government. A formal account can also open up channels to formal credit critical to investing in education or in a business. Yet women are 15 percent less likely than men to be financially included. Why?

In a new study and summary companion note we document and analyze gender differences in the use of financial service using new data from the Global Financial Inclusion (Global Findex) Database. Our analysis is based on almost 100,000 interviews with adults in 98 developing economies in 2011. We also combine the Global Findex data with cross-country data on legal discrimination against women from the World Bank’s Women and Law Database and on cultural norms from the OECD’s Gender, Institutions, and Development database to examine their relationship with financial inclusion. Because the later country-level variables show no variation across high income economies, our econometric analysis focuses on a sample of up to 98 developing countries.

Our regression results indicate that even after controlling for a host of individual characteristics (including income, education, employment status, rural or urban residence, marital status, household size, and age) and country characteristics, gender remains a significant determinant of account ownership and saving and borrowing behavior. Moreover, the results show that gender affects measures of financial inclusion not only directly but also indirectly, through gender differences in income, education, and employment status.

We also explore the degree to which economy-wide legal discrimination against women and gender norms are related to this gender gap. As a result of differential treatment under the law or by custom, for example, women may have less ability than men to own, manage, control, or inherit property, which in turn might affect women’s demand for financial services (see, for example, World Bank 2012). Using data from the World Bank’s Women, Business and the Law database, we show that in countries where women face legal discrimination in the ability to work, head a household, choose where to live, or inherit property or are required by law to obey their husband, women are less likely than men to own an account and to save and borrow. In country-level regressions we find that the gender gap is smaller in account ownership and formal savings and credit in countries where women are afforded equal rights after controlling for the level of economic development. And when we add an interaction term between the dummy variable for female and each measure of legal discrimination to individual-level regressions we find that, after controlling for individual characteristics and country fixed effects, women are more likely to own an account in countries where they are not subject to legal discrimination. We also find evidence that women are more likely to save formally and more likely to use informal credit — which is the most common source of credit in the developing world — in those countries.

We also consider gender norms as quantified by the Organisation for Economic Co-operation and Development’s Gender, Institutions and Development Database, such as the level of violence against women and the incidence of early marriage for women. The results confirm that gender norms help explain differences in the use of financial services.

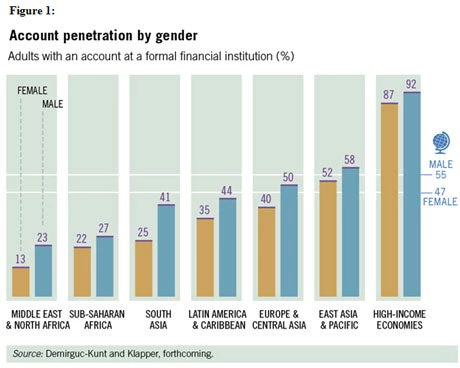

Taking a step back, just how big is the gender gap in financial inclusion? According to the Global Findex data, 47 percent of women and 55 percent of men worldwide have an account at a formal financial institution—a bank, credit union, cooperative, post office, or microfinance institution. In developing world, the gender gap grows larger – 37 percent of women compared to 46 percent of men — and it is larger still among adults living below the $2-a-day poverty line, a group in which women are 28 percent less likely than men to have a formal account

The gender gap also varies widely across economies and regions. In a few economies—such as Slovenia, Thailand, and Uruguay — there is essentially no gender gap in account penetration. But in some—such as Guatemala, Jordan, and Pakistan — women are only half as likely as men to have an account. Among regions, South Asia and the Middle East and North Africa have the largest gender gaps, with women about 40 percent less likely than men to have a formal account (Figure 1). But the gender gap is statistically significant in all regions, even when controlling for education, age, income, rural or urban residence, and country-level characteristics.[1]

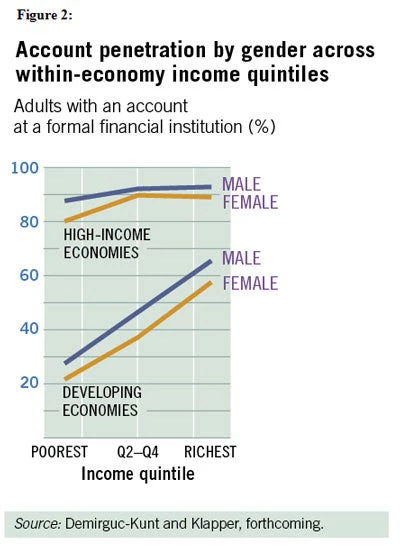

On average, the gender gap in account penetration persists across all within-economy income quintiles. In developing economies women are less likely to have a formal account than men across all income quintiles, with the differences in account penetration averaging between 6 and 9 percentage points (Figure 2). In high-income economies, however, the gender gap exceeds 4 percentage points only for women in the poorest income quintile.

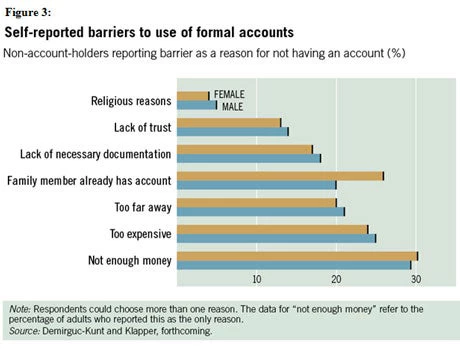

So why do more than 1.3 billion women have no formal account? Globally, among both men and women, the most frequently cited reason for not having a formal account is lack of enough money to use one (figure 3). This is the response given by 65 percent of adults without a formal account, with 30 percent citing this as the only reason (multiple responses were permitted).

Indeed, except for one key reason, men and women mostly cite similar reasons for not having an account. Women are more likely to cite not having an account “because someone else in the family already has an account” – a reason cited by 26 percent of women without an account but 20 percent of men without one.[2] Among women, it is the second most common reason whereas for men this reason comes in forth, after “too expensive” and “too far away.” While indirect use of an account increases access, widespread indirect use may be of concern to policy makers. Recent studies have shown that lack of account ownership (and of personal asset accumulation) limits women’s ability to pursue self-employment opportunities (Hallward-Driemeier and Hasan, 2012). And field experiments have demonstrated that expanding account ownership among female entrepreneurs can lead to significant increases in savings and productive investment (Dupas and Robinson, 2013).

When we relax the definition of account ownership to also include indirect access through a family member, the observed worldwide gender gap narrows from eight percentage points to three (the data do not distinguish the gender of the family member who already has an account). Thus even when the analysis accounts for indirect account use, a gender gap remains. And the fact that a larger share of women than men cite indirect access through a family member as a reason for not having an account can be interpreted as another manifestation of the gender gap.

We also observe a gender gap in savings and credit behavior in developing economies. A significantly smaller share of women than men report having saving in the past year (34 percent compared with 38 percent globally and 29 percent compared to 33 percent in developing countries). There is also a significant gender gap in borrowing behavior: globally 10 percent of men report having borrowed from a formal financial institution in the past year, compared with 8 percent of women.

More research is needed to better understand the channels that reduce women’s access to financial services and identify new products, processes, and technology that can expand financial inclusion of women. With complete updates in 2014 and 2017, the Global Findex will allow us to compare indicators not only across countries but also within countries over time. This will allow for a better understanding of how women around the world save, borrow, make payments, and manage risk and help track the impact of financial inclusion reforms and initiatives targeted at women over time.

The Global Findex data were collected by Gallup, Inc. using the Gallup World Poll Survey. The Research Group is building the database with a 10-year grant from the Bill and Melinda Gates Foundation. The complete country- and micro-level database is available through the Global Findex website.

References

Demirguc-Kunt, A., and L. Klapper. Forthcoming. “Measuring Financial Inclusion: The Global Findex Database.” Brookings Papers on Economic Activity.

Demirguc-Kunt, A., L. Klapper, and D. Singer. 2013. “Financial Inclusion and Legal Discrimination against Women: Evidence from Developing Countries.” Policy Research Working Paper 6416, World Bank, Washington, DC.

Dupas, P., and J. Robinson. 2013. “Savings Constraints and Microenterprise Development: Evidence from a Field Experiment in Kenya.” American Economic Journal: Applied Economics 5 (1): 163–92.

Hallward-Driemeier, M., and T. Hasan. 2012. Empowering Women: Legal Rights and Economic Opportunities in Africa. Africa Development Forum Series. Washington, DC: World Bank.

World Bank. 2012. World Development Report 2012: Gender Equality and Development. Washington, DC: World Bank.

Join the Conversation