Souvenirs at a shop in Oman. (Curioso.Photography/Shutterstock.com)

Souvenirs at a shop in Oman. (Curioso.Photography/Shutterstock.com)

The Middle East and North Africa (MENA) has faced a dizzying sequence of shocks since 2020—the COVID-19 pandemic, Russia’s invasion of Ukraine, rising public debt and interest rates, and natural disasters. While these shocks have been or are expected to remain temporary, could they permanently scar the region’s most precious resource, its people?

As the global landscape continues to experience heightened volatility, the latest World Bank Economic Update for the MENA region, which was issued on October 5th and is titled "Balancing Act: Jobs and Wages in the Middle East and North Africa When Crises Hit" provides insights on the human side of macroeconomic turmoil by examining labor market adjustments in MENA during periods of economic downturns.

When comparing labor market adjustments in MENA to those in other emerging market and developing economies (EMDEs) over the past 30 years, the report documents that, overall, labor markets in MENA and other EMDEs respond to shocks in similar ways. During economic downturns, labor force participation in both MENA and EMDEs declines, while unemployment and informality increase. Wages are also sticky downward in both country groups, that is, they tend to remain above their long-run trend during contractions. This evidence challenges the prevailing notion that labor markets in MENA are fundamentally distinct from the global landscape.

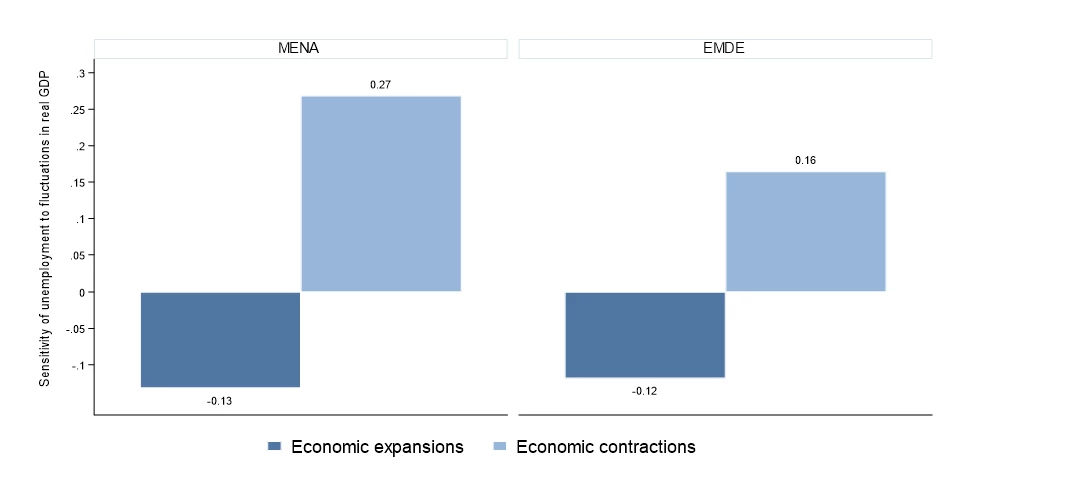

While similarities in labor market adjustments exist, a critical disparity emerges during economic downturns – the response of unemployment in MENA is nearly double that of other EMDEs. This stark difference is illustrated in Figure 1. Combined, the global shocks that hit the MENA region during 2020-2022 are estimated to have led to an increase of over 5 million people becoming unemployed above the already high levels of unemployment that have characterized the region even before COVID-19 hit.

Figure 1: The response of unemployment to fluctuations in real GDP in MENA and EMDEs

Unpacking the dynamics further, when economic shocks strike without triggering inflation, unemployment takes center stage as the primary margin of labor market adjustment in MENA. The aftermath of the COVID-19 pandemic and adverse shocks to the terms of trade underline the potential for an increase in the number of unemployed individuals in the MENA region. Insights from the COVID-19 MENA monitor surveys conducted by the Economic Research Forum (ERF) in November 2020 reveal that 29% of wage workers in Morocco and Tunisia reported experiencing a permanent or temporary layoff, but only 15% reported a decline in pay. Evidence from Iran also suggests that following the global decline in oil prices in 2014-15, which led to a decline in aggregate demand and downward pressure on prices, unemployment rate rose by around 5% in the quarter following the shock and by up to 15% three quarters later.

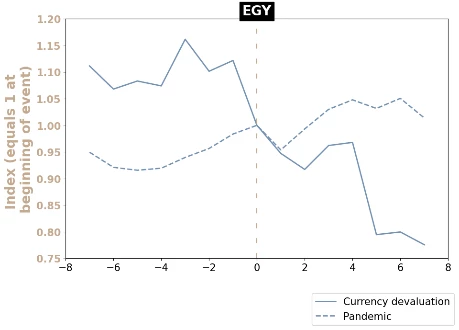

Conversely, when economic shocks trigger inflation, unemployment may be less responsive, but real incomes fall. Egypt's experience following the 2016 currency devaluation serves as a poignant example. Inflation soared to 30% in 2017, yet unemployment rates declined from 11% in 2016Q4 to 9% in 2017Q1. On the other hand, over the following six months, real wages declined by 10%. Fifteen months after the currency depreciation, real wages had fallen by a substantial 20%, as illustrated in Figure 2.

Figure 2: Real monthly wages following Egypt’s 2016 currency devaluation and the pandemic

Source: Authors’ calculations based on data from Labor Force Surveys.

The “balancing act” involves navigating the trade offs in the labor market when an economy confronts economic shocks that lead to a decrease in labor demand. One critical trade-off is the decline in employment and the decrease in real wages in inflationary environments – neither of which is desirable.

Temporary job losses can have long-term negative repercussions for workers, a phenomenon referred to in the academic literature as “labor scarring”. For example, men in Egypt who lost their jobs due to the closing of a firm or job termination were more likely to remain unemployed or informally employed even a decade later. The erosion of real incomes raises different concerns, as it has dire implications for standards of living and income inequality.

In the face of these challenges, the report discusses policy options and advocates for the importance of preserving the flexibility of real wages during periods of economic shocks. These recommendations aim to mitigate job losses while simultaneously safeguarding vulnerable segments of the population through well-targeted cash transfer programs.

Join the Conversation