People and children stand around a cauldron of food in the West Bank.

People and children stand around a cauldron of food in the West Bank.

With many competing demands for government resources and a recurring fiscal deficit, it becomes critical to identify clear strategies that address pressing development priorities, like poverty reduction and climate vulnerability. In the Palestinian territories, fiscal subsidy reforms can help free up resources and improve economic and social conditions for a bigger part of the population. Let’s see how.

Large numbers of people living in the West Bank and Gaza who are experiencing poverty are also highly vulnerable to climate change. Climate shocks have the potential to exacerbate existing socio-economic challenges further particularly through heightened food insecurity and increased constraints on access to resources like water and energy.

The COVID-19 pandemic exposed how severely vulnerable Palestinian households are. The economic restrictions early in the pandemic led to a sudden rise in the poverty rate by more than 6 percentage points across the West Bank and Gaza. This is the equivalent of 300 thousand more individuals who were pushed into poverty in the short term. We can expect that climate-induced shocks would similarly reinforce existing vulnerabilities and create a substantial number of newly-poor households in both the West Bank and Gaza.

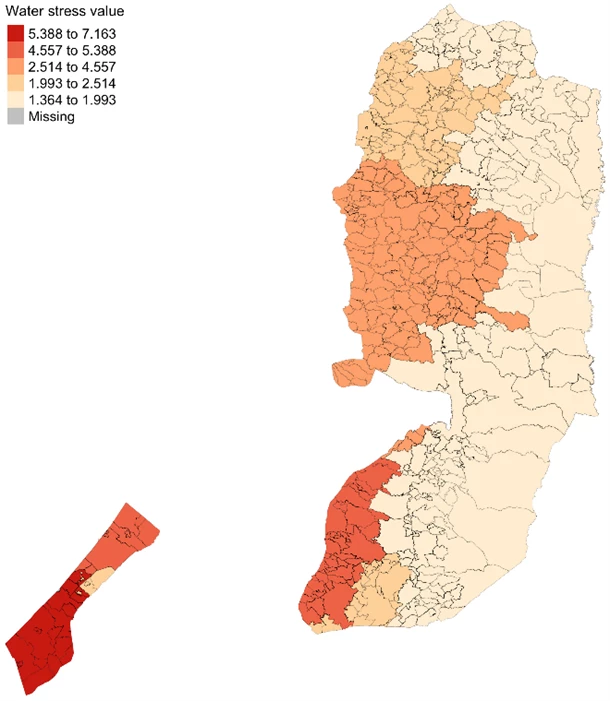

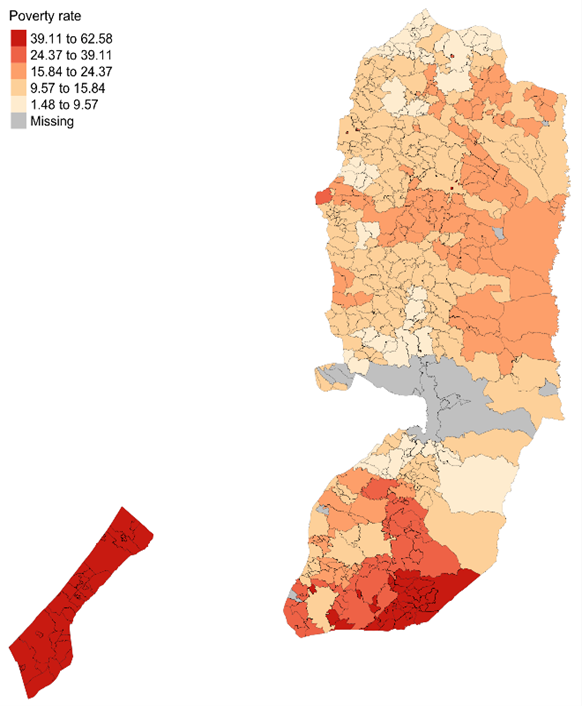

People living under severe water stress and with high rates of poverty are concentrated in Gaza and in the southern West Bank. The figures below show the overlap between areas that are expected to become the most water stressed over the next decade under a business-as-usual scenario (figure 1), and areas with the highest poverty rates (figure 2). Localities with the highest projected water stress are concentrated in Deir Al Balah, Rafah, and Khan Yunis in Gaza, and in the localities in the Hebron governorate in the West Bank.

| Figure 1: Populations under the most water stress are concentrated in Gaza and the south west of the West Bank | Figure 2: Poverty rates are highest in Gaza, and in localities in the southern West Bank |

| Projected locality-level water stress indicators in 2030 |

Poverty rates at the locality level |

|

|

| Note: Projected water stress to 2030 under a business-as-usual scenario. | Note: Poverty at the locality level calculated from PECS 2016/2017 data and 2016 census. |

| Source: World Resources Institute data and projections. | Source: World Bank Poverty Map for the Palestinian territories, 2019. |

Finding practicable solutions, in a strained fiscal context is no easy task, but there are options. The Palestinian Authority (PA) spends roughly one percent of GDP subsidizing fuel each year. This not only detracts from the climate agenda but also crowds out social spending in areas such as education and the national cash transfer program. In 2021, the fuel subsidy provided by the PA Ministry of Finance was worth US$77 million. In 2022, amid the global increase in fuel prices, the fuel subsidy rose by 191 percent year-over-year.

Subsidies have meant that fuel retail prices in the Palestinian territories are lower than the global oil price, highlighting that there is space for reform. Almost 100 percent of fossil fuels in the Palestinian territories are imported, mainly from Israel. Fuel prices do not fully reflect fluctuations in global oil prices due to the addition of taxes and subsidies, and exchange rate fluctuations with the dollar. Taxes represent an average of two-thirds of the final price that consumers end up paying. Changing fuel taxation is also an option, but in the context of the West Bank and Gaza this would require a specific negotiation between the Palestinian and Israeli authorities.

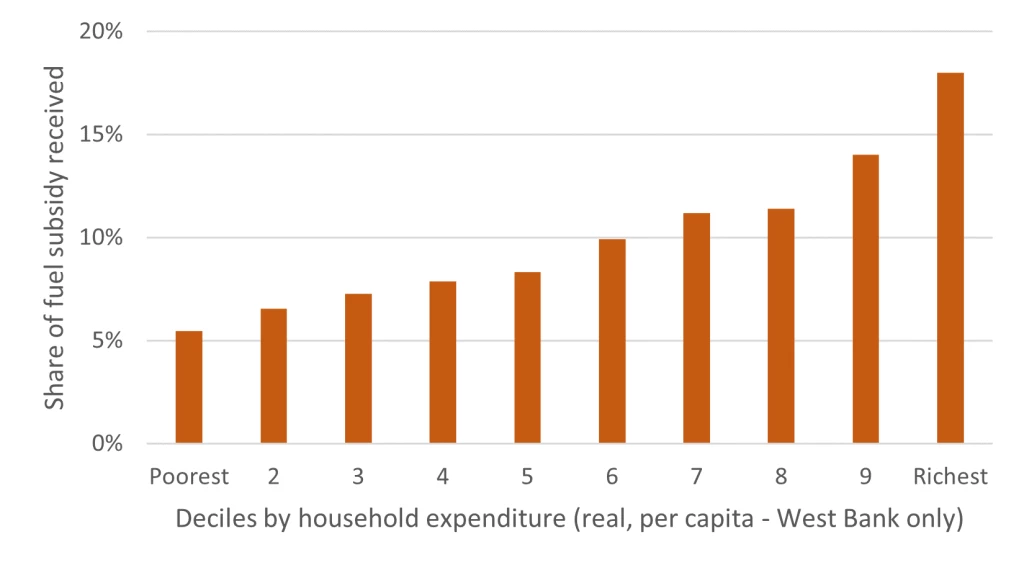

The fuel subsidy is the least progressive of all the public transfers in the West Bank and Gaza. This is because richer households receive a higher share of total subsidies, given that they also consume a higher amount of fuel than poor households. This finding is in contrast to subsidies on electricity which are progressive, and social spending such as education and cash transfers which are both highly progressive. Although the fuel subsidy is poverty reducing, it is a very inefficient way of doing so, as poor households are subsidized far less than richer households. As shown in Figure 3 below, the total fuel subsidy going to the richest ten percent of the population in the West Bank is almost four times higher than the amount going to the poorest ten percent.

Figure 3: Absolute incidence of fuel subsidies (direct plus indirect effects): West Bank - The share of fuel subsidies going to the richest households is about four times higher than for the poorest households.

The impact of reducing the fuel subsidy by 50 percent would be substantial, and the savings could be redirected into important priorities, including social spending and climate action. The average annual amount spent on fuel subsidies over the last decade is NIS 410 million per year. Freeing up a little over NIS 200 million for social spending would be an opportunity to finance the equivalent of 40 percent of the National Cash Transfer Program, for example1, which would, in other words, support over 46,000 Palestinian households currently living in deep poverty. Or it could pay the equivalent of 50 percent of the annual CAPEX estimated investment needs for the West Bank and Gaza to address the climate challenges in the water, energy, agricultural, urban development, and human capital sectors2. However, it is important to stress that any reduction of fuel subsidies should be carefully managed and implemented through a phased approach, to prevent negative consequences for the poor. While being highly regressive, fuel subsidies are still poverty-reducing for a certain portion of population. That should be taken into full account to ensure that the poor are protected from any abrupt negative impacts.

1 Based on 2021 Palestinian National Cash Transfer Program figures, source WB staff.

2 World Bank Staff calculations, 2023.

Join the Conversation