Following Russia’s annexation of Crimea after the popular voting in early March, the European Union and recently the U.S. and Canada have imposed their first round of sanctions—an asset freeze and travel ban on some officials in Russia and Crimea.

This week NATO's foreign ministers,

warning that Russian troops could invade the eastern part of Ukraine swiftly, ordered an end to civilian and military cooperation with Russia. Should the crisis escalate, potential fallout on Middle East and North Africa (MENA) countries is likely. The effects would be transmitted directly through trade and indirectly through commodity prices.

Following Russia’s annexation of Crimea after the popular voting in early March, the European Union and recently the U.S. and Canada have imposed their first round of sanctions—an asset freeze and travel ban on some officials in Russia and Crimea.

This week NATO's foreign ministers,

warning that Russian troops could invade the eastern part of Ukraine swiftly, ordered an end to civilian and military cooperation with Russia. Should the crisis escalate, potential fallout on Middle East and North Africa (MENA) countries is likely. The effects would be transmitted directly through trade and indirectly through commodity prices.

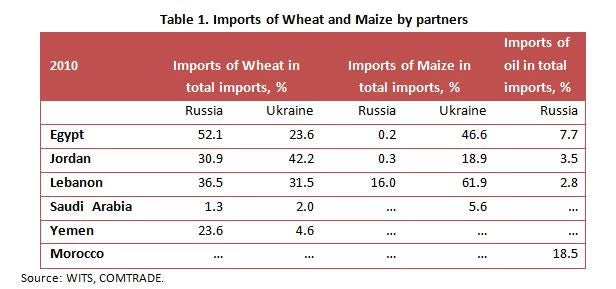

Russia and Ukraine are major agricultural producers and exporters. In 2012, Russia and Ukraine accounted for 11 and 5 percent of global wheat exports, and Ukraine accounted for more than 14 percent of global maize exports (third largest globally). A disruption to Russia’s and Ukraine’s exports could potentially lower the volume of trade globally and particularly to the MENA region. MENA is one of the two regions (after Sub-Saharan Africa) most dependent on imported wheat. More than 50 percent of Russian wheat exports go to Egypt followed by Lebanon, Jordan and Yemen (Table 1). These countries also rely on Ukraine for more than 50 percent of their supply of wheat and maize (60 percent in Lebanon and 50 percent in Egypt, see table 1). In the event of a supply disruption from Russia and Ukraine, these countries will have to import more from other sources with potentially higher prices that could have large economic effects.

Any disruption to Russia and Ukraine’s exports of commodities could also impact global commodity prices. Recent data from the World Bank show that, at the start of the crisis, the prices of wheat and maize for delivery in May jumped by 4-6 percent. Higher international prices of these commodities could worsen the already high fiscal and current account deficits in those countries that are directly affected by the shock. This could put additional pressures on their already high levels of public debt. Furthermore these countries have little space for fiscal and monetary policies to respond under an extreme scenario of a collapse in Russian and Ukrainian exports.

Since Russia is one of the world’s largest producers and exporters of oil (13 percent of global crude production and exports), a drop in its exports of energy could lead to an oil price hike. After the US and the European Union imposed sanctions on Russia, the price of Brent crude for delivery in May climbed 47 cents and stood at US$106.92 per barrel. Some estimate that a price hike of US$30 per barrel range is possible under a severe supply shock scenario. Oil exporters in the MENA region, particularly Kuwait, Iraq, Saudi Arabia, UAE and possibly Iran will see a gain in their export receipts. Oil importer countries, except for Morocco which imports about 20 percent of petroleum from Russia and could be directly affected by the volume of oil imports as well, will feel the brunt directly through an increase in their import bill. This could put extra pressure on their twin deficits and force governments to resort to their foreign reserves or raise public debt.

The World Bank’s latest report, Middle East and North Africa: Harnessing the Global Recovery, a Tough Road Ahead projects growth in MENA region to accelerate from an average of 2.6 percent in 2013 to 4.6 percent in 2015 and these economies will start to benefit from stronger external demand in the high-income economies due to global economic recovery. However the prospects of a full economic recovery remain uncertain should domestic as well as external shocks including conflict in Ukraine escalates.

Join the Conversation