A large container ship passing Suez Canal, Egypt | © shutterstock.com

A large container ship passing Suez Canal, Egypt | © shutterstock.com

Egypt continues to struggle with significant labor market problems — notably, low real wages, low female labor force participation (FLFP), and high informality. The possibility that the liberalization strategy pursued by the government in the last decades might either impose or reinforce harmful effects on local labor markets has been cited as a concern. Higher imports could affect labor markets in at least two ways. Most often people think of imports as competition for domestic production that puts domestic jobs at risk. The rise of global value chains (GVCs), however, raises the possibility that imports could have a positive effect on the labor market when domestic workers use foreign inputs in production, making imports and domestic jobs complements rather than substitutes. The fact that Egypt’s industries rely heavily on imported goods for production — with almost 75 percent of them being either intermediate or raw materials — suggests that whether imports have net positive or net negative effects on labor market outcomes is an empirical question.

Our paper, “Is international trade always beneficial to labor markets? A case study from Egypt”, tackles the question of whether rising imports could be a problem for Egypt’s workers. It does this by taking a two-pronged approach. First, we use a Gravity model to understand how trade agreements changed trade flows to Egypt by measuring how trade is affected by geographical proximity, trade agreements, economic variables, and costs. Second, we use the geography-based Bartik model to study the link between rising trade and local labor markets by measuring how a change in trade can alter wages, employment, and informality for different types of workers. We conclude that imports, at least on net, are not to blame for Egypt’s disappointing labor market outcomes.

How Trade Agreements Affect Trade Flows

More than half of Egypt’s trading partners have a Free Trade Agreement (FTA) with Egypt, and this share has held steady from 2010 to 2019. From 2004 to 2009, however, the volume of imports and exports more than doubled and average applied tariffs fell significantly. With falling tariffs came rising imports. Over the same period, imports consistently held a higher share of GDP than exports and a long-running trade deficit characterized the balance of trade.

What was the connection between trade liberalization and Egypt’s trade flows? We first test whether these new FTAs boosted trade for Egypt. While conventional wisdom assumes that trade agreements increase trade, the rising complexity of trade agreements and recent studies suggest that a positive relationship between trade agreements and trade flows cannot be taken for granted. This question is important, because if Egypt’s trade agreements had little or no effect on trade flows, the decline in wages and FLFP, and the increase in informality, would more likely be explained by domestic factors than trade liberalization. To evaluate the relationship between Egypt’s agreements and subsequent trade flows, we use the nearly ubiquitous gravity model.

While the literature finds heterogeneous effects of trade agreements on trade flows, our results show that Egypt’s FTAs are associated with over 50 percent more trade, much larger than the 10-20 percent range found in most studies. But most of the effect is led by increasing exports, which rise 45 percent, with imports up only 4.2 percent. This means that Egypt’s trade agreements have tangible positive effects on the volume of exports, but they are not generating a flood of new imports. This result suggests that, even if imports increase competition for Egypt’s workers, trade agreements seem to have a very limited potential for explaining Egypt’s labor-market outcomes.

How Trade — Especially Imports — Affect Labor Market Outcomes

The fact that trade agreements are associated with a relatively small increase in trade does not mean that Egypt’s imports do not adversely affect labor market outcomes. Imports could, in fact, disproportionately affect labor-intensive industries and significantly lower the demand for labor. We next estimate whether increasing imports are directly related to local labor market outcomes. We start by computing a "trade exposure index" to estimate how an increase in imports per worker in Egypt affects average wages, FLFP, and informality rates. We then look at whether labor markets in sub-districts with higher “trade exposure” — that is, those more exposed to trade for a particular sector and with major employment for the same sector — are more affected by trade shocks.

Consistent with the hypothesis that imports increase competition for domestic workers, we find that sub-districts more exposed to imports experienced a small decrease in wages and FLFP, along with an increase in informality. These results, however, do not persist very long and, overall, there is insufficient evidence of import-labor market linkages that could indicate globalization — in the form of import competition — is driving the poor labor market outcomes in Egypt. The volume of imports is limited, the estimated effects are small, and the effects do not last long.

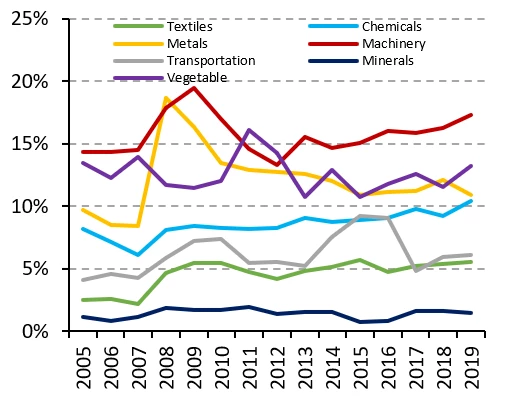

The size of top importing industries and their capital-intensive nature are two plausible factors limiting the effects of trade on Egyptian labor markets (Figure 1). All major imported goods in Egypt are capital intensive, particularly from the machinery, chemical, and mineral (mainly petroleum) industries. Even if imports were substituting for domestic production, since imported goods are not labor-intensive, the impact on local labor markets would be low. Non-labor-intensive imports, which are almost double the value of exports, are typically used as intermediate goods for production. The latter could potentially boost domestic production, but we do not find evidence of that either. That is, the net effect of trade on local labor markets is effectively zero.

Figure 1. Machinery accounts for most of Egypt’s imported goods

Egypt Imports, Industry share

Source: Author elaboration using data from WITS, 2022

Higher Imports Have Little Effect on Labor Market Outcomes

Egypt’s case serves as an example that an increase in imports does not necessarily generate big disruptions in local labor markets, as occurred in other developing countries after liberalizing their economies. In fact, its liberalization policy seems to have tangible effects on the volume of exports — but not imports — and small, not encouraging effects in the local labor markets.

Future research is needed on two fronts to gain more insight into the relationship between greater trade and local labor market outcomes in Egypt. First, a theoretical and empirical framework to identify firm-level and short-run industry-specific effects separately. Second, a disaggregated imports analysis with data that distinguishes between intermediate imports and imports of final goods would be a fruitful next step in this line of research.

Join the Conversation