This blog is the second in a series of ten blogs on commodity market developments, elaborating on themes discussed in the latest edition of the World Bank’s Commodity Markets Outlook. Earlier blogs are here.

Recent Developments and Forecasts

Oil prices have been volatile in 2018, with the price of Brent, the international barometer, ranging from $63/bbl to $86/bbl. Prices have been buffeted by an array of geopolitical and macroeconomic factors, notably supply disruptions in Venezuela, and the reinstatement of U.S. sanctions against Iran. These factors supported prices this year, particularly in September and October; however, prices fell sharply in early November as fears of a supply shortfall receded after the United States announced temporary waivers to its sanctions on Iran for eight countries, as well as stronger-than-expected U.S. oil production.

Oil prices are expected to increase modestly to $74/bbl in 2019, before falling to $69/bbl in 2020. However, there is considerable uncertainty around these forecasts, relating to both demand and supply factors.

Risk 1: Demand

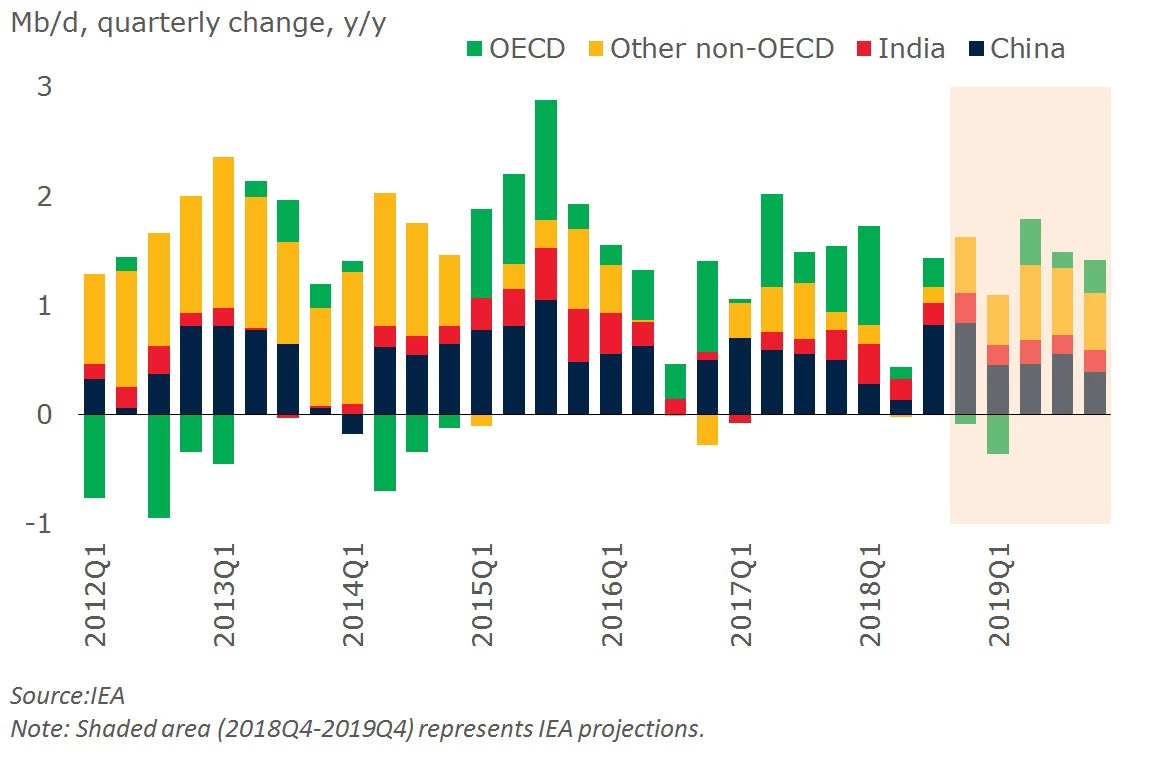

On the demand side, growth in oil consumption has been strong this year and the International Energy Agency (IEA) expects a similar pace of growth next year, driven by China and other emerging market economies. However, the IEA recently revised down its forecast, citing slower global growth and the negative impact of higher oil prices on oil demand. Further weakening of global oil demand could put downward pressure on oil prices.

Oil demand

Risk 2: U.S. production

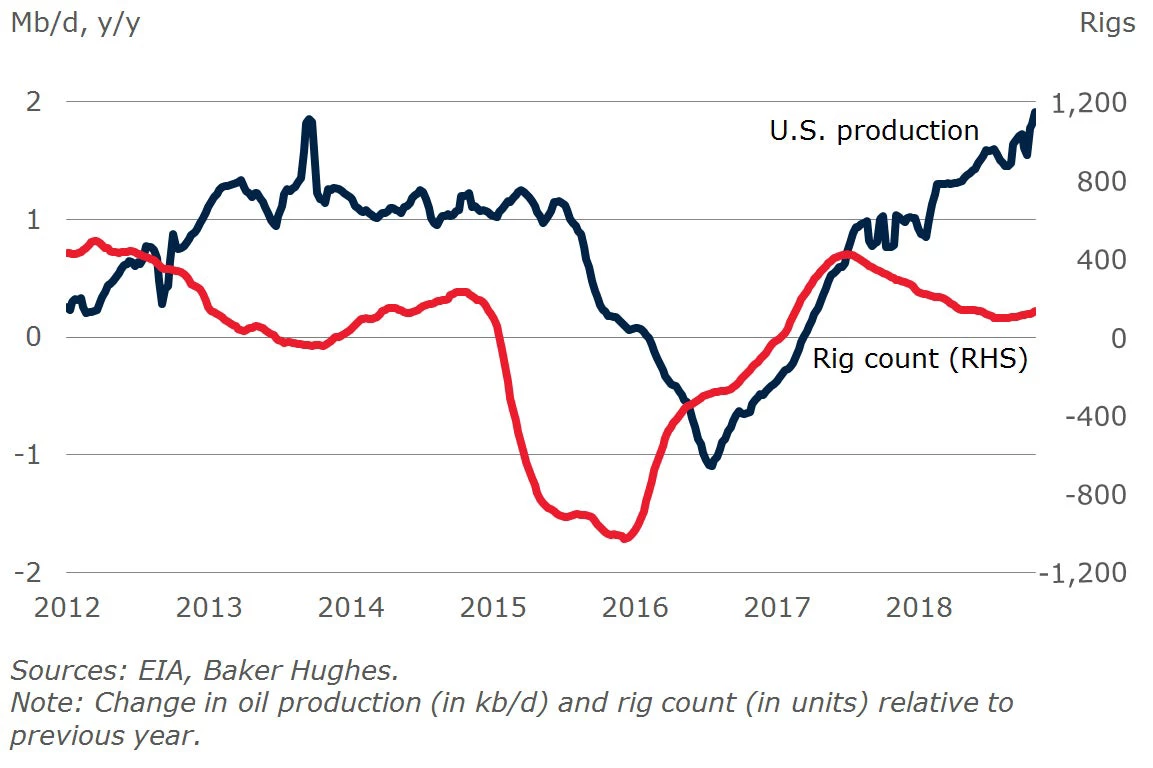

On the supply side, oil production in the United States has continued to surge, with output reaching a record high of 11.3 million barrels per day (mb/d) in August, according to the U.S. Energy Information Administration. The latest data are a significant upward revision relative to earlier estimates and indicate that the United States has overtaken of Russia as the largest oil producer in the world.

Annual change in U.S. oil production and rig count

However, the increase in U.S. oil production has been so rapid that it has outpaced available pipeline capacity, resulting in a substantial price discount for Permian (Midland) West Texas Intermediate (WTI) crude oil relative to U.S. benchmark (Cushing) WTI crude. These bottlenecks are likely to endure until new pipeline capacity comes on line toward the end of 2019 and will likely restrict the pace of growth in U.S. oil production, although progress on some new pipelines has been faster than expected.

Risk 3: Supply disruptions in Iran and Venezuela

Oil prices had been supported this year by ongoing disruptions to production in Venezuela, and fears about the impact of the U.S. re-imposition of sanctions on Iran. The IEA estimates that Iranian oil production in September was 0.4mb/d lower than its peak earlier this year, even though the sanctions did not come into effect until November. However, the U. S. announcement of temporary waivers for eight countries that import oil from Iran, including China and India, has alleviated fears of a sudden shortfall. Nevertheless, the full impact of sanctions on Iranian oil exports when the waivers expire in mid-2019 remains uncertain. Further, production is likely to continue to fall in Venezuela, and the decline could accelerate.

Risk 4: Supply response by OPEC and Russia

In response to perceived tightness in the oil market, the “Vienna Group” of OPEC and non-OPEC oil producers agreed in June to increase production, bringing the group’s overall compliance with the production cuts agreed to in 2016 back to 100 percent. The largest increases by volume have been from Russia and Saudi Arabia, taking them back to or above their level of production prior to the cuts, with Russian production reaching a record high of 11.4mb/d in September. These increases have more than offset declines in Iran and Venezuela so far by around 0.6mb/d. However, since the announcement of waivers on Iranian sanctions by the United States and subsequent sharp fall in oil prices, Saudi Arabia has proposed new production cuts of up to 1 mb/d. The success of any new cuts would depend heavily on whether they had widespread support, particularly from Russia.

Risk 5: Levels of spare capacity

Increased production has resulted in very low levels of spare capacity among OPEC countries. While new production cuts would mechanically raise spare capacity, the level would remain low by historical standards as a result of the losses in Venezuela and imposed reductions in Iranian supply. That suggests the oil market may be susceptible to supply shocks such as geopolitical events, additional sanctions, or natural disasters, raising the likelihood of oil price spikes in 2019.

Join the Conversation