Emerging economies are routinely affected by monetary policy announcements in the US. This was starkly evident on May 22, 2013, when Federal Reserve Chairman Ben Bernanke first spoke of the possibility of the Fed tapering its security purchases. This “tapering talk” had a sharp negative impact on financial conditions in emerging markets in ensuing days—their exchange rates depreciated, bond spreads increased, and equity prices fell; so much so that some of the countries seemed on the verge of a full-fledged balance of payments crisis. The event helps explain why issues related to the spillover of US monetary policy have gained prominence in recent contributions to the literature and in policy discussions (Rajan, 2015).

In a recent paper, we analyze the spillover of US monetary policy announcements on twenty of the largest emerging countries. We find that US monetary policy surprises have a significant impact on emerging economies’ exchange rates, equity prices, and bond yields. The impact is larger for surprise tightening of policy than for surprise easing. The impact is disproportionately larger for large surprises, implying that emerging markets are relatively insulated from anticipated policy announcements. The spillover effects of policy announcements of other advanced economies, such as the Eurozone, Japan, and UK, is much weaker than those of the US.

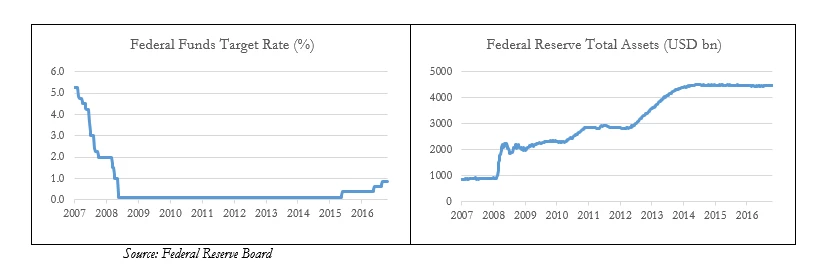

Our empirical approach rests on identifying the surprises associated with the monetary policy announcements. Traditionally, the literature has used changes in federal funds rate futures in a very short period of time around policy announcements, often within minutes or hours, to identify monetary policy surprises. This approach works well for the period until 2008 when the Fed conducted conventional monetary policy by setting the target federal fund rate. During the period we consider, 2008-2016, the Federal Reserve Board conducted monetary policy primarily through direct asset purchases, altering the size and composition of its balance sheet (see Chart 1).

Chart 1: The Period of Unconventional Monetary Policy

Since the federal funds rate futures do not provide a meaningful basis to identify policy surprises during the period of unconventional monetary policy, high frequency changes in longer term Treasury yields have been used to identify the surprises. The identifying assumption is that movements in Treasury yields in a narrow window around policy announcements are attributed to unanticipated changes in the policy stance or to forward guidance regarding the future path of monetary policy. Drawing from the literature we use changes in 2-year Treasury yields on announcement day as an indicator of the surprise change in the US monetary policy. Using event study methodology, we analyze the impact of the Federal Open Market Committee (FOMC) announcements on emerging economies between October, 2008 to August, 2016 (during this period 65 FOMC meetings took place). We estimate panel regressions of asset price returns for all emerging economies over a one to three-day window around FOMC announcements.

Our main results are:

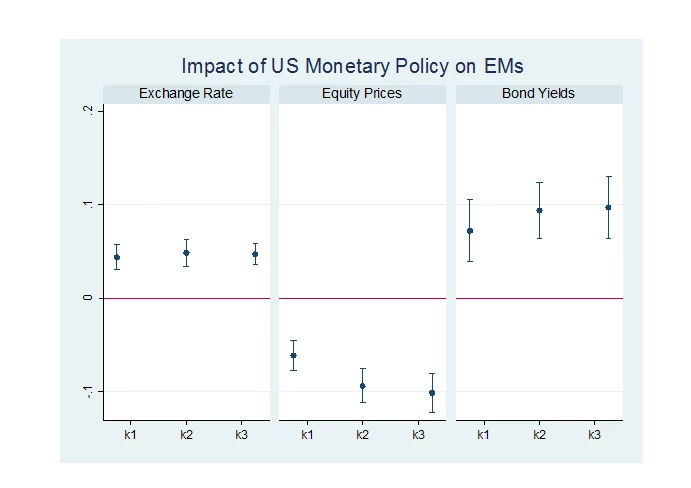

- A surprise monetary tightening, estimated by an increase in 2-year Treasury yield on the day of the FOMC announcements, results in exchange rate depreciation, decline in equity prices, and higher sovereign yields in emerging economies. Specifically, a 10 percent increase in Treasury yield results in about a 0.5 percent exchange rate depreciation, 1 percent decline in equity prices, and a 1 percent increase in sovereign yield of emerging economies (see Chart 2). A surprise easing on the other hand, estimated by a decline in Treasury yields has the opposite effect. The impact persists for all three days that we consider in the analysis.

-

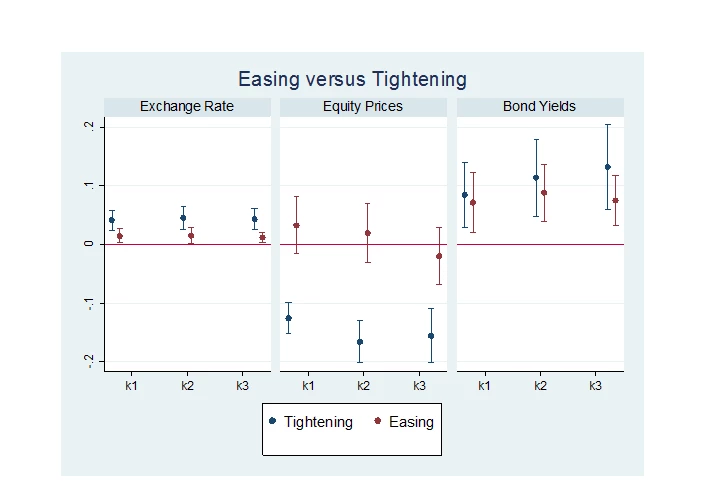

We ask if the spillover is similar for an unanticipated tightening and an unanticipated easing of US policy. Results show that the spillover to exchange rates and equity prices is larger for a surprise tightening of US monetary policy than for an unanticipated easing. The spillover coefficient for exchange rates, e.g., is twice as large for surprise tightening as for easing (see Chart 3).

-

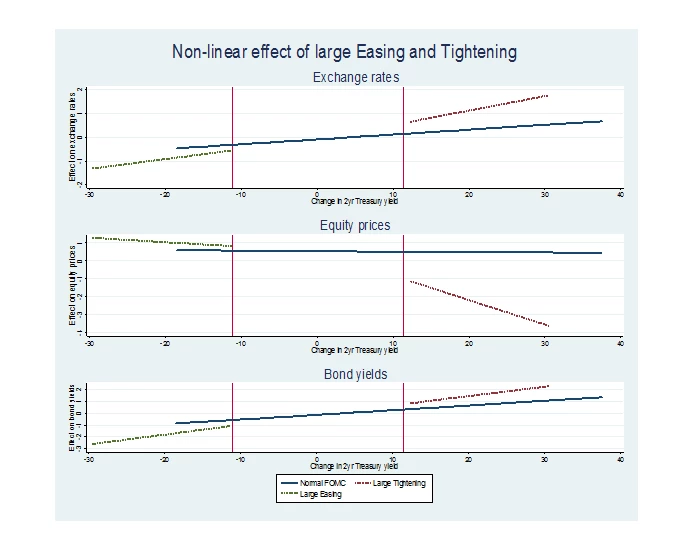

We also ask whether emerging economies experienced a disproportionately larger impact following FOMC meetings in which Treasury yields experience a sharp increase or decline. The criterion we use for sharp changes is that the percent change in yields exceeds or is below the average of the entire period by at least two standard deviations. Evidently, the spillover on emerging economies is particularly large for large perceived surprises in the US monetary policy. The impact on exchange rates and equity prices is stronger for large perceived tightening than for easing of policy (see Chart 4).

-

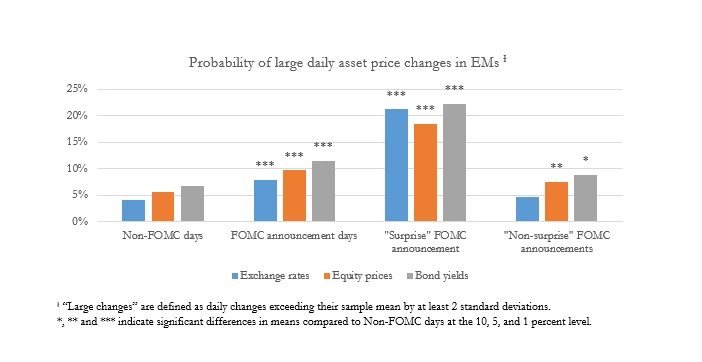

Finally, we ask whether the extent of spillover matters from the emerging country perspective, and find that it does matter. A significant proportion of very large changes in emerging market asset prices coincide with FOMC announcements, particularly the ones that result in large changes in Treasury yields. Quantitatively, probability of a large change in asset prices in emerging economies is nearly four times as large after the FOMC announcements that result in large changes in Treasury yields, as on any other day (see Chart 5).

- We extend the spillover period from 1 to 3 days to 5, 10 and 15 days and ask whether the spillover persisted for a longer period. While acknowledging that the omitted variable bias may be larger over longer horizons, results show that the impact of surprise US policy announcements on emerging economies’ exchange rates, equity prices and bond yields persists for a period as long as 15 days. We also ask whether the tapering event which triggered a sharp sell-off in emerging economies, was an anomaly; and whether the average impact in our sample was primarily driven by this particular episode. We find that while the spillover for a given change in Treasury yield was larger during the tapering event, the average impact is not driven solely by this event.

- Evidence indicates weaker spillover of monetary policy surprises in other advanced economies, such as the Euro Zone, Japan and UK, to emerging economies, presumably because of their weaker financial integration with the latter.

Our results signify the importance of surprise US monetary policy announcements for emerging economies. They also emphasize the importance of sufficient guidance ahead of the US policy announcements in order to prepare the markets, both domestic and foreign, in advance, and to insulate them from the sudden and sharp reactions to those announcements.

Join the Conversation