Public procurement of services, works and supplies is estimated to account for 15-20% of GDP in developing countries, and up to 50% or more of total government expenditure. Efficient and effective procurement is vital to core government functions, including public service delivery and provision of infrastructure. Weaknesses in procurement systems can lead to large-scale waste of public funds, reduced quality of services, corruption, and loss of trust in government.

There is relatively little systematic evidence, however, on the links between procurement systems and procurement outcomes. A new Policy Research Working Paper adds to the evidence base, using data on almost 34,000 firms from the World Bank’s Enterprise Surveys, in 88 countries that also have data on procurement systems from PEFA (Public Expenditure and Financial Accountability) assessments conducted between 2011 and 2015. This study finds that in countries with more transparent procurement systems, where exceptions to open competition in tendering must be explicitly justified, firms are more likely to participate in public procurement markets. Moreover, firms report paying fewer and smaller kickbacks to officials in countries with more transparent procurement systems, with effective and independent complaints mechanisms, and with more effective external auditing systems. These findings – particularly on kickbacks – are robust to the inclusion of numerous controls and to a range of sensitivity tests.

Another PEFA procurement indicator, on the appropriateness of the legal and regulatory framework, is not associated with firms’ kickbacks or participation in procurement markets. That measure is primarily a de jure indicator of official rules regarding transparency, competition, etc., in contrast to the other more de facto indicators of actual systems and practices. Only the latter turn out to be associated with better procurement outcomes in the study.

Prevailing procurement practices on balance appear to disadvantage smaller firms (defined here as those with fewer than 20 employees). Small firms in the Enterprise Surveys are somewhat less likely to report that they have bid on public contracts in the past year: only 15.4%, compared to 21.9% of medium-sized and large firms. Smaller firms also report that larger kickbacks are needed for them to obtain a public contract: 2.9% of the value of the contract on average, compared to 1.8% for medium-sized and large firms.

However, procurement systems that encourage transparency, competition, and trust, and reduce transactions costs, can potentially level the playing field somewhat for smaller firms. For example, improved access to procurement information should reduce transactions costs, which will tend to be proportionately larger for smaller firms. A low-cost, independent complaints mechanism can provide a check against favoritism and potentially deter procurement officials from demanding kickbacks, which tend to be larger for smaller (and typically less well-connected) firms.

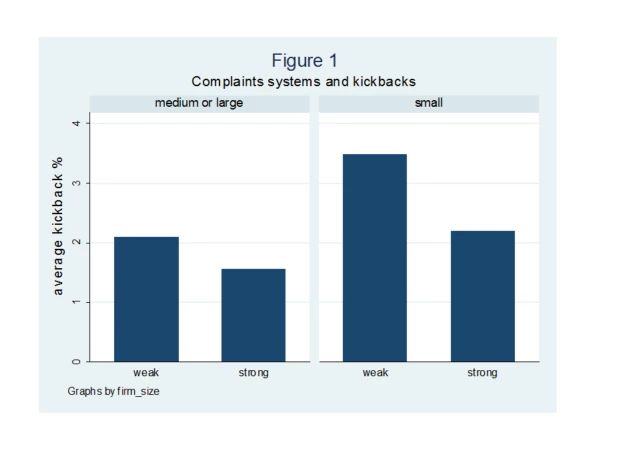

As shown in Figure 1, kickbacks as a percentage of contract value tend to be lower in countries with “strong” procurement complaints mechanisms (those graded as “A” or “B” on PEFA assessments; grades of “C” or “D” are considered “weak”). The left panel of the figure shows that this effect is modest, however, for medium-sized and large firms. For small firms – as seen in the panel to the right – operating in a country with strong complaints mechanisms is associated with a much larger reduction of 1.3 percentage points in needed kickbacks.

The study is not designed to answer many other aspects of procurement quality, such as quality or cost, or the appropriate choice of projects in upstream procurement needs assessments. Nor does it address all forms of corruption in procurement, e.g. bid rigging among firms where no kickback to a public official occurs. Future cross-country analysis of procurement can benefit from new indicators as more data become available. A new sub-indicator on “procurement monitoring” in the 2016 PEFA Framework assesses the accuracy and comprehensiveness of databases on procurement contracts. A new “Benchmarking Public Procurement” dataset for 180 countries provides objective indicators on various stages of the procurement life cycle, from the standpoint of information and other transactions costs to private suppliers.

Join the Conversation