In Africa, CPIs receive much less popular attention. There is no such thing as ‘inflation-adjustment’ in the informal economy, where wages, rents and other prices are set and adjusted in a more ad-hoc manner and few people are covered by social security. That is not to say that Africans don’t care about prices. Rising prices, particularly of food stuffs, regularly drive people onto the streets. But the CPI, as an official measure of inflation, is much less in the limelight.

Even though Africa’s poor have more pressing concerns than to fuss about the technicalities of inflation measurement, CPIs do matter for our understanding of poverty on the continent. Global poverty estimates (reported in PovcalNet) rely on national CPIs to deflate nominal consumption to a base year. Poverty trends can be highly sensitive to this inflation adjustment. To give an example: Tanzania’s 2007 Household Budget Survey Report shows that there was almost no change in poverty between 2001 and 2007. Underlying these figures is an estimated cost of living increase of about 90% (computed directly from the survey), which is much higher than the 40% cumulative inflation reported by the CPI. Had the latter been used to adjust for price changes, the poverty rate would have fallen by 15 percentage points, what would have been surely regarded as significant progress (see also an earlier post by Waly Wane and Jacques Morisset). In other words, our assessment of how much poverty has changed often depends on how much we think prices have changed.

So what are the problems with Africa’s CPIs? Poverty in a Rising Africa reviews what we know about CPIs in the region, drawing on metadata collected by the International Labor Organization (ILO) and other sources. A few things stand out:

- CPI basket weights are often outdated. Every price index has two basic ingredients – prices and weights. The latter are needed to compute a weighted average of price changes in the economy. In July 2012, the reference date of the ILO metadata, 13% of the African population was living in countries where the CPI basket dated from the 1990s or earlier (an additional 11% had missing information). The most extreme case was Liberia, where the weights were based on the 1964 Household Survey – at the time a whopping 48 years old. Clearly, such outdated weights are a cause of concern.

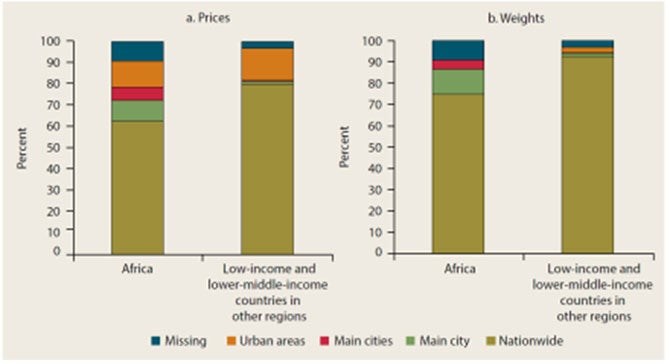

- Weights and prices are too often exclusively urban. Because of the logistical difficulties of collecting prices in rural areas, still too many national statistical offices (NSOs) collect prices only from urban areas and some also base basket weights on urban consumption patterns. As shown in figure 1, urban bias in weights and prices is more common in Africa than elsewhere (and there is reason to suspect that it may be even more common than suggested by the graph). This is problematic if rural inflation does not track urban inflation.

- CPIs do not reflect consumption patterns of the poor. CPIs generally use ‘plutocratic’ weights, which weight households in proportion to their total consumption. So a household spending $1000/month gets 10 times the weight of a household spending just $100/month. In parts this is by design. There are some purposes, e.g. deflation of national accounts, where plutocratic weights are preferred. But it also reflects a lack of alternatives. Because the price data underlying the CPI are collected from stores, not households, ‘democratic’ weighting – whereby each household gets the same weight – is infeasible at the lowest levels of price data aggregation. As a result CPI weights are generally representative of households in the 70th-95th percentiles of the expenditure distribution, who are typically way above the poverty line.

It is difficult to say with certainty how much plutocratic bias matters. Case study evidence by economists Isabel Guenther and Michael Grimm demonstrates that CPIs can seriously bias measured poverty trends when relative prices change rapidly – for example during a drought or immediately after a liberalization event. On the other hand, a comparison of CPI series for countries in Africa does not show that food CPIs, a crude measure of the poor’s inflation, have increased systematically more or less than all-item CPIs over the past decade (though they did increase faster during the food price crisis of 2008/09). This suggests that plutocratic bias may be less relevant over longer periods of time.

Where does this leave us? First, caution ought to be exercised in using the CPI as a cost of living deflator for the poor in Africa. Second, there is a need for an applied research agenda on prices for poverty measurement in Africa - to provide more systematic evidence of urban and plutocratic bias in CPIs, identify cost-effective ways of collecting price data in rural areas, and so on. And finally, price statistics programs in the region clearly require more support, not least in terms of funding and technical assistance.

This blog is part of a series reflecting on the findings of the 2016 World Bank Report “Poverty in a Rising Africa." Next in the series: measuring inflation with Engel curves in Africa on March 14, 2016. Previous blogs in the series include:

- Africa is rising! But are people better off?

- Who will fund poverty surveys in Volkswagen countries?

- The European refugee crisis: What we can learn from refugees in Sub-Saharan Africa

- Poverty is falling faster for female-headed households in Africa

- The shock of widowhood: Marital status and poverty within Africa

- Domestic Violence and Poverty in Africa: When a Husband’s Beating Stick is Like Butter

- Data gaps: The poor typical household survey’s miss

- Inequality of opportunity in Sub-Saharan Africa

- Is inequality in Africa rising?

- Education for all in a “rising Africa”

- When growth alone is not enough

- Yep, about reading and writing again

Join the Conversation