Photo: John Hogg / World Bank

Photo: John Hogg / World Bank

This blog was published as an op-ed in the Business Day Newspaper on November 13, 2023

The role of the State is to ensure macroeconomic stability and equity, while delivering quality public services to all citizens. South African authorities have struggled to meet the second aspect, despite significant public spending. For example, in 2021, the country was ranked 135th (out of 173) on the World Bank’s Human Capital Index, despite spending on education and health being amongst the highest in the world (almost 15 % of GDP). South Africa’s level of crime insecurity is also higher than would be expected in relation to the level of public spending on police, safety, and protection services. The quality of public infrastructure has also rapidly deteriorated in recent years.

The South African public sector’s challenge with delivering high-quality public services to citizens is a major source of concern for the country’s economic, social, and political future. Service delivery failures have generally been explained by the diminishing capabilities of public administration, which is itself rooted in limited coordination, weak technical and financial capacities, poor motivation, and corruption. But is it possible that there are other factors that underlie the government’s poor performance?

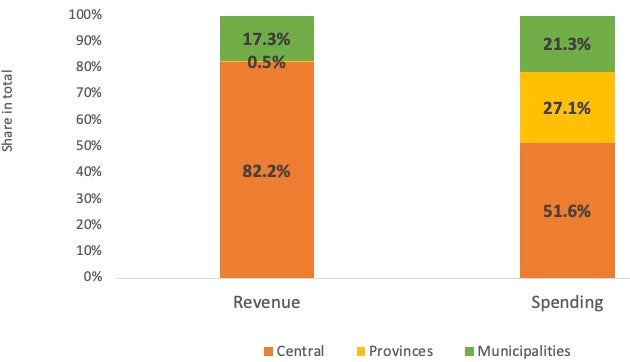

Public spending is decentralized in South Africa, while revenue collection is not.

I argue that one of the most important underlying factors has been the unbalanced allocation of responsibilities between spending and revenue across levels of government. Two of the most eminent economists in this field, R. Musgrave and W. Oates have claimed that the structure of the State should follow two basic principles. The first is the subsidiarity principle, which indicates the responsibility of public service delivery should be allocated to the level of government the closest to beneficiaries, accounting for the capacity to deliver. The second principle is that there should be consistency in the degree of decentralization of spending and revenue responsibilities.

To what extent has South Africa adhered to these two principles? On the first principle, the country has performed relatively well since roughly 50% of public spending has been decentralized to the nine provinces (for health, education, housing, and public transport) and 257 municipalities (for water, sanitation services, municipal health, and public transportation, energy distribution). This makes South Africa a fiscally decentralized country when compared to OECD economies. On the second principle, only 15-18% of total public revenue is collected by local governments. This discrepancy between decentralized revenue and spending is measured in the economic literature by the so-called vertical fiscal imbalance, which is on average equal to 70 % in South Africa, but with significant variations between big municipalities and provinces. By comparison, the vertical imbalance is only 13-25% in fiscally decentralized countries such as Iceland, Sweden, Switzerland, and Canada.

So, what are the problems associated with a high vertical fiscal imbalance in South Africa? These are multiple, starting with the lack of fiscal discipline. Indeed, local governments are likely to continue to spend if the cost of collecting revenue is supported by the central authorities – the IMF estimates that a one percentage point increase in the vertical imbalance leads to a 0.1-0.2 percentage point increase in the ratio of fiscal deficit over GDP. An additional problem is the limited motivation for local authorities to improve value for money in service delivery as they are weakly accountable for their financing. Lastly, local governments don’t have the flexibility to adjust the delivery of services to their citizen needs or willingness to pay, which may vary across locations.

South African policymakers could explore a number of options to address these challenges. Firstly, policy makers could rethink the vertical structure of the State so the vertical fiscal imbalance can be reduced. This could be achieved by decreasing the spending responsibilities devolved to subnational governments or by increasing their revenue responsibilities. For example, there is an increasing debate in South Africa regarding whether some education or health services should not be (re) centralized at the national level given the limited delivery capacity of several subnational governments. However, whatever the direction of these changes (towards less or more decentralization), they would require significant efforts in the current political economy context and would most likely require amending the Constitution.

Two intermediary solutions can be considered, to reduce the vertical fiscal gap, which have the advantage of being more practical in the short term as they would not significantly change the current structure of the State. These options would, however, incentivize the sub-national governments to become more effective. First, the current formula-based transfer system from the central to local governments could be adjusted to strengthen the link between revenue and spending responsibilities. So far, in South Africa unearmarked transfers are mainly calculated by the equitable share formula which only accounts for the needs and capacities of each local government, while they could also be determined by their efforts to deliver more and better services. National Treasury has recently initiated this process under the conditional debt relief offered to municipalities that have accumulated large arrears with Eskom. This could be further applied to social sectors under the responsibility of the provinces, for example, Brazil did it for the health sector with relatively good results. Second, the responsibilities of revenue collection (except for the income tax, which will require a constitutional amendment) could be further decentralized but only for good performers or subnational governments with proven capacity. The Vietnamese authorities used this approach to enhance the local authorities in Ho Chi Minh City to increase their collection performance.

As emphasized by D. Acemoglu – a professor of economics at the Massachusetts Institute of Technology, the performance of the State is largely determined by its capacity to adjust to the needs of its citizens. While inter-governmental relationships are complex, the South African authorities will send a strong signal to their citizens by fixing the existing vertical fiscal imbalance - since South Africa is clearly an outlier, with pragmatic but decisive actions.

Join the Conversation