This blog is part of the “Africa Knowledge in Time for COVID-19” series of analyses and discussions hosted by the office of the Chief Economist, Africa Region. The series draws on research and the experience of policymakers on the frontlines, to put forward critical questions and issues around the public health and socio-economic implications of the pandemic for African countries.

The COVID-19 pandemic is expected to hit African economies extremely hard. According to the World Bank biannual Africa’s Pulse report, as a result of the pandemic, economic growth in sub-Saharan Africa will decline from 2.4% in 2019 to between -2.1% and -5.1% in 2020, depending on the success of measures taken to mitigate the pandemic’s effects. This means that the region will experience its first recession in 25 years.

The decline will be primarily due to large contractions in South Africa, Nigeria, and Angola driven by their reliance on exports of commodities whose prices have crashed as well as other structural issues. This will inevitably affect Africa’s participation in trade and value chains as well as reduce foreign financing flows. Given the limited regional market, trade with the rest of the world is vital for Africa. Before the pandemic, Africa’s trade with the rest of the world has been showing good momentum. According to UNCTAD’s Economic Development In Africa 2019 report, in the period of 2015-2017, total trade from Africa to the rest of the world averaged $760 billion in current prices, and the share of exports from Africa to the rest of the world ranged from 80% to 90% in 2000 –2017 in Africa’s total trade. The only other region with a higher export dependence on the rest of the world is Oceania.

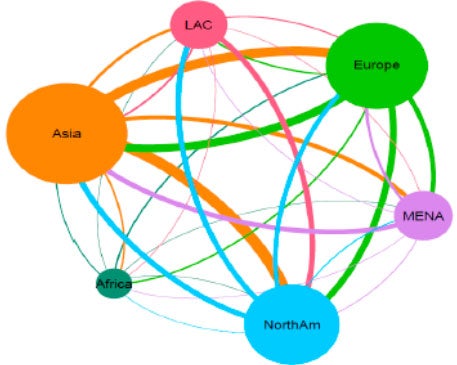

However, intra-African trade, defined as the average of intra-African exports and imports, was around 2% during the period 2015–2017, and the intra-African exports were 16.6% of total exports in 2017, much lower compared with 68.1% in Europe, 59.4% in Asia, 55.0% in America, and 7.0% in Oceania. Figure 1 shows the small size of intra-regional trade in Africa compared with other regions, and (b) the lower trade linkages of Africa with the rest of the world —when compared with other regions.

Figure 1. Comparison of Intra-Regional Trade

Source: Beaton, K., et al. (2017) “Trade Integration in Latin America: A Network Perspective.” IMF Working Paper WP/17/148.

Note: The size of each node is proportional to each region’s trade flow and the width of each link reflects trade values and the color of the link corresponds to that of the exporting region.

In the recent decade, Africa’s trade linkage has been steadily increasing. Based on an upcoming study on Africa-Asia global value chain (GVC) linkages, exports to Asia are positively correlated with exports to the rest of the world, and increased exports from a Sub-Saharan African country to Asia tend to raise exports to the rest of the world as well as to other African countries, thus, helping Sub-Saharan African nations move up the value chains. Although exports from Sub-Saharan Africa to Asia remain highly concentrated in resource-intensive products, such as petroleum, minerals, metals, and primary goods, there are a few exceptions. For instance, Ethiopia and Tanzania have done relatively well in diversifying their export portfolios during the boom of exports to Asia.

However, the COVID-19 (coronavirus) pandemic will put a brake on this for the time being. The mass production shutdowns and supply chain disruptions due to the rare “twin supply-demand shock” will create ripple effects across all global economic sectors, causing further uncertainty for a continent already grappling with widespread geopolitical and economic instability. With China, Africa’s largest trading partner, and other major economies gradually reopening their economies, Africa’s trade will gradually pick up, however, the path might not be that smooth at least for the foreseeable 1-2 years.

So, where is Africa’s future market and trading opportunities? As the old saying states, “crisis is also an opportunity.” This time is no exception. African countries can build more resilient and sustainable economies if they can do things right following the pandemic. At least four policy options can be considered;

First, it is crucial to further diversify African economies and strengthen the few strategic sectors. The pandemic crisis highlights the importance of food and health sectors for all countries. Africa is uniquely positioned to further leverage its rich agricultural resources by improving basic infrastructure and efficiency, and agro-processing capacity. More resources will be needed to strengthen the public health sectors, with the support of development partners.

Secondly, Africa must embrace the digital age and adopt more and more digital technologies for both productions and services, such as banking, retailing, and learning as well as public services. The sectors with high-level of digitization seems to weather the storm much better. In doing so, it needs to strengthen its education system, especially the training and learning related to digital skills.

Thirdly, Africa must strengthen intra-regional trade. To boost the intra-regional trade, African countries need to make concerted efforts to harmonize their trade-related regulations, customs controls, and reduce both tariff and non-tariff barriers, and meanwhile, improve the infrastructures and connectivity to lower the logistics cost. This crisis provides an opportunity to take more concrete steps towards realizing the African Continental Free Trade Area (AfCFTA).

Finally, Africa will need more international trade agreements to support its growing but still fragile export sectors. This means that Africa would not only need the existing favorable treaties such as African Growth and Opportunity Act (AGOA) and Everything But Arms (EBA), but also should pursue more such treaties with other major economies, including India, Japan, China and other such markets.

Join the Conversation