We're thrilled to release five new data notes in collaboration with the International Finance Corporation and Mastercard Foundation Partnership for Financial Inclusion outlining Sub-Saharan Africa's successes and challenges in building digital financial inclusion.

The notes—all of which are available for download at our homepage—draw on tens of thousands of surveys to explore how adults in the region use accounts, digital payments, and savings to manage their financial lives.

Sub-Saharan Africa leads one of the most exciting development innovations of our time—the rise of mobile money. Our first note explains how this technology can expand the use of financial services and describes how it has spread over time.

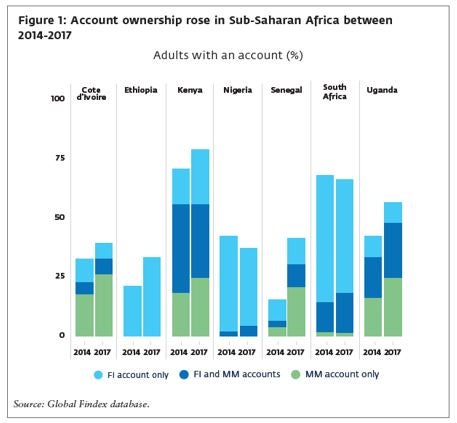

Since 2014, the region's big financial inclusion gains have been driven by mobile money, not old school brick-and-mortar banks. In Cote d'Ivoire and Uganda, mobile money penetration rose while bank account ownership was mostly flat. At the same time, mobile money has spread from East Africa to West Africa. Three years ago in Senegal, only 6% of adults had a mobile money account; today, the share is 32%.

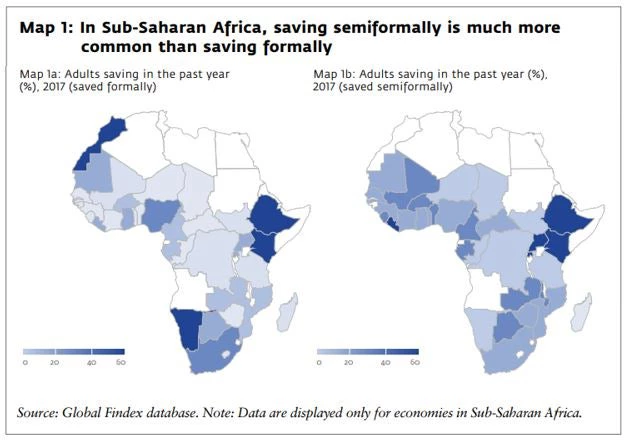

How do people save, borrow, and cover emergency expenses in a region with low access to formal banking and weak safety nets? That's the subject of our note on savings, credit, and financial resilience. Spoiler alert: Semi-formal savings groups are popular, and when people need a loan, they usually turn to their friends and relatives—not a bank.

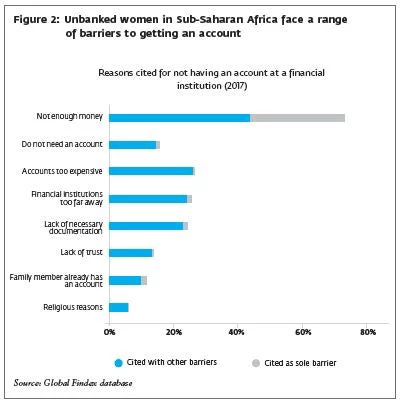

Women are still less likely than men to have basic financial services. While there are early, untested indications that mobile money might be helping to shrink gender differences in some countries, things have barely changed at the regional level since we launched the Global Findex in 2011. How big is the gender gap? What are the potential benefits and limitations of mobile solutions? Why don't more women have accounts? Where are the opportunities to bring unbanked women into the financial system? Our third note digs into the data.

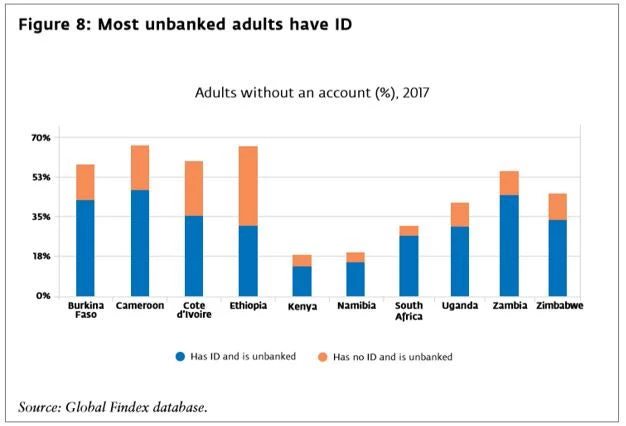

Our forth note explores the link between digital financial inclusion and access to government-issued identification. It draws on the first-ever global dataset collected with the World Bank ID4D team covering ownership and use of ID to explore questions like: Who has ID and who doesn't? What are the hurdles to ID access? What do people use their ID for? (If you guessed that it has something to do with mobile phones, you're on the right track). The good news is that ID ownership is high among unbanked adults, which might make it easier for them to get financial services.

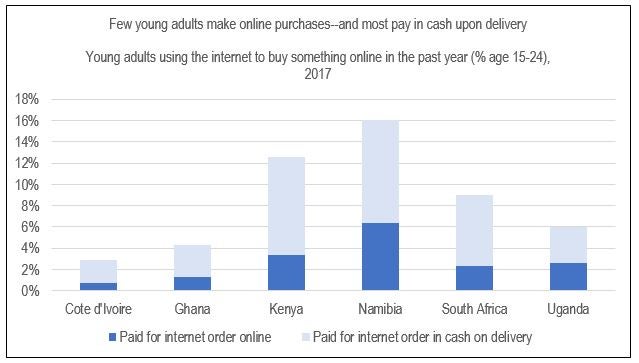

Today's young Africans are growing up in a new financial world. Our youth note (forthcoming!) looks at how they use digital financial services and explores key areas of growth.

We hope these notes will help policymakers think through opportunities and challenges in expanding financial inclusion in Sub-Saharan Africa. The goal is not to give people accounts just for the sake of it. Research shows that use of digital financial services can spark development in areas ranging from farming to health and education. As governments seek to expand access to digital banking services, its vital to acknowledge the risks and enact strict consumer protections—especially for the most vulnerable people, such as those with limited educational attainment or financial experience.

Find all the data on our Global Findex homepage and be sure to follow us on Twitter @GlobalFindex.

Join the Conversation