Enhancing the ownership of program-based budgeting will require the continued buy-in and engagement of key stakeholders such as Parliament and the Audit Authorities. Credit: Arne Hoel/WorldBank

Enhancing the ownership of program-based budgeting will require the continued buy-in and engagement of key stakeholders such as Parliament and the Audit Authorities. Credit: Arne Hoel/WorldBank

Zimbabwe is on a path to strengthening transparency in how it manages public finances and delivers results for citizens. The southern African nation, home to about 15 million people, has shifted to a program-based budgeting (PBB) approach, a budgeting reform approach that promotes sound public financial management (PFM). Despite its benefits, adopting and implementing PBB can be difficult and requires a long-term commitment.

Implementation challenges aside, PBB still provides government authorities with a platform that enhances transparency and accountability in public finances.

So, what has changed?

Zimbabwe’s shift to a performance-based approach ensures that budget allocations reflect policy priorities, improve service delivery, and monitor the use of resources within each area of service delivery (budget program).

Since 2014, Zimbabwe’s progressive development of the PBB architecture and practice is widely seen as an important milestone in the country’s journey towards improving transparency and accountability; and is enabling the government‘s focus on service delivery programs that have the most significant benefits for citizens. Despite Zimbabwe’s important strides in PBB implementation, with visible benefits, the continued commitment of government is critical for sustained implementation.

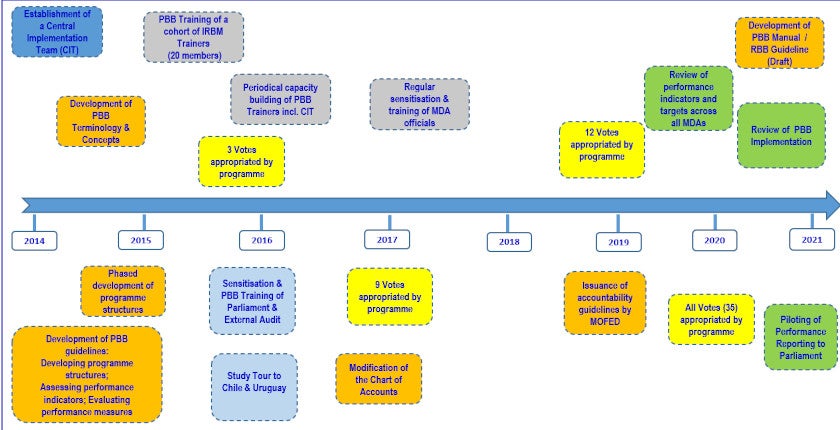

The country’s PBB initiative received funding from the Zimbabwe Reconstruction Fund (ZIMREF) in 2014, along with national budget revenues. That supported Zimbabwe’s PBB for four years, starting with three ministries in the 2016 budget, and then all 35 ministries and agencies in the 2020 budget (Figure 1). This will be the second year that the budget is submitted to Parliament in PBB format, including spending allocations by programs as well as expected outputs and outcomes.

Spending priorities by program and outcomes are also fully aligned with the Zimbabwe’s medium-term national development priorities, outlined in the National Development Strategy. That means PBB will continue to anchor the integration of national budgeting and planning that helps achieve national outcomes and priorities.

Figure 1. PBB Implementation Timeline

Continuous government commitment has smoothed PBB implementation in Zimbabwe, where PBB reforms are government driven. The Ministry of Finance and Economic Development (MOFED) has championed PBB reforms. Initially, the Central Implementation Team (CIT) at MOFED — was the main driving force behind PBB reforms. In 2021, a dedicated unit under the public finance directorate was formally established and is now responsible for implementing PBB. The OPC has overall responsibility for overseeing the implementation of the Integrated Results Based Management (IRBM) philosophy, and it has played a key role in linking PBB with IRBM through its Results-Based Budgeting pillar.

Various training programs helped Zimbabwe’s rapid adoption of PBB by creating internal capacity in a cohort of trainers, drawn from an existing pool. They were tutored on the concepts and implementation of PBB, which aided the reform momentum and the entrenchment of program-budget concepts while ensuring the sustainability of budgetary reforms.

The collaboration with IRBM trainers was critical, in that it gave impetus to the designing and developing of the PBB architecture, which further benefitted from the in-house technical capacity of the Accountant General’s public financial management system unit. The unit led the process of modifying the chart of accounts to allow planning, spending, and reporting based on program classifications and to economic and functional classifications. The complementarity of PBB’s alignment with another ZIMREF activity, also enabled its smooth implementation.

Going forward, transparency and accountability can be further enhanced through the inclusion of program budgeting reporting provisions in either the PFM Act or PFM regulations. In addition, the strengthening of institutional capacity and enhancing the ownership of PBB will need the continued buy-in and engagement of key stakeholders. Steps have already been taken to sensitize Parliament and the Audit Office on the rationale of PBB and their respective institutional roles and responsibilities:

- In Parliament, training sessions were held with portfolio committee members prior to the initial tabling of the appropriation in program-budget format;

- Engagements with the Audit Office have focused on developing its program structure; going forward, measures will focus on delivering technical support to facilitate the auditing of the integrity of performance data as well as the service delivery performance of ministries, department, and agencies.

While there has been notable progress in creating appropriate and policy-relevant performance information and measures, there is room to improve their quality and relevance. Concurrent to the development of program structures, initial efforts have focused on developing and refining performance data and measures. According to the performance information and measures in both the 2020 and 2021 estimates of expenditure books, key challenges relate to the use of: (i) activity and input indicators that inherently focus on internal processes; (ii) indicators that are difficult or expensive to measure and monitor; and (iii) performance information with limited relevancy for budgetary decision-making.

Moving forward, the authorities need to prioritize efforts to improve the policy appropriateness of performance information and measures. To have a positive and lasting impact on budget transparency and enhance accountability, MDAs’ performance reports should be tabled and debated in Parliament, and publicly available on their websites.

Notable progress achieved to date needs to be sustained and deepened by addressing institutional, human resource, and technical constraints to PBB implementation. That means ensuring implementation reports are produced and made publicly available. It also means that the authorities should consider adopting enabling legislative amendments to anchor the PBB reform and nurture a performance culture within the public service. Such measures would strengthen the dedicated reform unit in MOFED; the strategic phase of the budget cycle; and enhance parliamentary oversight.

Join the Conversation