Photo: Shutterstock

Photo: Shutterstock

South Africa has lost its two main levers of economic development: public investment in physical and social infrastructure (think China, which invests almost 20% of its GDP per year) and a Schumpeter-like creative destruction process through which obsolete firms are replaced by innovative ones (think IBM and Microsoft). The economy, a sleeping giant on the African continent, can only achieve a faster and more inclusive trajectory of growth if the country rebuilds its public capital stock and dynamizes its businesses, especially by creating synergies between the public and private sectors. This simple lesson is derived from economic theory and empirical evidence in fast-growing countries.

Anatomy of failure

South Africa’s stock of public capital lags behind those of the most successful East Asian economies, to which it had been superior in the early 1960s. When adjusted for the rapid depreciation of aging infrastructure, corruption, and sabotage, its stock has declined by about 20% since 2009. By 2017 it was about 3.5 times lower than Malaysia’s (Figure 1). One example of this degradation is the unreliable electricity supply: in 2022, households and businesses faced electricity cuts averaging 8.8 hours per day. This reflects the low rate of public investment—only 2.9 % of GDP a year over the past two decades, which is about 5 percentage points lower than many countries in East Asia and almost ten times less than in China (Figure 2).

| Figure 1. Stagnating public capital stock since 1960 | Figure 2. Systematically low investment relative to East Asia over the past two decades |

| Source: IMF database. Note: The public stock is adjusted by assuming a 10% depreciation rate (rather than 5%) of the existing capital and a diversion of 10% of annual gross investment from its intended allocation. |

|

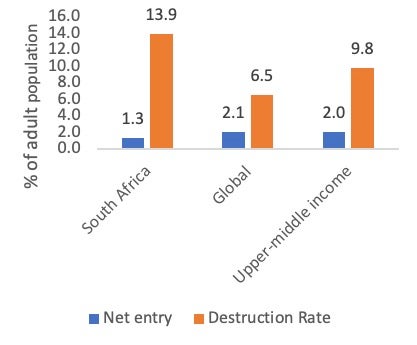

The second lever, dynamism, is also failing: Many businesses have lost their innovative drive, with labor productivity dropping significantly in all sectors over the past few decades (Figure 3). To put it bluntly, although South Africa was close to the technology frontier in 2000, it is now far away from it. Successful countries are those whose businesses and people can climb the productivity ladder. The lack of dynamism in its economy is illustrated by the weak net rate of the entry of new firms, which is about 60% lower than in countries with similar income levels (Figure 4). Intergenerational upward mobility is also limited: only 30% of children are better educated than their parents, as against 50% and 60% in upper-middle-income and high-income economies, respectively.

| Figure 3. Widening gap in labor productivity relative to high-income countries since 2001 | Figure 4. Low net creation rate of firms, 2021 |

| Source: World Bank Development Indicators | Source: Global Entrepreneurship Monitor |

Waking up the economy takes two levers

The government must urgently invest in physical and social infrastructure to upgrade the stock of public capital. If properly implemented, this could both enhance economic activity and create jobs during the construction phase. To finance this investment, the authorities could leverage private investment in infrastructure as is increasingly done in the energy sector. They will probably also need to cut unproductive public spending to free up resources in the limited fiscal space. Whether they collect more taxes or borrow money, they cannot forget two simple fiscal rules: the return on investment should always exceed the cost of financing, and the efficiency of public investment (especially procurement) should be improved. Otherwise, money will be wasted.

Dynamizing the private sector will require acting on several fronts. First, the barriers to entry faced by young and small firms must be removed—South Africa is a hard place to register and operate a business, especially for those that do not have the means to hire legal support. The existing byzantine regulations and laws raise the operational costs of new businesses while protecting incumbent firms (which can navigate the system and extract rents without innovating). Second, the business landscape should be revitalized by encouraging interactions between large and small firms, foreign and domestically owned firms, public and private firms, and formal and informal firms. Granted, the existing silos are partly a legacy of apartheid, but they have been perpetuated rather than corrected by ineffective industrial policies. No country can force such interactions; instead, as several East Asian countries have demonstrated, they need to be incentivized. China has used price signals through tax policy to develop backward linkages between large firms and local suppliers. South Korea has developed blended financial instruments (including public-private partnerships) to de-risk innovative projects. Malaysia has enhanced synergies between foreign investors and local industries through programs of technology transfer and joint training. This is a policy lesson that should inspire local policymakers.

Creating synergies is essential

Each of these two levers is important on its own, but their joint impact can be substantially increased if synergies are created between the public and private sectors. For example, South Africa aims to improve its energy supply by boosting public investment in transmission (first lever) and enhancing private investment in generation (second lever) as considered in the Presidential Energy Action Plan. This is a good start, but more ambitious and coordinated initiatives could harness more synergies. South Africa could try to attract global producers of solar technologies and equipment such as panels or batteries, as did Vietnam, leveraging the size of its local market, the potential demand from the rest of the continent, and the availability of raw materials. Producers could be incentivized to train local workers and develop forward and backward linkages with domestic industries. The equipment could be sold and installed locally, including in poor neighborhoods through subsidized programs with local banks, and in other countries. Ultimately, such new production facilities could help address the energy crisis, create jobs, increase access to electricity, and potentially establish South Africa as the new hub for solar technologies in Sub-Saharan Africa.

Creating such synergies has been at the heart of the success of fast-growing countries. They reinforce the two levers of economic development and increase their economic benefits for individuals. Even more importantly, they help to build a collective sense of solidarity, which is urgently needed in South Africa today.

Join the Conversation