The development of many Southern African countries is inextricably linked to the mining sector. For example, South Africa’s Johannesburg-Pretoria metropolitan area, a regional economic and financial hub, developed because of the local gold supply in the late 1800s. Yet the history of mining in Southern Africa, a region marked with high levels of inequality, is beset with controversy. In a recent report, we posed the question: what is the net benefit of mining for Southern African economies?

First things first: we were very constrained by data, making it difficult to get a good estimate of the benefits and costs of mining, and to understand how they are distributed across a variety of stakeholders. Data is sparse partially owing to the fact that Zambia is the only country in the region who has joined the global Extractive Industries Transparency Initiative (EITI), which was created to reduce information asymmetry by requiring disclosed information of “how revenues make their way through the government, and how they benefit the public.” To quantify the net benefits of mining, we used data from national accounts, firm-level financial reports, social accounting matrices from GTAP, and market intelligence platforms.

To guide our analysis, we used a novel framework (Figure 1), mapping the benefits and costs for a range of mining stakeholders: workers, investors, government, communities, and other parts of society, domestic and global. To estimate benefits, we largely relied on the mining production function (value-added), while costs were calculated based on the methodology found in the recent Changing Wealth of Nations. We focused our analysis on Botswana, Eswatini, Lesotho, Namibia, South Africa, Zambia, and Zimbabwe.

Figure 1: A framework to assess the net benefits of mining

Our analysis finds that the overall net benefit of mining is positive in all seven countries we studied. Even when accounting for foreign outflows of income—for data constraints again forced us to make assumptions—the net benefits remain positive, although significantly reduced. This in line with the considerable degree of foreign ownership in the mining industry in the region.

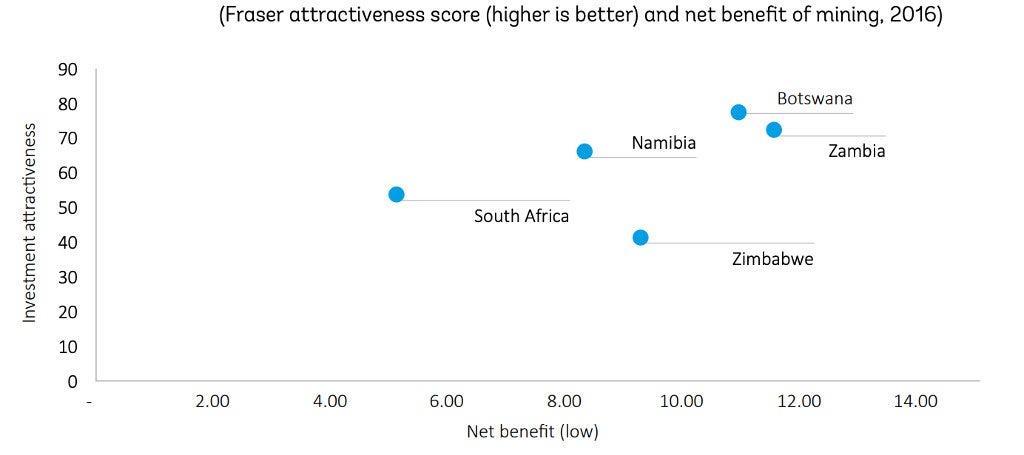

What does this tell us about policy? We consider our research a first step toward understanding how the distribution of the net benefits of mining affects the social dynamics that underly policy-making. Especially in an environment of data constraints, trust among stakeholders is difficult to build, perceived unfairness around the distribution of net benefits can easily become controversial. Resulting conflict can express itself as industrial action (by workers), protests (by communities) or tighter regulation (by government). This can result in declining investment and thus fewer resources to be shared across all stakeholders—and exploration investment has fallen in many Southern African countries. Although we do not have sufficiently conclusive enough data, we did notice that countries with higher net benefits tend to have investment climates that encourage investment more. This could suggest, that when countries perceive that mining is beneficial to their economy they are more likely to develop a policy environment that attracts further investments (Figure 2). We hope that these issues will be explored in future research.

Figure 2: Net benefits (% of gross domestic product) and the investment climate

Join the Conversation