I have been covering South Africa for nearly four years now. I have learned a lot, and I keep learning. One question I had been pondering for a while: in January 2017, we published our 9th South Africa Economic Update where we discussed industrial policy. When we launched the update, a member from the audience stood up and asked us about a graph we presented (Figure 1). He was a representative from the manufacturing sector and asked us how South African manufacturing was expected to survive with unit labor costs rising as the data suggests. The problem: labor productivity has remained broadly flat since 2011, while wages have been rising. This means that firms have to pay workers more for the same output they produce. Clearly, as firms have to remain price-competitive, this is not a sustainable situation and it can accelerate premature de-industrialization. At the same time, this dynamic can explain help why South Africa finds itself fighting job losses rather than seeing massive job creation, especially for the large number of unskilled youth. I did not have a good answer back then, but I thought it was something we would need to understand better.

Over two years later, I now believe I have a better answer. It draws on a just-published working paper, which I co-authored with Vincent Dadam and Nicola Viegi from the University of Pretoria. The paper focuses on the impact of productivity on relative prices, which economists refer to as the Balassa-Samuelson effect. To keep it simple: why can a New Yorker waiter afford a holiday in South Africa, but a South African waiter cannot necessarily afford a holiday in New York? The difference is the productivity differential: wages are much higher in more productive places. Normally, goods that are globally traded (often manufactured goods) drive productivity gains, and higher productivity drives higher wages both in traded sectors and non-traded sectors (many services are non-traded: it is difficult to globally trade a restaurant visit). But what if the productivity gains happen in the non-traded sectors and raise wages in the traded sector? In that case, wages will decouple from productivity and unit labor costs will increase in traded sectors like manufacturing. It the exact narrative the representative from the manufacturing sector during our launch bemoaned.

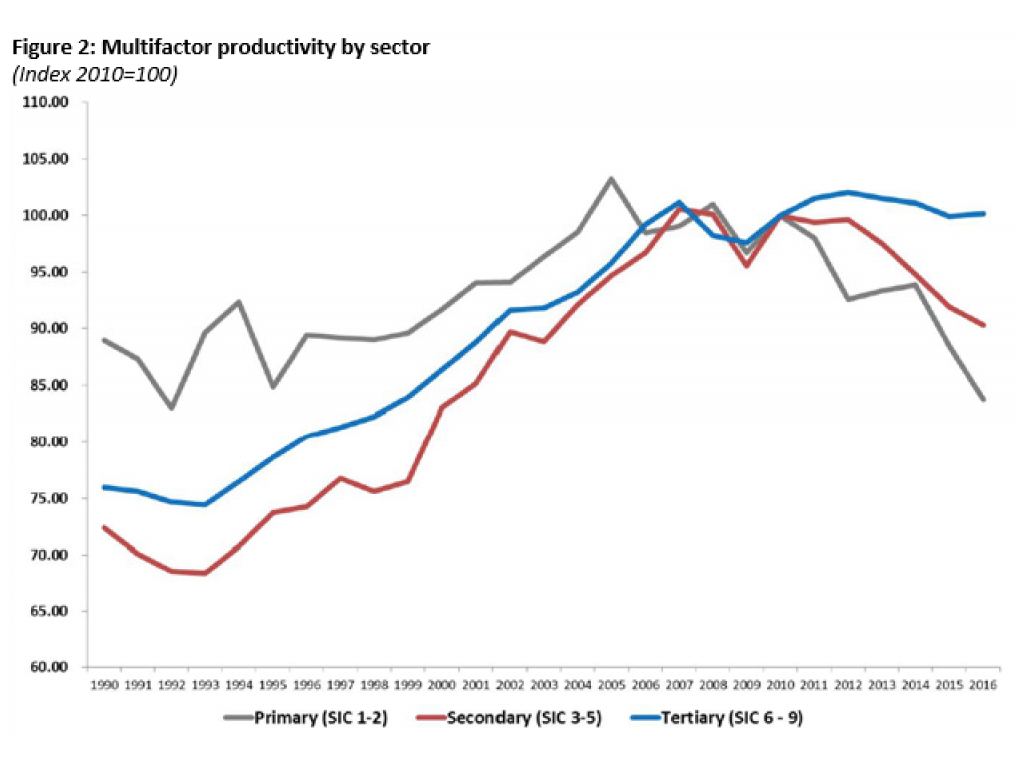

South African data clearly show that productivity gains have been much higher in the tertiary sectors (i.e. services, Figure 2), which tend to be less traded. Productivity gains have been strongest in sectors like finance and construction, while they have been much lower in agriculture, mining, and manufacturing. Our analysis demonstrates that this can explain the decoupling of wages from productivity in traded sectors.

This dynamic has a few important implications for South Africa. For one, it helps explain why manufacturing exports barely respond to a depreciating real exchange rate: the real exchange rate captures the differential between prices for traded and non-traded goods. South Africa’s long-term depreciation reflects the relative drop in productivity of South Africa’s manufacturing sector. In this case, clearly, a depreciation will not result in higher exports. Our paper also shows that the dynamic disproportionately hurts the poor: the poor consume relatively more manufactured goods (notably food) than services, so if productivity gains are higher in services, the rich can afford more items in their consumption basket at the same price. The poor do not benefit from a similar gain in the goods they tend to buy. South Africa is cheap for the rich and expensive for the poor.

What does this mean for policy, and for the role of the World Bank? Clearly, the answer is that productivity in manufacturing needs to increase. Linking South African manufacturing more closely with global productivity trends requires a further opening of the economy to international trade—this would need to be done very carefully, however, as it can result in large-scale job-losses in the short-term, as South Africa painfully experienced in the 1990s. The World Bank is already working with the South African government to increase global competitiveness, attract foreign direct investment, and foster regional integration.

Another area for intervention is education. The World Bank’s Human Capital Index shows that a South African child born today can expect to be about 41% as productive as an adult, when compared to a child from one of the world’s best education systems (such as Singapore). Apart from the direct impact of skills on productivity, insufficient skills also aggravate the impact of productivity increases on wage differentials and prices. To improve the foundations for skills, South Africa could also to consider joining the World Bank’s World Bank’s Human Capital Project, a new initiative to help countries enhance their citizens’ potential and productivity.

Join the Conversation