In the run up to the global financial crisis, European banks significantly increased their lending activities both domestically and outside home markets driven by a pro-cyclical spiral of cheap abundant funding, increasing profitability, and economic growth. In the process, European banks became excessively leveraged and reliant on sources of wholesale short-term funding making them more susceptible to shocks which could force them to adjust their operations abruptly and shrink their balance sheets (Le Lesle (2012)).

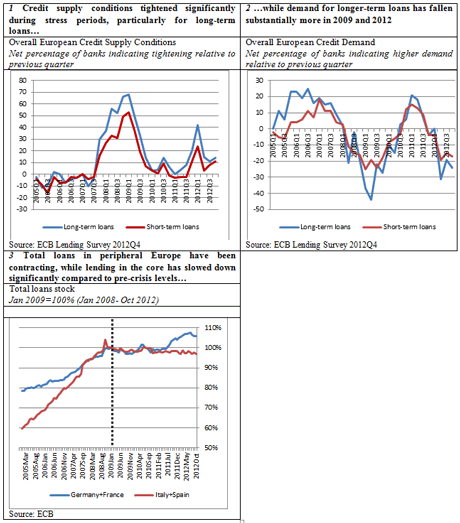

When the crisis erupted, a process of bank deleveraging was put into motion and European bank lending standards deteriorated significantly during various episodes of financial stress (Feyen, Kibuuka, and Ötker-Robe (2012), Giannetti, and Laeven, (2012)). First lending standards in Europe deteriorated considerably as the US subprime mortgage crisis unfolded in 2007 and reached a peak in 2009 in the wake of the default of Lehman Brothers in September 2008. Credit supply weakened significantly in 2011Q4 again when the European crisis deepened.

Despite European Central Bank (ECB) action in the form of long-term refinancing operations which loosened lending conditions significantly in 2012Q2, they have recently tightened again even in the wake of the positive impact of the OMT (Outright Monetary Transactions) sovereign bond buying program.

A credit squeeze, particularly for long-term loans

European banks have systematically tightened their standards for longer-term loans (i.e. with a maturity of at least 5 years) more than for short-term loans (Exhibit 1). At the same time, demand for longer-term loans has fallen more than for shorter-term loans, particularly in 2009 (Exhibit 2). Note that both trends mask substantial heterogeneity between peripheral and core countries. In the periphery, both supply and demand for long-term loans have deteriorated substantially more compared to the core, which underscores the impact of austerity programs, impaired financial markets, and financial fragmentation. Consequently, credit growth has been negative in the periphery since 2011 while it is still positive in the core, albeit significantly lower (Exhibit 3).

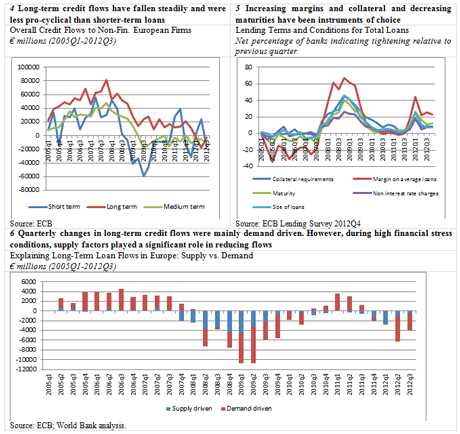

Combined, tightening supply and demand factors triggered a downward trend of long-term loan flows since 2007. This process accelerated by the end of 2011 and flows have become negative in 2012, marking the break of a pre-crisis pattern in which longer-term flows were dominant (Exhibit 4). Medium-term flows have already been negative since 2010Q4. Shorter-term flows have behaved more pro-cyclically―they were hit disproportionately in 2009 and rebounded strongly in early 2011 and 2012 when credit conditions temporarily improved.

Banks have used various means to tighten their credit terms including increasing prices, shortening maturities, and demanding more collateral (Exhibit 5). By the end of 2008, banks mostly readjusted prices to tighten the supply of credit and promptly correct for pre-crisis risk underpricing where margins were falling precipitously. More recently, margins continue to be the instrument of choice to restrict credit conditions, but there is also a significant role for shortening maturities.

Does supply or demand drive the fall in long-term credit? A simple regression approach

A key question is whether the fall in long-term loan flows was driven by supply or demand factors. To gauge this, Exhibit 6 shows the results of an illustrative regression analysis that disentangles both factors using ECB bank lending survey data. The simple model is able to explain almost 90 percent of the variation in quarterly long-term loan flows. The exhibit displays the supply- and demand-driven parts of the flows that can be explained by the model. The results imply that falling demand mainly drove the decrease in flows. However, a sizeable portion of the fall in loan flows was supply driven during stress peaks in 2007Q3-2009Q3 and 20011Q4.

The regression is based on data from 2003Q1-2012Q3. The independent variable is long-term flows to non-financial corporations in Europe, taken from the ECB. The explanatory variables are the cumulative net percentage of banks reporting tightening conditions, the cumulative net percentage of banks reporting higher demand, taken from ECB bank lending surveys. The regression also includes season-fixed effects. The supply and demand factors are highly statistically significant using robust standard errors. The R-squared of the model is 0.90.

Conclusion

So within Europe, European banks have been structurally tightening credit conditions more for longer-term credit. This has contributed to a steady fall of longer-term loan flows which recently became negative, reversing a pre-crisis pattern in which they were dominant. Although weak demand is an important factor, during financial stress peaks, supply factors added significantly to falling longer-term credit underscoring the harmful consequences of a deleveraging-induced credit crunch. Therefore, to the extent that long-term finance is deployed for long-term (corporate) investment, a squeeze of long-term credit could undermine future growth prospects.

Outside Europe, European financial stress has been transmitted to emerging markets which experienced a sustained deterioration of credit standards and funding conditions. Emerging markets might also be affected by the overhaul of the regulatory framework (FSB (2012)). At the same time, growth of credit provided by European banks to emerging markets and developing economies (EMDEs) has slowed down significantly from extremely high pre-crisis levels and even became negative in some countries as banks realign their business models and retrench to home markets. Moreover, many EMDEs are reliant on cross-border flows from European banks and local activities of their foreign affiliates. Other banks and capital markets could help fill the gap, but they will not always be willing or able to do so, particularly for longer-term and more complex forms of finance. As such, the Euro crisis really is a global crisis.

Reference

Le Lesle, V., 2012. Bank Debt in Europe: Are Funding Models Broken? IMF Working Paper 12/299.

Feyen, E., Kibuuka, K., and Ötker-Robe, I., 2012. Bank Deleveraging: Causes, channels, and Consequences for Emerging Market and Developing Countries, World Bank Research Working Paper 6086.

Financial Stability Board (FSB), June 2012. Identifying the Effect of Regulatory Reforms on Emerging Market and Developing Economies: A Review of Potential Unintended Consequences.

Giannetti, M. and Laeven, L., 2012. The Flight Home Effect: Evidence from the Syndicated Loan Market During Financial Crises. Journal of Financial Economics 104:1, pp. 23-43.

Join the Conversation