Stacked coins illustrating the decline of interest rate overtime. | © shutterstock.com

Stacked coins illustrating the decline of interest rate overtime. | © shutterstock.com

To stabilize financial markets and support activity in response to the COVID-19 pandemic, many central banks have employed asset purchase programs—in the case of several emerging markets and developing economies (EMDEs), for the first time. Although these programs appear to have initially helped to lower government bond yields, their broader macroeconomic consequences have yet to be seen. The programs present risks if they are perceived to be financing unsustainable fiscal deficits, or if they are expanded in the absence of the uniquely accommodative macroeconomic policies enacted by advanced economies. Embedding asset purchase programs in a transparent monetary policy framework that is consistent with inflation and financial stability objectives will reduce these risks.

A diverse set of program designs

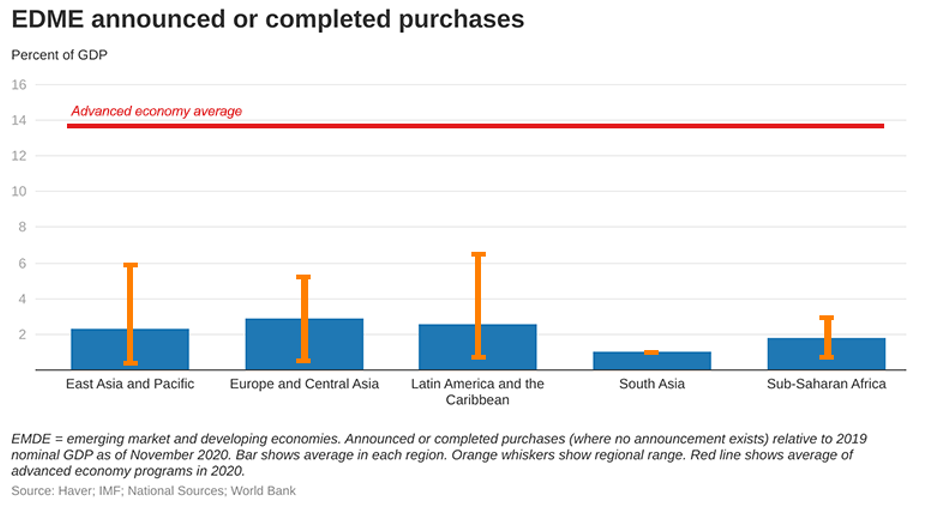

In 2020, central banks in 18 EMDEs announced or implemented asset purchase programs focused on local currency government bonds. The size of purchases varied from less than 1% to 6% of GDP, significantly smaller than the programs launched in advanced economies. In some cases, however, the asset purchases continue to grow. Many EMDE central banks have not announced the scale or duration of purchases. While most have been purchasing only in secondary markets, some have purchased bonds directly from governments with the objective of financing rising fiscal deficits.

Decline in long-term bond yields

Announcements of asset purchase programs appear to have helped stabilize bond markets and boost equity prices while having avoided putting pressure on currencies. The effects on long-term bond yields and equity prices have been on average greater than the effects of announcements of monetary policy rate cuts in response to COVID-19. In addition, the announcement effect of EMDE asset purchases on government bond yields appears to have been larger than the announcement effects of advanced-economy asset purchases. The broader macroeconomic implications, however, remain to be seen.

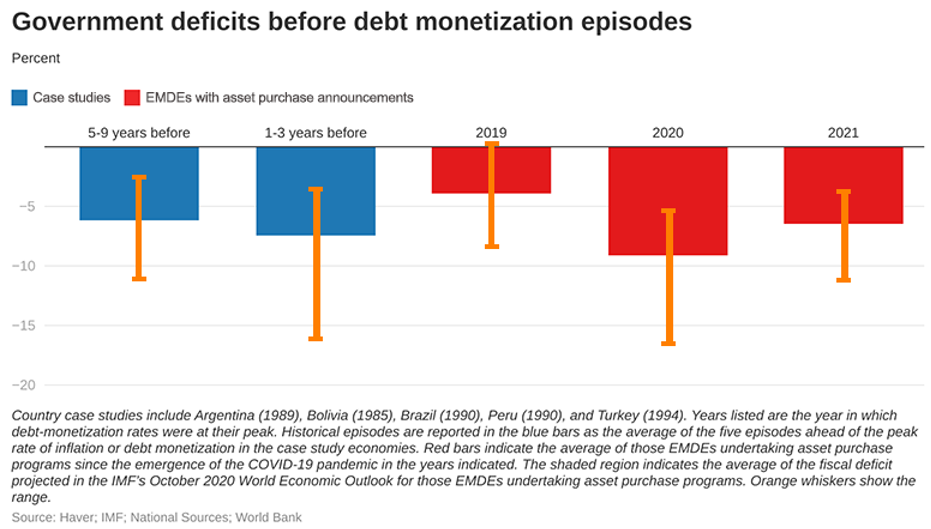

Risks to central bank credibility and perceptions of debt monetization

In the 1980s and 1990s, some EMDE central banks financed fiscal deficits. These episodes of debt monetization differ from recent instances in having been preceded by long periods of high inflation, external debt defaults, and stubbornly high fiscal deficits, set against the backdrop of less credible fiscal and monetary frameworks. For now, macroeconomic conditions in EMDEs are more benign than in those historical episodes, and monetary and fiscal authorities have established greater credibility. However, history is a reminder of the risks to central bank credibility if asset purchase programs are used for prolonged monetary financing of fiscal deficits.

Future effectiveness

The recent experience of EMDE asset purchase programs may overstate their future effectiveness. First, they were set against the backdrop of uniquely accommodative macro-economic policies in advanced economies that could be subject to reversal. Second, they were an unanticipated departure from earlier policy guidance of EMDE central banks that had focused on buttressing their independence. Third, fragile liquidity conditions in EMDE financial markets are conducive to volatile movements in asset prices, possibly leading to unintended consequences.

Join the Conversation