Interest rate cut illustration | © shutterstock.com

Interest rate cut illustration | © shutterstock.com

Banks dominate credit intermediation and savings mobilization in most emerging markets and developing economies (EMDEs). As bank lending interest rates and the lending-deposit interest spreads capture the efficiency with which banks allocate society’s savings to its most productive uses, high lending rates and spreads pose a challenge for policy makers in EMDEs: they can affect monetary policy transmission, hinder private investment and job creation, inhibit financial development and inclusion, and ultimately compromise financial stability.

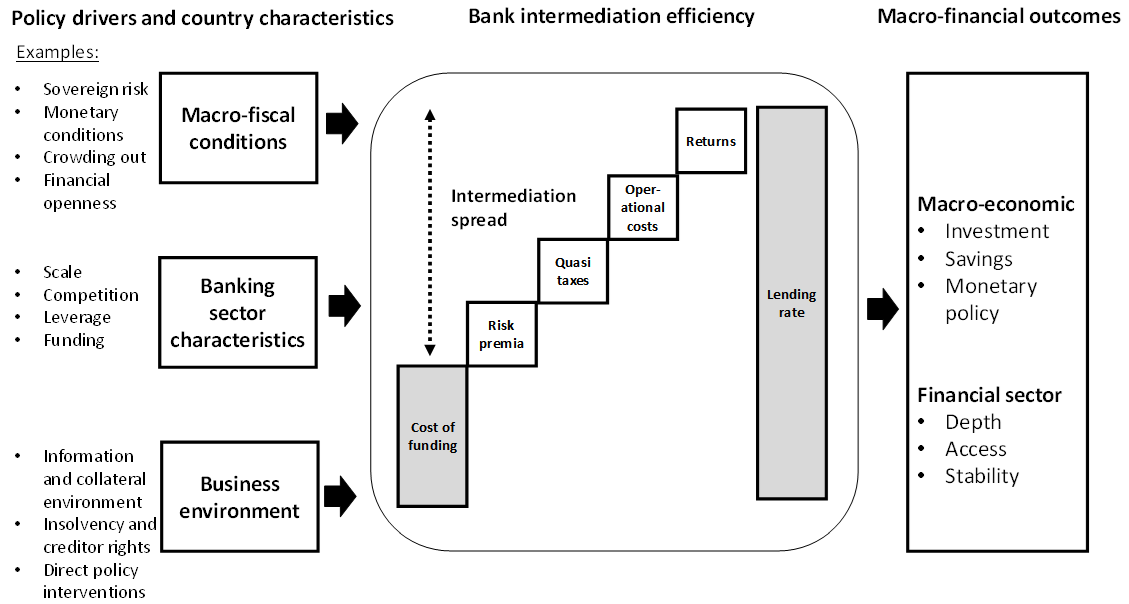

In a new working paper, we provide a conceptual framework to identify the main drivers that underpin the formation of bank lending interest rates and spreads (Figure 1) and discuss the main trends of rates and spreads between 2003 and 2017.

Figure 1: Drivers and macro-financial outcomes of bank lending rates and intermediation spreads

Between 2003 and 2017, the country median nominal lending rate and spread declined, but with regional heterogeneity (Figure 2). For example, rates and spreads have been consistently higher in Latin America and the Caribbean (LAC), Sub-Saharan Africa (AFR), and in many countries in Europe and Central Asia (ECA), whereas they have been typically lower in East Asia and Pacific and the Middle East and North Africa (MENA).

Figure 2: Interest rate and spread trends in EMDEs

Source: World Bank Finstats 2019; authors’ calculations

In addition, our quantitative analysis of data from 140 EMDEs presents the following main findings:

- First, less economically and financially developed countries tend to exhibit higher lending rates and spreads. These higher rates tend to be driven by higher spreads, not deposit rates, suggesting that intermediation efficiency is what matters most in less developed countries.

- Second, illustrative regressions using annual panel data for 51 EMDEs suggest that relevant correlates of nominal lending rates include the following:

- Macro-fiscal conditions: inflation, public debt, and policy interest rate

- Banking sector characteristics: overhead costs, non-performing loans, and non-interest income

- Business environment: credit bureau coverage, and time to resolve insolvency.

These results are illustrative and should be interpreted with caution as many other factors are associated with interest rates (e.g., productivity trends, demographics, and money supply trends), and deeper country-level analysis is required given country idiosyncrasies such as the policy environment and data issues.

- Third, with these caveats in mind, we conduct illustrative decompositions of the level and change of nominal lending rates and find relative differences across regions. For the 2017 average lending rate, high public debt and inflation (in South Asia (SA) and AFR) and high overhead costs (ECA, LAC, and AFR) appear to be key components. Weak insolvency frameworks (AFR and MENA) and high non-performing loans (NPLs) (MENA, ECA, and AFR) are also important. On the decline over 2007–17, rising public debt and NPLs pushed rates up, which was counterbalanced by a reduction in inflation, the policy interest rate, and overhead costs and a better business environment. Moreover, since the global financial crisis, a common global factor has increased in importance and contributed to the downward trend in nominal lending rates.

What are the policy implications for sustainably reducing rates and spreads? Policy makers should consider focusing on root causes to lower lending rates and intermediation spreads sustainably. Eight considerations are offered, which should be assessed holistically to formulate a coherent policy mix and avoid compromising macro-financial stability:

Macro-fiscal conditions

First, strengthen macro-fiscal fundamentals: Build strong public balance sheets and sound monetary, exchange rate, and debt management frameworks, since these exert a first-order effect on intermediation spreads and bank funding conditions.

Second, avoid crowding out the private sector: Large public sector debt levels financed through bank lending may dissuade banks from lending to a riskier private sector and result in a substantial increase in lending rates, particularly in countries with shallow banking systems.

Banking sector

Third, support competition: As stronger competition will incentivize banks to innovate and become more efficient, policy makers should consider reducing restrictions on financial market entry and activities, allowing competition from non-bank financial institutions, deepening capital markets, reducing or eliminating switching costs, and so forth.

Fourth, facilitate operational and scale efficiencies: As banks in EMDEs are often relatively small, policy makers could consider encouraging bank consolidation and providing enabling policy frameworks for the expansion of financial services through agent networks and the adoption of digital financial services.

Fifth, strengthen bank regulation and supervision: A strong supervisory approach will prevent the buildup of risks in bank balance sheets and promote good corporate governance and risk management.

Business environment

Sixth, improve insolvency and creditor rights regimes: Policy makers could consider strengthening regulatory frameworks that inhibit viable businesses from corporate restructuring, improving commercial insolvency regimes, and promoting the efficiency and independence of the insolvency practitioners.

Seventh, improve information and collateral registry frameworks: Policy makers could consider strengthening the regulatory underpinnings of these frameworks, updating local accounting principles, promoting the coverage and quality of information held in credit and collateral registries, and supporting the exchange of information between eligible market players.

Eighth, revisit direct policy interventions: Policy makers could consider reviewing interventions such as interest rate restrictions and directed credit programs , which may bring certain benefits but also give rise to distortionary effects that may ultimately have repercussions for financial deepening and stability.

Join the Conversation