Illustration of a "For Sale" sign in front of a house | ©shutterstock.com

Illustration of a "For Sale" sign in front of a house | ©shutterstock.com

Housing is the largest asset on households’ balance sheets and homeowners take mortgage loans from banks to finance the purchase of housing. When a central bank changes the federal funds rate, it influences the cost of bank lending. However, the banks set the mortgage rates, and the effectiveness of monetary policy depends on households’ exposure to changes in mortgage rates. Banks fund themselves on a short-term basis via deposits from households and wholesale funding from institutional investors in financial markets. So, what is the role of banking in transmitting monetary policy to mortgage rates?

In my job market paper, I examine how market concentration in the banking sector and reliance on wholesale funding affect the transmission of monetary policy to mortgage rates, housing prices, output, and borrowers’ consumption. I measure market concentration in a local deposit market and wholesale funding reliance by wholesale funding over deposits. Market concentration in the banking sector dampens monetary policy transmission, but it also affects the composition of wholesale funding reliance. Contractionary monetary policy increases the cost of short-term funding, but banks with high market power widen the spreads they charge on deposits and deposits flow out of the banking system (Drechsler, Savov and Schnable QJE 2017). Thus, banks in concentrated markets rely more on wholesale funding, while banks in competitive markets borrow from deposits.

Bank heterogeneity in monetary policy transmission to mortgage rates

My empirical specification estimates how monetary policy transmission to mortgage rates depends on two measures of the bank characteristics: market concentration and wholesale funding reliance. I control for metropolitan statistical area fixed effects because deposit can be transferred across the country, while mortgage loans are geographic specific, so my identification comes from variation across banks.

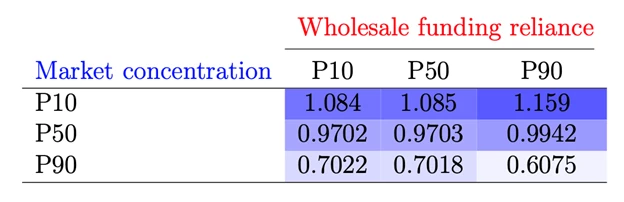

When the monetary authority raises the federal funds rate, banks with larger market size experience a decline in their deposits; in turn, they rely more on wholesale funding (Drechsler, Savov and Schnable QJE 2017). Table 1 shows that banks at the 90th percentile of the wholesale funding reliance distribution in concentrated markets transmit 61 basis points, while banks in competitive markets transmit 116 bps. These findings suggest that wholesale funding is an expensive form of funding, but it partially mitigates deposit shortfalls in concentrated markets and smooths the pass-through to mortgage rates.

Why is monetary policy transmitted partially to mortgage rates?

To understand the underlying mechanisms for how monetary policy is transmitted to mortgage rates, I build a New Keynesian model with a monopolistically competitive banking sector that faces financial friction. Banks engage in maturity mismatch by lending long-term mortgages and borrowing short-term funding with costly access to wholesale funding, and they have a dividend-smoothing motive.

When the federal funds rate increases, the cost of banks’ short-term funding increases. The opportunity cost of relying on wholesale funding is higher than the opportunity cost of borrowing from deposits because banks raise deposit rates partially. As a result, banks cut wholesale funding, which falls relative to deposits. Banks’ funding falls due to the rise in the deposit and federal funds rates; thus, banks partially transmit monetary policy to mortgage rates. Banks reduce markups to mitigate the negative effects on mortgage demand. Hence, market concentration in the banking sector dampens monetary policy transmission, while costly access to wholesale funding amplifies the pass-through to mortgage rates.

How does the partial transmission to mortgage rates translate into the real economy?

Due to the partial rise in mortgage rates, borrowers’ consumption falls less compared with a model with perfect monetary policy transmission to mortgage rates. The lower fall in consumption does not induce borrowers to work more; thus, output falls less. In response to a rise in the federal funds rate, banks substitute between wholesale funding and deposits, to mitigate negative shocks on mortgage loans, which leads to less of a decline in housing prices. Therefore, the partial transmission to mortgage rates dampens the monetary policy pass-through to output, housing prices, and consumption.

Implications for policy and research

A detailed understanding of bank characteristics in the mortgage market is an important input in the analysis of monetary policy.

Basel III Liquidity Coverage Ratio rule

Reliance on wholesale funding increases liquidity risks during market disruption because wholesale funding is susceptible to bank runs. To understand how the transmission of monetary policy works under the Basel III liquidity coverage ratio, which restricts excessive reliance on wholesale funding, I increase the cost of accessing wholesale funding in my model. I find that banks with high market power that rely excessively on wholesale funding are affected the most by this regulation. During monetary tightening, high market power banks cannot borrow from wholesale funding. As a result, the banks increase deposits by increasing their deposit rates. Lower bank funding reduces their issuance of new mortgages and amplifies the increase in mortgage rates relative to low market power banks.

Inflation target shock and the zero lower bound

I extend the analysis to unconventional monetary policy by raising the inflation target to provide policy makers more room to cut rates before reaching the zero lower bound. The inflation target shock has a persistent effect on mortgage and deposit rates, while the Taylor rule has a transitory effect. I find that the inflation rate rises under an inflation-targeting shock due to the construction of the shock, whereas the inflation rate falls under the Taylor rule. Deposit rates rise more in an inflation target environment, so banks rely more heavily on wholesale funding, compared with banks under the Taylor rule. The decline in housing prices is amplified by 0.4 percentage point, and the fall in borrowers' consumption is amplified by 0.5 percentage point.

Amina Enkhbold (@amina_enkhbold) is a PhD candidate at the University of Toronto. You can find more of Amina’s research at https://sites.google.com/view/aminaenkhbold.

Join the Conversation