“You never want a serious crisis to go to waste.”

Rahm Emanuel, former White House Chief of Staff

Looking in the rearview mirror, the recent U.S. subprime crisis seemed to be precipitated by a cauldron of events which were embedded in the fundamental problem that credit risk management was compromised on various levels. Naturally with a few years of hindsight, academics, economists, regulators, and supervisors have all wondered how the crisis could have been adverted or at least mitigated.

In this light, the existence of information data gaps and the importance of complete, accurate and timely credit information in the financial system have become more poignant. As a result of accelerated financial innovation, the banks offered new, but opaque, vehicles for investment. This made it difficult to assess risk levels and the true extent of credit leverage. Thus, as financial institutions began to develop and issue more convoluted instruments, credit risk management became more imprecise and at times erroneous. Without proper regulatory oversight and amid highly liquid credit markets (i.e. high demand for CDOs, ABSs, etc.), it further enabled banks to loosen their lending policies and thus continue to take riskier positions. As this occurred, banking supervisors and regulators often lacked the appropriate information to readily monitor the developments unfolding in the marketplace.

It has been evident that authorities need a device that allows them to look at the universe of credit in a detailed and timely fashion. More importantly, they need tools that would readily exploit this information for monitoring purposes. Public Credit Registry (PCR) databases capture individual credit information on both individual and firm borrowers and their credits. This could make PCRs a rich source of credit information for financial authorities. By implementing advanced credit analysis techniques on the information contained in PCRs, it can be a useful data source to measure banks’ credit risk exposure. It would allow for the optimization of prudential regulation, ensuring that provisioning and capital requirements are properly calibrated to cover expected and unexpected losses respectively. It would permit validating banks’ internal rating systems, performing stress tests and informing macroprudential surveillance. It is in this respect that PCRs could play an important role in enhancing the supervision and regulation of the financial system.

Supporting banking regulation and supervision

Credit analysis performed with PCR data that has sufficiently long historical data for a large segment of borrowers in the banking sector can assist in reshaping the prudential regulation for credit risk. By means of diverse data mining and econometric techniques, such as transition matrices and credit scoring models, and by deriving loss distributions from credit portfolio models, local authorities can better calibrate provisioning ratios and capital requirements to more closely reflect expected and unexpected losses for credit risk. For example, many banks use their own internal rating system to manage credit risk. The importance and usefulness of sharing credit information between lenders in determining credit risk becomes even more pronounced between small banks and large banks. Statistical evidence for Argentina in Majnoni et al (2004a) shows that a rating system built with PCR data benefits smaller banks with a larger reduction in their loan portfolio credit risk, as compared to that observed in bigger banks. Transitions matrices coupled with assumptions regarding recovery rates can indicate to what extent provisioning ratios are aligned with average risk. Furthermore, computing credit portfolio models with PCR data can also assist in optimizing the design and calibration of the regulatory framework, since they typically yield loss distributions that depict banks’ risk profile.

Utilizing PCRs can enhance risk-based supervision practices. With the PCR information, bank supervisors have detailed data of banks loans, so they can depict a more accurate risk profile of bank loan portfolios and perform more efficient and effective off-site monitoring and on-site inspections. For on-site examinations, the inspection can be streamlined with PCR data. Given that assessments are conducted via samples of borrowers, PCR samples can help data stratification to ensure representativeness of the bank’s activity by geographic regions, business sectors and type of product in which they are active or tailored to those segments that merit closer scrutiny during the visits. For example, when PCRs register individualized credit operations, they can produce samples to evaluate how new credit policies or financial products are impacting the bank’s risk profile and if this is consistent with their credit strategy. PCR databases can be programmed to produce regular, timely supervisory reports containing key risk indicators that summarize banks’ exposure to credit risk. They could characterize the overall quality of a bank’s portfolio and of its various segments, depicting with particular detail the risk profile of the largest borrowers. The reports can also measure bank exposure to concentration risk by type of borrower, region, business sector, credit type, etc.

Supporting macroprudential monitoring

The new International Regulatory Frame work for Banks (Basel III) is the response engineered by the Basel Committee on Banking Supervision (BCBS) to avoid a repeat of a similar crisis in the future. Basel III builds upon Basel II with additional reforms concerning credit risk management. In addition to the ordinary on-site and off-site supervisory processes, under Pillar 2 supervisors are responsible for revising banks’ validation of their internal rating systems and their assessment of their risk profile and capital adequacy. The additional requirements will require impact studies and stress testing under the new regulatory framework. The recalibration and validation of credit risk assessments via the Internal Risk Based (IRB) approach used by banks for this approach can be supplemented by information supplied by the PCR. Loan default and recovery data stored in PCRs would allow the regulators to assess if the loss experience in these credits would warrant that those risk weights should be increased.

One of the main related changes in Basel III is the countercyclical capital framework. It is the BCBS’ effort to introduce a macroprudential layer in banking sector regulation. This mechanism attempts to make the banking sector less pro-cyclical through the creation of a capital conservation buffer and a countercyclical capital buffer, the latter demanding closer credit risk analysis. Decisions will be made on various variables which can be useful indicators of rising tensions in the credit market. Some of these include interest rates, collateral valuations, delinquency rates and other variables commonly encountered in complete PCRs. For example, to the extent that PCRs have information about credits origination date, a simple vintage analysis can indicate if credits that have recently been granted are displaying an abnormally high delinquency rates. This could lead to conclude the convenience of activating the countercyclical add-on.

Optimal PCR Architecture

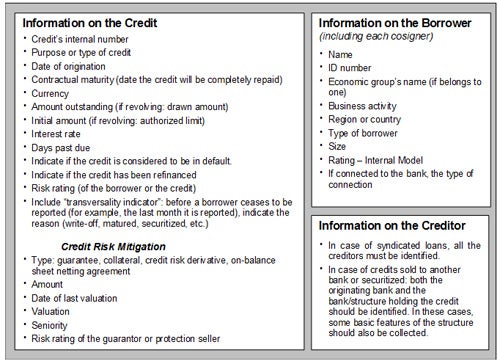

The architectural shape of the PCR is critical in order to effectively complement rigorous financial supervision and regulation of the financial sector. To accomplish this, the PCR would have to provide timely and sufficient data for those purposes. Basic borrower information would be necessary (i.e. full name, ID number, location, etc.) along with the corresponding credit information (i.e. type of credit, outstanding debt, days past due, date of origination, etc.). Also the information of any risk mitigation measures securing the credit (i.e. credit derivatives, guarantors, collateral, etc.) is needed to estimate the severity of losses in the event of default; this is particularly so to support supervisors when revising bank’s loss given default (LGD) estimates. Figure 1 depicts the minimum set of information that a PCR should contain. The coverage of the PCR should be extensive and when possible include as many financial intermediaries as possible. For example, in some Latin American countries, beyond the traditional information on credits issued by commercial banks, PCRs have included information on non-bank financial institutions, microfinance institutions as well as credit information regarding cooperatives operating in the country. Overall the extent, accuracy and availability of the information collected by the authorities will determine the usefulness of the PCR as part of their toolkit to monitor potential vulnerabilities of the financial sector.

Figure 1: Minimum Set of Information that a PCR Should Contain

Further Reading: Girault, Matias Gutierrez, and Jane Hwang. 2010. "Public credit registries as a tool for bank regulation and supervision." World Bank Policy Research Working Paper No. 5489.

Join the Conversation