Credit information and credit reporting systems are critical to a modern financial sector’s infrastructure. Since past behavior is one of the most powerful indicators of future behavior, credit reports which detail payment histories provide lenders with a valuable tool to classify the risk posed by different borrowers. Credit reporting systems reduce the impact of asymmetric information on credit markets, both by helping lenders to more effectively screen borrowers and avoid adverse selection and by providing an incentive for borrowers to repay their loans—thus reducing moral hazard.

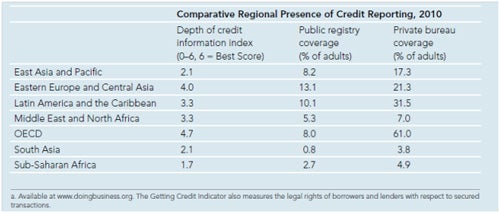

These systems are very well developed in North America and parts of Western Europe but are relatively new in most of the world. As data from the World Bank’s Doing Business database shows (see Figure 1 below), only a small fraction of adults are covered even where credit bureaus do operate. Even in Latin America, which has the best coverage of any emerging market region, only about one third of adults are covered. In many other regions, significantly fewer than 10% of adults have a credit report, and those who are in the system are likely to be high-income consumers with bank loans, not customers of microfinance lenders or retail credit providers.

FIGURE 1

It is only recently that attention has been paid to the potential and, in some cases, existing role of information sharing in microfinance markets. To some extent, the lack of attention may have been due to the business models traditionally adopted by microlenders, where there is limited borrower mobility, where borrowers concentrate their financial dealings in one institution and where local or soft information— sometimes formalized in group lending schemes—is a key aspect of the lending technology. However, in markets where microlenders have aggressively grown their portfolios and where microfinance institutions and competition have increased, attention has naturally turned to the need to share information and establish credit reporting for the sector.

What do we know already about the value that information sharing can have at the base of the pyramid, both for poor consumers and for micro and small enterprises? While research findings are far from complete, we have significant evidence that credit bureaus enable small firms and consumers to establish and then use their good name, or “reputation collateral” in the financial marketplace, which increases opportunities for accessing credit and reduces costs. Here are some examples:

- Credit bureaus contribute to the growth of an economy’s SME sector. One empirical study showed that about 1/3 of the variation in the size of a country’s SME manufacturing sector was related to the extent of credit information sharing.1

- Information sharing is linked not only with improved availability of credit, but also with lower costs, according to a recent study using data from 24 countries. These effects were shown to be especially important in countries with weak legal environments and for smaller and less transparent firms which would be relatively costly to screen.2

- Credit information is valuable for the development of non-bank firm finance, such as factoring. Empirical evidence shows credit information to be highly significant as a predictor of the level of factoring in an economy (weighted for GDP) and much stronger than creditor rights.3

- A study of the introduction of credit bureau data in the Guatemalan microfinance sector showed that default rates fell at one institution by 1-3 percentage points in the first six months after adoption. In a competitive market, this would correspond to a reduction in interest rates of more than 2.5 percentage points.4

Given the evidence that exists, and the importance of transparency in financial markets that has been demonstrated vividly over the past few years of crisis, why is it that credit reporting at the base of the pyramid continues to be a rare exception rather than the rule? A recent paper published jointly by CGAP and the IFC looks at the challenges, and opportunities, for credit reporting at the base of the pyramid.5

The report’s authors quickly hit upon a key question: Where should efforts to strengthen credit reporting start? Private credit reporting firms are keen to enter new markets and obtain new customers. Especially when there is competition in the market for credit reporting services, reaching new customers – even those who may be outside the economic mainstream and operating at low income levels – provides a competitive advantage. This was true more than a century ago in the U.S. in the competition that existed between credit reporting services,6 and appears to be the case more recently in Ecuador as well.5 But lenders’ resistance to credit reporting persists for a variety of reasons, including a reluctance to share data with competitors which is especially strong for dominant lenders in a market. A market leader may realistically expect that they will lose some of their “information rents” when markets become more transparent.

Another competition related concern for information sharing at the base of the pyramid relates to the decision to participate – or not – in the mainstream, commercial bank focused credit bureau or bureaus. These tend to be established first and enjoy better technology and value added services, such as credit scoring and other decision tools, than credit reporting firms that service only the microfinance sector and other non-bank lenders. In some cases non-banks are not permitted to participate – due to legal restrictions on data sharing linked to bank secrecy or the decisions of banks who are participating in the bureau (and who may even own it) to restrict access. But even where mainstream credit bureaus allow MFIs and other non-banks to participate, the terms of participation – cost structures which penalize smaller lenders or require a fee even when inquiries don’t yield data, lack of data from banks on borrowers at the base of the pyramid, etc. - may discourage MFIs from joining.

In some countries, governments have mandated that lenders participate in credit reporting in order to increase financial market transparency and competition. There are many times at the base of the pyramid, however, when financial providers are not supervised by banking authorities and are therefore not required or even prohibited from participating in credit information sharing. Often, this is the case with public credit registries that limit involvement to banks and other supervised institutions. In these situations, non-traditional sources of support for credit reporting--including encouragement or pressure from donors and investors in microfinance –can be especially valuable. Borrowers also have the power to encourage change. Once borrowers realize the value of a good payment history in credit markets, they may increasingly organize to encourage information sharing. As mobile payment systems grow, services that consumers can join to create and manage their own credit information profiles will likely develop.

Credit reporting increases transparency and introduces discipline into credit markets. When the data are available to a wide variety of potential lenders, this also results in greater competition in financial markets which can help drive down prices and improve quality. It’s high time for credit reporting to become a common feature of doing business at the base of the pyramid.

1 Ayyagari, Meghana; Beck, Thorsten; and Demirguc-Kunt, Asli. “Small and Medium Enterprises across the Globe.” Small Business Economics, December 2007, Vol. 29, issue 4, pages 415-34.

2 Brown, Martin; Jappelli, Tullio; and Pagano, Marco. “Information Sharing and Credit: Firm-Level Evidence from Transition Countries.” Centre for Economic Policy Research (CEPR), Discussion Paper Series No. 6313, June 2007.

3 Klapper, Leora. “The Role of Factoring for Financing Small and Medium Enterprises.” Journal of Banking and Finance. Volume 30, 2006, pages 3111-3130.

4 Luoto, Jill; McIntosh, Craig; and Wydick, Bruce. “Credit Information Systems in Less Developed Countries: A Test with Microfinance in Guatemala.” Economic Development and Cultural Change, January 2007, Vol. 55, issue 2, pages 313-34.

5 Lyman, Timothy; Lythgoe, Tony; Miller, Margaret; Reille, Xavier and Sankaranarayan, Shalini. “Credit Reporting at the Base of the Pyramid: Key Issues and Success Factors.” Access to Finance Forum: Reports by CGAP and Its Partners, No. 1, September 2011, published jointly by CGAP and the IFC.

6 Olegario, Rowena. “Credit Reporting Agencies: A Historical Perspective” in Credit Reporting and the International Economy, Margaret J. Miller editor. MIT Press 2003.

Join the Conversation