One of the most hotly debated policy questions with respect to the 2008 global crisis is how to stimulate business recovery. Because the crisis started in and severely affected the financial sector, the conventional assumption is that the recovery of the financial sector is a precondition to recovery in the corporate sector. While this conjecture appears reasonable, some have challenged it, pointing to numerous crises across the world in recent years in which real sector recovery preceded that of the financial sector. Of particular interest are episodes characterized by Calvo et al. (2006) as Systemic Sudden Stops (3S episodes) where output declines are associated with sharp declines in the liquidity of a country’s financial sector. Subsequent credit-less recoveries—in which external credit collapses with output but fails to recover as output bounces back to full recovery—have been termed “Phoenix Miracles.”

Empirically, 3S episodes offer an unusual natural experiment since they provide an opportunity to observe how firms are affected in economies which have been subjected to a financial shock that precedes or is contemporaneous with a recession. To date there has been little evidence at the firm-level on how corporations respond to crises in general. In a recent paper, my co-authors Meghana Ayyagari, Vojislav Maksimovic and I use a database of listed firms in emerging markets to analyze the recovery process after a financing crisis. We try to see if recovery of the financial sector precedes or occurs at the same time as the recovery in output of the corporate sector. In other words, we ask: Do firms experience Phoenix Miracles where their sales recover without a recovery in external credit? We then compare and contrast the experience of emerging market firms to that of US firms during the 2008 US financial crisis and investigate if the recent US recovery process qualifies as a Phoenix Miracle.

To answer these questions, we first use firm-level data from the Bloomberg database for 9 emerging market 3S episodes over the 1990s: Argentina, Indonesia, Korea, Malaysia, Mexico, Russia, Thailand, and two episodes in Turkey. Next we use data on US listed firms from Compustat to study recovery from the 2008 financial crisis in the US. We then compare the US experience with that of the 3S episodes.

We have the following main findings:

First, while averaged macro data across the nine 3S episodes (reported in Figure 1) is consistent with the notion of Phoenix Miracles—with output recovering one period before credit—a closer look at the evidence suggests that there is heterogeneity across countries even when using macro data. For example in Korea and the two crisis episodes in Turkey, private credit recovers at the same time as GDP, calling into question whether they are truly Phoenix Miracles.

Figure 1: Phoenix Miracles at the Macro Level

Macro data averaged across 9 3S episodes

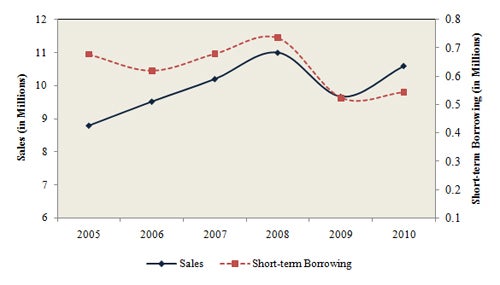

Second, when we investigate Phoenix Miracles at the micro level, the evidence is weaker. Aggregate firm level data does not provide much support, since both sales and short term borrowing recover simultaneously (Figure 2). When we analyze the financial statements of individual firms we see that only a small fraction of firms follow a pattern of recovery in sales without a recovery in external credit, and even this small fraction of firms has access to external sources of cash.

Figure 2: Phoenix Miracles at the Micro Level

Corporate data averaged across 9 3S episodes

Third, we find no evidence that the US financial crisis qualifies as a Phoenix Miracle. At the macro level, we find that GDP and Bank Credit (defined as the aggregate amount of assets held by banks excluding vault cash) decline in 2008 but begin to recover simultaneously in 2009 (Figure3a). At the firm level, we find that both Sales and Debt in Current Liabilities (aggregated across publicly traded firms in Compustat) recover simultaneously (Figure3b), suggesting that output recovery was not credit-less.

Figure 3: The US Case

A: GDP and Bank Credit

B: Sales and Short-Term Borrowing

Forth, a closer look at what drives the recovery process in 3S episodes suggests that the recovery is not in fact credit-less. Rather, firms on average substitute short-term credit with long-term external finance either through long-term borrowing or capital issuance. Thus, these potential miracles are miracles in a very restricted sense, if at all, in that firms are relying not on short-term but on long-term financing. So we find little support for the mechanism suggested by Phoenix Miracles that firms finance themselves primarily out of cash saved from cutting investments following a crisis.

Finally, we examine the investment and financing behavior of firms dealing with positive and adverse cash flow shocks to better understand corporate decision making during the crisis period and recovery. We find that both in emerging markets and in the US, firms use their positive cash flow shocks to add to their cash balances and repay short-term debt. Firms facing a negative cash flow shock and presumed to be financially constrained are still able to borrow in the long-term debt markets and issue equity, thus calling into question the notion of credit-less recoveries.

Overall our results suggest that the phenomenon of Phoenix Miracles is not supported by the micro level data either in the emerging markets or the U.S. Even the macro evidence reveals a great deal of heterogeneity in the relationship between GDP and credit recovery across the emerging market countries, and in the US we find no evidence that there was a recovery in output without a recovery in credit.

The finding that credit-less recoveries are all but nonexistent has important policy implications for crisis recovery policies. The firms in both our samples are large publicly listed corporations, and hence are able to access long term debt and equity markets to finance their recovery even when there is a reduction in short term bank credit. For smaller firms access to longer term debt and equity is likely to be very limited, making recovery without access to short term debt much more difficult. Government efforts to off-set the credit crunch and ensure a continuous flow of credit after the latest crisis is supported by our findings.

Further Reading:

Ayyagari, Meghana, Asli Demirguc-Kunt and Vojislav Maksimovic, “Do Phoenix Miracles Exist? Firm-level evidence from financial crises,” World Bank Working Paper No. 5799.

Calvo, Guillermo A., Izquierdo, Alejandro, and Ernesto Talvi, 2006, "The Economics of Sudden Stops in Emerging Economies: Sudden Stops and Phoenix Miracles in Emerging Markets," American Economic Review 96(2), 405-410.

Join the Conversation