In a recent paper with Luc Laeven and Ed Kane, we have now updated our database of deposit insurance arrangements around the world through 2013. Our starting point was the World Bank’s survey on regulation and supervision conducted in 2010. This survey asked national officials for information on capital requirements, ownership and governance, activity restrictions, bank supervision, as well as on the specifics of their deposit insurance arrangements. We combined this data with the deposit insurance surveys conducted by the International Association of Deposit Insurers in 2008, 2010, and 2011, and in the case of European countries with detailed information on deposit insurance arrangements obtained from the European Commission (2011). Finally we checked discrepancies and data gaps against national sources, including deposit insurance laws and regulations, and IMF staff reports. Following Demirguc-Kunt, Kane, and Laeven (2008), we assume any country that lacks an explicit deposit insurance scheme has implicit deposit insurance given the widespread governmental pressures to provide relief in the event of a widespread banking insolvency.

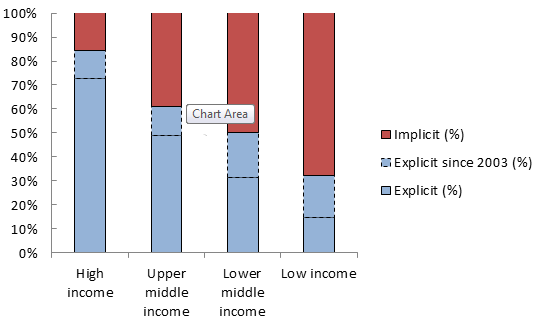

What do we see? The number of countries with explicit deposit insurance schemes has continued to increase. Out of 189 countries covered, 112 countries (or 59 percent) had explicit deposit insurance by year-end 2013, having increased from 84 countries (or 44 percent) in 2003. The 2008 global financial crisis contributed to this trend, with 5 countries adopting deposit insurance in the year 2008 alone. Australia, long an advocate of implicit deposit insurance, was a notable example among those countries that joined the ranks of those with explicit deposit insurance in 2008.

Another force has been the EU-driven harmonization process of deposit insurance, which spurred the adoption of explicit deposit insurance throughout Central and Eastern Europe. So in Europe, almost all countries (or 96 percent of countries) have deposit insurance. Explicit deposit insurance is less widespread in other parts of the world, with only 24 percent of countries in Africa having explicit deposit insurance.

Explicit Deposit Insurance by Income Group, 2013

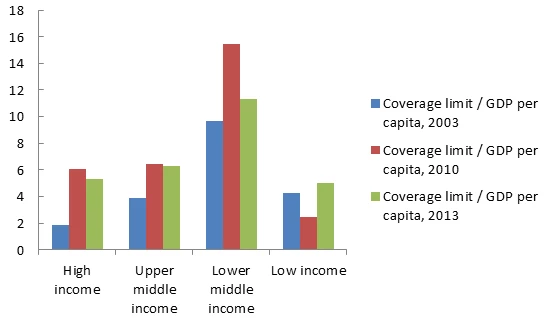

Coverage limits also vary markedly across countries, both in absolute level and relative to per capita income. Coverage increased sharply during the recent financial crisis (in part reflecting the announcement of government guarantees on deposits) and was subsequently reduced, although coverage levels on average remain above pre-crisis levels. By end-2013, coverage limits on average amount to 5.3 times per capita income in high income countries, 6.3 times per capita income in upper middle income countries, 11.3 times per capital income in lower middle income countries, and 5.0 times per capita income in low income countries.

Coverage Increased During Crisis and Remains Above Pre-Crisis Levels

The expansion of the safety net was substantial, especially for crisis countries, and extended beyond traditional deposit insurance. Fourteen countries introduced explicit deposit insurance since 2008, and almost all countries with explicit deposit insurance that experienced a banking crisis over this period increased the statutory coverage limit in their deposit insurance scheme (96 percent of countries to be precise). Government guarantees on deposits were introduced in 32 percent of countries with deposit insurance and experiencing a banking crisis. 38 percent of these deposit guarantees were blanket guarantees, guaranteeing deposits in full. Government guarantees on bank liabilities were particularly widespread, especially among countries with deposit insurance experiencing a banking crisis (72 percent of these countries extended guarantees on bank liabilities). These guarantees varied from extending guarantees on debt issuances to blanket guarantees on all debt liabilities. Government guarantees on bank assets were used in 36 percent of countries with deposit insurance experiencing a banking crisis. Bank nationalizations were also widespread, occurring in 64 percent of countries with deposit insurance experiencing a banking crisis.

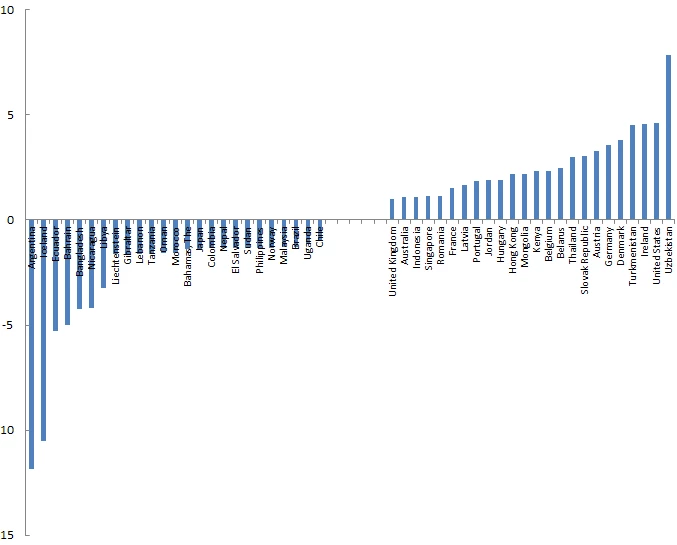

To measure the generosity of the deposit insurance scheme and the existence of government guarantees on bank assets and liabilities, we create a safety net index, similar to the moral hazard index in Demirgüç-Kunt and Detragiache (2002). The safety net index (SNI) is computed using principal component analysis of standardized design feature variables that each are increasing in moral hazard and it is the sum of the first six principal components for which the eigenvalues exceed 1.

Safety Net Index, 2013

The above figure shows the values of our SNI index, with higher values denoting more generosity, and consequently more moral hazard. We observe much country variation in the SNI index. It ranges from a low of -11.9 in Argentina and -10.5 in Iceland (which both have imposed losses on insured depositors) to a high of 4.6 in Ireland and the United States (both of which issued temporary guarantees on deposits and non-deposit liabilities during the recent crisis) and 4.5 in Turkmenistan and 7.8 in Uzbekistan (both of which have blanket guarantees). Some of these countries will be able to fund such generous safety nets promises, but the fairness and efficiency of imposing such a burden on households and nonfinancial firms is questionable. And the moral hazard it creates is hard to contain as evidenced in the difficulty of eliminating the too big to fail problem.

While it is too early to draw definitive conclusions about the adequacy of deposit insurance systems during the recent global financial crisis, our preliminary assessment is that, by and large, deposit insurance fulfilled its foremost purpose of preventing open runs on bank deposits. There were some notable exceptions (such as Northern Rock in the UK) and there were protracted withdrawals by uninsured depositors, but the world did not experience systemic bank runs by insured depositors. From this perspective, deposit insurance delivered on its narrow objective. However, as we look to what we hope are many post-crisis years, the expansion of the financial safety net (both through an extended coverage of deposit insurance and increased reliance on government guarantees and demonstrated rescue propensities to support the financial sector) is something to worry about. The expansion of national safety nets raises questions about (i) whether government finances are adequate to support the promises of existing deposit insurance in future periods of stress (the more so given that governments will likely face renewed pressures to further increase insurance promises in future crises) and (ii) how to balance the objective of preventing bank runs with the potentially negative effects of deposit insurance in the form of moral hazard and the threat to financial stability from the incentives for aggressive risk-taking.

A more comprehensive analysis of these issues is needed and we hope that publishing this database will facilitate this research.

Further reading:

Demirguc-Kunt, Asli, Edward Kane and Luc Laeven, Deposit Insurance Database, World Bank Policy research working Paper, 2014.

Demirgüç-Kunt, A., E.J. Kane, and L. Laeven (Eds.), 2008, Deposit Insurance around the World: Issues of Design and Implementation (Cambridge, MA: MIT Press).

Demirgüç-Kunt, A., and E. Detragiache, 2002, “Does Deposit Insurance Increase Banking System Stability? An Empirical Investigation,” Journal of Monetary Economics, Vol. 49, No. 7, pp. 1373-1406.

Join the Conversation