A Mexican artist from Chiapas, México | © Jessica Belmont, World Bank

A Mexican artist from Chiapas, México | © Jessica Belmont, World Bank

Small and medium-size firms (SMEs) have been a subject of great interest to scholars and policy makers, as these enterprises play a critical role in the provision of employment around the globe (Ayyagari et al. 2011). However, the ability of SMEs to create jobs is hampered by their limited access to adequate finance, particularly in low- and middle-income economies (LMIEs) in which credit constraints are severe et al. 2003; Ayyagari et al. 2011; Stein et al. 2010). Having lower saving rates, weaker investor protection, underdeveloped credit bureaus, and less competitive banking environments, LMIEs have credit markets that are smaller and less efficient in dealing with informational asymmetries (La Porta et al. 1997; Djankov et al. 2007; Calomiris et al. 2017). Thus, SMEs in these countries face higher interest rates, larger credit constraints, and higher costs of switching across banks, implying that they are also more likely to benefit from positive credit supply shocks. Thus, we study the impact of bank-specific credit shocks on employment in an LMIE.

In the macroeconomic literature, the fact that credit growth and aggregate economic outcomes co-move has been well established (Azariadis 2018; García-Escribano and Han 2015); however, establishing a causal link between credit growth and these outcomes is difficult for obvious concerns of reverse causality and omitted variables. Early studies in the micro literature investigated the impact of government-induced bank branch expansions on economic activity, competition, and rural poverty, using difference-in-differences techniques that exploit variation across locations and over time (Jayaratne and Strahan 1996; Black and Strahan 2002; Burgess et al. 2005).[1]

A more recent strand of the literature benefits from the increasing availability of detailed data on credit and uses them to build bank-idiosyncratic supply shocks and study their impact on employment and other outcomes (Greenstone et al. 2019; Chodorow-Reich 2014; Morais et al. 2019; and Guler et al. 2019, for a literature review). Nevertheless, most of these studies focuses on the advanced economies (AEs) for which credit-level data are available and find moderate to null effects of credit shocks on employment. Considering that firms in LMIEs face higher interest rates, greater credit constraints, and higher costs of switching across bank than firms in AEs, credit supply shocks could have larger employment impacts in LMIEs.[2]

Our paper contributes to this literature by measuring the causal relationship between credit supply shocks to small and medium-size firms and changes in employment in Mexico. We use a detailed data set containing loan-level information for the universe of loans extended by commercial banks to private firms in Mexico, together with publicly available information on the total number of employees reporting formal wages to the Mexican Social Security Institute. Our analysis focusses on 2010–16, when the Mexican economy was relatively stable and credit availability to firms increased.

We exploit differences in preexisting bank market shares across Mexican labor markets, along with variation over time in total lending from each bank and empirically assess the causal impact of credit shocks on employment changes. Specifically, we follow Greenstone et al. (2019) and construct our explanatory variable by first estimating changes in lending from each bank that cannot be explained by changes in credit demand across labor markets, and then calculate labor market–level weighted averages of these credit shocks, using the market share of each bank in each labor market as weights.[3] Figure 1 shows the credit supply shocks we estimate for different years, which display large variation across Mexican labor markets in a given year and across years for a given labor market. In essence, our empirical strategy asks whether labor markets with banks that have higher idiosyncratic increases in firm credit availability also experience larger changes in employment outcomes.

Figure 1: Exposure to shocks among local labor markets in the sample

Notes: Authors’ calculations of credit shocks at the local labor market level. The figure shows the average estimated credit supply shock in the baseline year. The figure also shows the geographic location of labor markets in our restricted sample (labor markets excluded from the empirical analysis are shown in white). In all labor markets, more than one bank issued a loan during the period analyzed.

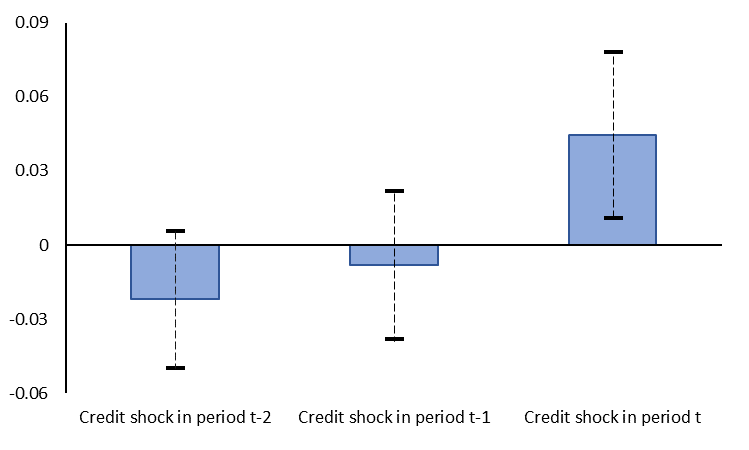

Our results (Figure 2) suggest that, contrary to evidence for AEs, in Mexican labor markets, increases in credit supply have a relatively higher and positive effect on formal employment in SMEs. Essentially, we find that when a labor market faces an exogenous credit supply shock of one standard deviation, formal employment increases 0.45 percentage point (13 percent of the mean yearly employment change in our sample).

Our results contrast with the moderate to null employment effects of recent papers that focus on the relationship between credit and employment in developed economies during normal times. In the specific case of Greenstone et al. (2019), on which our empirical methodology is based, credit supply shocks in the United States have no effect on employment in small firms during the years prior to the 2009 recession, even though the credit supply was growing rapidly. We explore potential reasons for this discrepancy: the institutional context of an LMIE, the role of informality, and the unit of analysis (administrative units versus local labor markets). We conclude that the larger relationship between credit supply and formal employment in Mexico is mostly due to the larger credit constraints faced by SMEs. This suggests that credit supply shocks can have a stronger effect on formal employment in LMIEs where small firms represent a larger share of total employment and tend to be more credit constrained.

Figure 2: Effect of credit supply on formal employment in SMEs in Mexico

Notes: Authors’ estimation of changes in log of formal employees in small firms in each labor market as the dependent variable and credit supply shocks in years t-2, t-1 and t as the independent variables. Regressions include local labor market and year fixed effects. The figure shows point estimates of the effect of credit supply shocks in different years on changes in employment. Observations are weighted by the number of workers in small firms in each labor market-year cell. The lines extending from the bars show the 95% confidence intervals with standard errors clustered at the local labor market level.

References

Ayyagari, Meghana, Asli Demirguc-Kunt, and Vojislav Maksimovic. “Small vs. young firms across the world: contribution to employment, job creation, and growth.” The World Bank (2011).

Azariadis, Costas. "Credit Cycles and Business Cycles." Federal Reserve Bank of St. Louis Review, First quarter (2018).

Barbosa, Luciana, Andrada Bilan, and Claire Celerier. “Credit supply shocks and human capital: Evidence from a change in accounting norms.” Working Paper no. 2271 (2019), ECB.

Bartik, Timothy J. "Who benefits from state and local economic development policies?" (1991).

Beck, Thorsten, Asli Demirgüç-Kunt, and Vojislav Maksimovic. Bank competition, financing obstacles, and access to credit. The World Bank (2003).

Berg, Tobias. “Got rejected? Real effects of not getting a loan.” Review of Financial Studies 31, 4912–4957 (2018).

Bentolila, Samuel, Marcel Jansen, and Gabriel Jimenez. “When credit dries up: Job losses in the Great Recession.” Journal of the European Economic Association 16, 650–695 (2017).

Berton, Fabio, Sauro Mocetti, Andrea F. Presbitero, and Matteo Richiardi. "Banks, firms, and jobs." The Review of Financial Studies 31, no. 6 (2018): 2113-2156.

Black, Sandra E., and Philip E. Strahan. "Entrepreneurship and bank credit availability." The Journal of Finance 57.6 (2002): 2807–2833.

Blyde, Juan, Matias Busso, and Dario Romero. “Labor Market Adjustment to Import Competition: Long-run Evidence from Establishment Data.” Mimeo (2019).

Boeri, Tito, Pietro Garibaldi, and Espen Moen. “Financial shocks and labor: Facts and theories.” IMF Economic Review 61, 631–663 (2013).

Bruhn, M., and Love, I. (2014). The real impact of improved access to finance: Evidence from Mexico. The Journal of Finance, 69(3), 1347–1376.

Burgess, Robin, Rohini Pande, and Grace Wong. "Banking for the poor: Evidence from India." Journal of the European Economic Association 3.2–3 (2005): 268-278.

Calomiris, C. W., Larrain, M., Liberti, J., & Sturgess, J. (2017). How collateral laws shape lending and sectoral activity. Journal of Financial Economics, 123(1), 163–188.

Caggese, Andrea, Vicente Cuñat, and Daniel Metzger. “Firing the wrong workers: Financing constraints and labor misallocation.” Journal of Financial Economics 133, 589–607 (2019).

Chodorow-Reich, Gabriel. "The employment effects of credit market disruptions: Firm-level evidence from the 2008–9 financial crisis." The Quarterly Journal of Economics 129, no. 1 (2014): 1–59.

Djankov, Simeon, Caralee McLiesh, and Andrei Shleifer. "Private credit in 129 countries." Journal of financial Economics 84.2 (2007): 299–329.

García-Escribano, Ms Mercedes, y Mr Fei Han. Credit expansion in emerging markets: propeller of growth? No. 15–212. International Monetary Fund, 2015.

Giannetti, Mariassunta, Andrei Simonov. “On the real effects of bank bailouts: Micro evidence from Japan.” American Economic Journal: Macroeconomics 5, 135–167 (2013).

Greenstone, Michael, Alexandre Mas, and Hoai-Luu Nguyen. "Do Credit Market Shocks Affect the Real Economy? Quasi-Experimental Evidence from the Great Recession and “Normal” Economic Times." (2019).

Hochfellner, Daniela, Joshua Montes, Martin Schmalz, and Denis Sosyura. “Winners and losers of financial crises: Evidence from individuals and firms.” Mimeo (2015).

Huber, Kilian. “Disentangling the effects of a banking crisis: Evidence from German firms and counties.” American Economic Review 108, 868–898 (2018).

Jayaratne, J., and Strahan, P. E. (1996). The finance-growth nexus: Evidence from bank branch deregulation. The Quarterly Journal of Economics, 111(3), 639-670.

La Porta, R., Lopez‐de‐Silanes, F., Shleifer, A., and Vishny, R. W. (1997). Legal determinants of external finance. The Journal of Finance, 52(3), 1131–1150.

Morais, Bernardo, José‐Luis Peydró, Jessica Roldán‐Peña, and Claudia Ruiz‐Ortega. "The international bank lending channel of monetary policy rates and QE: Credit supply, reach‐for‐yield, and real effects." The Journal of Finance 74, no. 1 (2019): 55–90.

Popov, Alexander, Jörg Rocholl. “Do credit shocks affect labor demand? Evidence for employment and wages during the financial crisis.” Journal of Financial Intermediation 36, 16–27 (2018).

Stein, Peer, Tony Goland, and Robert Schiff. “Two trillion and counting: Assessing the credit gap for micro, small, and medium-size enterprises in the developing world.” No. 71315. The World Bank, (2010).

Join the Conversation