To reduce asymmetric information problems associated with extending credit and increase the chances of loan repayment, banks typically require collateral from their borrowers.

Movable assets often account for most of the capital stock of private firms and comprise an especially large share for micro, small, and medium-size enterprises. Hence, movable assets are the main type of collateral that firms, especially those in developing countries, can pledge to obtain bank financing. While a sound legal and regulatory framework is essential to allow movable assets to be used as collateral, without a well-functioning registry for movable assets, even the best secured transactions laws could be ineffective or even useless.

Given the importance of collateral registries for moveable assets, 18 countries have established such registries in the past decade. However, to my knowledge there is no systematic empirical evidence on whether such reforms have been effective in fulfilling their primary goal: improving firms’ access to bank finance.

In a recent paper, Inessa Love, Sandeep Singh and I explore the impact of introducing collateral registries for movable assets on firms' access to bank finance using firm-level surveys for 73 countries. Following a difference-in-difference approach, we compare access to bank finance pre and post the introduction of movable collateral registries in seven countries (Bosnia, Croatia, Guatemala, Peru, Rwanda, Serbia, and Ukraine) against three different “control” groups: a) firms in all countries that did not implement collateral reforms during our sample frame (59 countries), b) firms in a sample of countries matched by location and income per capita to the countries that introduced movable collateral registries (7 countries), and c) firms in countries that undertook collateral legal reforms but did not set up registries for movable assets (7 countries). This difference-in-difference approach controlling for fixed country and time effects allows us to isolate the impact of the introduction of movable collateral registries on firms’ access to bank finance.

Overall, we find that introducing movable collateral registries increases firms' access to bank finance. In particular, our baseline estimations indicate that the introduction of registries for movable assets is associated with an increase in the likelihood that a firm has a bank loan, line of credit, or overdraft; a rise in the share of the firm’s working capital and fixed assets financed by banks; a reduction in the interest rates paid on loans; and an increase in the maturity of bank loans.

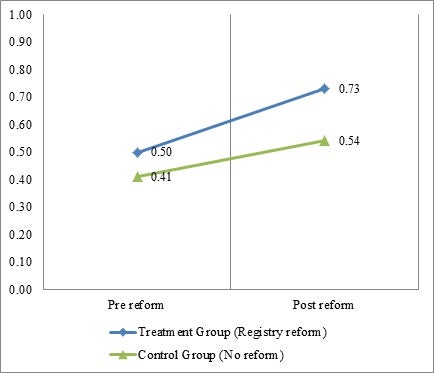

The impact of the introduction of movable collateral registries is economically significant: registry reform increases access to bank finance by almost 8 percentage points and access to loans by 7 percentage points. These are sizeable effects considering that in our sample, about 60 percent of firms have access to finance and 47 percent have a loan. There is also some evidence that the impact of the introduction of registries for movable assets on firms’ access to bank finance is larger among smaller firms, which also report a reduction in a subjective, perception-based measure of finance obstacles.

Average access to finance before and after registry reform in treatment and matched control countries

Join the Conversation