The current policy debate on spurring growth is sometimes couched as a binary battle between fiscal stimulus and structural reform. In the context of the euro zone, this gives an incomplete picture. Two other issues are important. Adding these complicates the picture, but it helps point the way to a fuller policy response and a clearer hierarchy among policy actions to address the current mutually reinforcing combination of a growing sovereign debt-banking problem on the one hand and fears of a recession on the other.

The first issue is the likelihood of a credit crunch as commercial banks scramble to meet higher capital adequacy ratios even as their portfolio of sovereign bonds deteriorates. Going to the markets to raise capital is not an attractive option, and banks are more likely to deleverage to meet the new capital requirements. The second issue is that of flagging confidence. This started rearing its head in the summer of 2011 with speculative attacks on the sovereign debt of Italy and Spain in addition to the EU/IMF-supported program countries (Greece, Ireland and Portugal). This confidence problem has its roots in the botched bailout of Greece and what is perceived as a weak crisis resolution framework in the euro zone. Table 1 attempts to pull the various elements together.

Table 1: Options for spurring growth

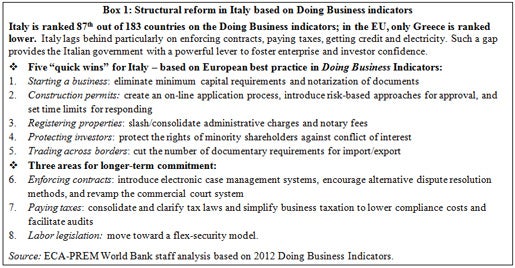

To make the discussion more concrete, let us take Italy as an example. It has announced considerable fiscal austerity under the new government. It is also in a position to implement significant structural reform. But fiscal austerity alone is not the answer, and if pushed too far it can backfire by lowering growth and accentuating a vicious cycle of lower revenues, lower primary fiscal balances, and higher interest rates. Box 1 on structural reform shows considerable scope for reforms including some quick wins. But these on their own are unlikely to help much unless interest rates and macroeconomic uncertainty come down. Lower interest rates would also help stave off a credit crunch to the extent that they raise the value of sovereign bonds in banks’ balance sheets.

The top priority is to restore confidence so that interest rates start falling. This would help in multiple ways: first, given high levels of indebtedness, it would lower interest payments and fiscal deficits, reducing the pressure for fiscal austerity in the midst of a recession; second, as noted, it would help avert a credit crunch, especially if banks are allowed more time to meet the new capital requirements; and, third, in conjunction with structural reforms, it would give both growth and long-run debt sustainability a better chance.

This leaves a central question: how to bolster confidence and begin a move toward lower interest rates. Recent developments provide some clues. First, the problems in countries like Italy flow not from insolvency but a combination of weak fundamentals and contagion from the unraveling Greek bailout. Second, countries like Italy cannot bolster confidence on their own; they need help from the ECB and better-placed countries such as Germany. For example, the ECB’s December 2011 Long-Term Refinancing Operation that lent banks about €490 billion at 1 percent for 3 years has helped cut spreads appreciably on vulnerable sovereign bonds at the shorter end of the yield curve and boosted confidence. A similar operation has been announced for February and will further help banks with liquidity. The question is what sort of support can be provided at the long end of the yield curve. In this regard, markets reacted positively to the recent news that the IMF might be given a substantial amount of additional funding ($600 billion), coupled with a possible boosting of Europe’s own financial firewall.

These developments suggest that Italy is dealing with a confidence, and not solvency, problem (in the case of Greece, spreads rose even as the bailout package was being augmented). Italy must do its part on the fiscal and structural fronts. But the levers to restore confidence do not all rest with Italy but also importantly with the ECB and Germany—and perhaps beyond. A bolder, unequivocal plan to help shore up the market for the longer-term bonds of vulnerable sovereigns like Italy and Spain could yield high dividends by restoring confidence and starting a virtuous cycle. This will require an immediate and significant strengthening of the financial firewall and backstopping arrangements in the euro zone. Eventually, ECB reform may be needed to enable it to function more like a lender of last resort. Down the road, the agenda for collective action in the euro zone would likely also include greater steps toward fiscal union.

Join the Conversation