This post is part of a series highlighting the key findings of the Global Financial Development Report 2015 | 2016: Long-Term Finance. You can view all the posts in the series at gfdr2015.

The first part of Chapter 2 of the 2015 Global Financial Development Report examines the use of long-term finance from the firm’s perspective. It draws on theoretical and empirical studies to ask why firms would want to use long-term finance and how this use affects their performance. It also relies on the most recent data and evidence to show how use of long-term finance varies across countries and discusses what governments can do to promote the use of long-term finance by firms. Here are the main messages regarding firms’ use of long-term finance:

Firms tend to match the maturity of their assets and liabilities, and thus they often use long-term debt to make long-term investments, such as purchases of fixed assets or equipment. Long-term finance also offers protection from credit supply shocks and having to refinance in bad times. But not all firms need long-term finance. For example, firms with good growth opportunities may prefer short-term debt since they may want to refinance their debt frequently to obtain better loan terms after they have experienced a positive shock.

The theoretical literature is inconclusive on how the maturity of debt affects investment and firm performance. On the one hand, long-term finance is likely to have a positive effect on investment and performance for firms that need it since it allows firms to invest in projects that bring in returns in a relatively long time horizon. On the other hand, long-term finance can distort managers’ incentives, hampering investment and firm performance. However, empirical evidence from both cross-country and within country studies suggests that long-term finance has a positive effect on firm investment and performance—unless the finance is provided in the form of directed credit.

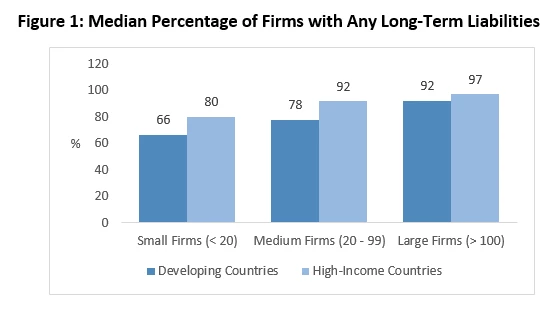

Information on the use of long-term finance by firms across a large number of countries comes primarily from balance sheet data collected from Bureau Van Dijk in the ORBIS database and also from the World Bank’s Enterprise Surveys. Both data sources suggest that firms in developing countries have fewer long-term liabilities than firms in high-income countries, even after controlling for firm characteristics (see Figure 1 below). Also, small firms use less long-term finance than larger firms.

Source: ORBIS data for 87 countries, covering the period 2004 to 2011. For a detailed data description, see Demirgüç-Kunt, Martinez Peria, and Tressel (2015a).

Note: Developing countries include low- and middle-income countries. Firm size is defined based on number of employees.

A stable political and macroeconomic environment is a necessary condition for long-term finance to thrive since it allows firms to predict the risks and returns associated with long-term investments. Also, firms’ ability to obtain long-term financing tends to be greater in countries with a contestable, well-regulated banking system and with developed capital markets.

Weakness in the contractual environment is an important underlying reason why long-term debt is less common in developing countries. When lenders cannot rely on legal institutions to enforce their claims to loan repayment, they may prefer to lend short term, so that the continued need for renegotiation provides incentives for borrowers to exert effort and make sound investments. In fact, most policies that can increase the supply of long-term finance are based on interventions that lessen the need to rely on short-term debt to discipline and monitor firms.

- Quick contract enforcement through specialized debt recovery courts, in particular, has been shown to increase firms’ debt maturity. Other legal institutions that help lenders enforce their claims include creditor rights and bankruptcy laws.

- An effective corporate governance framework can lessen firms’ reliance on short-term debt. Corporate governance matters for loan maturity because monitoring firm managers through independent boards and stronger shareholder protections can substitute for monitoring through the use of short-term debt.

- Information sharing through credit bureaus fosters long-term finance by reducing information asymmetries between firms and lenders.

- The introduction of registries for movable assets is also associated with an increase in the maturity of bank loans to firms since these registries increase the amount of assets that firms can post as collateral.

- Leasing arrangements allow firms to use and eventually own fixed assets and equipment. While leasing tends to be more prevalent in strong institutional environments, countries that do not have strong contract laws can still develop a leasing market if they pass appropriate leasing legislation.

Join the Conversation