Favorable growth prospects and higher asset returns in emerging market economies have been led to a sharp increase in flows of foreign finance in recent years. Massive inflows to the domestic economy may fuel activity in financial markets and — if not properly managed — booms in credit and asset prices may arise (Reinhart and Reinhart, 2009; Mendoza and Terrones, 2008, 2012). In turn, the expansion of credit and overvalued asset prices have been good predictors not only of the current financial crises but also of past ones (Schularick and Taylor, 2012; Gourinchas and Obstfeld, 2012).

In a recent paper, Megumi Kubota and I synthesized both strands of the empirical literature and examine whether gross private inflows can predict the incidence of credit booms — and, especially, those financial booms that end up in a systemic banking crises.1 More specifically, our paper finds that surges gross private capital inflows can help explain the incidence of subsequent credit booms — and, especially those financial booms that are followed by systemic banking crises. When looking at the predictive power of capital flows, we argue that not all types of flows behave alike. We find that gross private other investment (OI) inflows robustly predict the incidence of credit booms — while portfolio investment (PI) has no systematic link and FDI surges will at best mitigate the probability of credit booms. Consequently, gross private OI inflows are a good predictor of credit booms.

Our paper evaluates the linkages between surges in gross private capital inflows and the incidence of booms in credit markets. In contrast to previous research papers in this literature: (i) we use data on gross inflows rather than net inflows; and, (ii) we use quarterly data for 71 countries from 1975q1 and 2010q4 instead of annual frequency. In this context, we argue that the dynamic behavior of capital flows and credit markets along the business cycle is better captured using quarterly data.2 As a result, we can evaluate more precisely the impact on credit booms of (the overall amount and the different types of) financing flows coming from abroad. On the other hand, we are more interested the impact on credit markets of investment inflows coming from foreign investors. Using information on net inflows — especially since the mid-1990s for emerging markets — would not allow us to appropriately differentiate the behavior of foreign investors from that of domestic ones and it may provide misleading inference on the amount of capital supplied from abroad (Forbes and Warnock, 2012).[3]

Credit booms are identified using two different methodologies: (a) Mendoza and Terrones (2008), and (b) Gourinchas, Valdés and Landarretche (2001) — also applied in Barajas, Dell’Ariccia, and Levchenko (2009). Moreover, we look deeper into credit boom episodes and differentiate bad booms from those that booms that may come along with a soft landing of the economy. In general, the literature finds that credit booms are not always followed by a systemic banking crisis — see Tornell and Westermann (2002) and Barajas et al. (2009). For instance, Calderón and Servén (2011) find that only 4.6 percent of lending booms may end up in a full-blown banking crisis for advanced countries whereas its probability is 8.3 and 4.6 percent for Latin America and the Caribbean (LAC) and non-LAC emerging markets. Those credit booms that end up in an episodes of systemic banking crisis are denoted as “bad” credit booms — see Barajas et al. (2009).

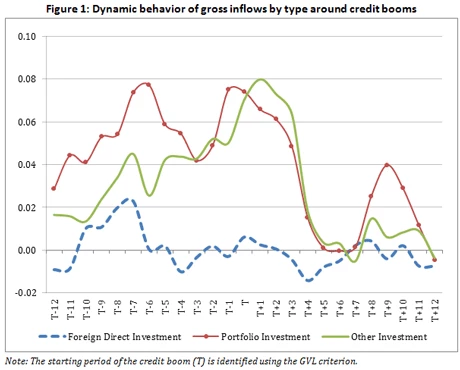

Our panel Probit regression supports the evidence that gross private capital inflows are a good predictor of the incidence of credit booms. This result is robust with respect to any sample of countries, any criteria of credit booms and any set of control variables. Next, the probability of credit booms is higher when the surges in capital flows are driven by gross OI inflows and, to a lesser extent, by increases in gross portfolio investment (FPI) inflows. Surges of gross foreign direct investment (FDI) inflows would, at best, reduce the likelihood of credit booms. The main conduit is gross OI bank inflows when we unbundle the effect of gross private OI inflows on credit booms. Third, we find that capital flows do explain the incidence of bad credit booms and that the overall impact is significantly positive and greater than the impact on overall credit booms. Figure 1 confirms our econometric findings: gross OI inflows tend to precede the start of the credit boom and persists even 2 periods after its beginning. Gross FPI inflows also tend to precede credit booms but not as monotonically. Finally, gross FDI inflows tend to remain almost invariant around credit boom episodes.4

The likelihood of bad credit booms is greater when surges in capital inflows are driven by increases in OI inflows. As a result, the overall positive impact of gross OI inflows significantly predicts an increase in credit booms although the evidence on the impact of gross FDI and FPI inflows is somewhat mixed. So far, the literature has shown that increasing leverage in the financial system and overvalued currencies are the best predictors of financial crisis (Schularick and Taylor, 2012; Gourinchas and Obstfeld, 2012). Moreover, our findings suggest that surges in capital flows (especially, rising cross-border banking flows) are also a good indicator of future financial turmoil.

Reference

Barajas, A., G. Dell’Ariccia, and A. Levchenko, 2009. “Credit Booms: the Good, the Bad, and the Ugly.” Washington, DC: IMF, manuscript

Calderón, C., and M. Kubota, 2012. “Gross Inflows Gone Wild: Gross Capital inflows, Credit Booms and Crises.” The World Bank Policy Research Working Paper 6270, December.

Calderón, C., and M. Kubota, 2012. “Sudden stops: Are global and local investors alike?” Journal of International Economics 89(1), 122-142

Calderón, C., and L. Servén, 2011. “Macro-Prudential Policies over the Cycle in Latin America.” Washington, DC: The World Bank, manuscript

Forbes, K.J., and F.E. Warnock, 2012. “Capital Flow Waves: Surges, Stops, Flight, and Retrenchment.” Journal of International Economics 88(2), 235-251

Gourinchas, P.O., and M. Obstfeld, 2012. “Stories of the Twentieth Century for the Twenty-First.” American Economic Journal: Macroeconomics 4(1), 226-265

Gourinchas, P.O., R. Valdes, and O. Landerretche, 2001. “Lending Booms: Latin America and the World.” Economia, Spring Issue, 47-99.

Mendoza, E.G., and M.E. Terrones, 2008. “An anatomy of credit booms: Evidence from macro aggregates and micro data.” NBER Working Paper 14049, May

Mendoza, E.G. and M.E. Terrones, 2012. “An Anatomy of Credit Booms and their Demise,” NBER Working Paper 18379, September.

Reinhart, C.M., and V. Reinhart, 2009. “Capital Flow Bonanzas: An Encompassing View of the Past and Present.” In: Frankel, J.A., and C. Pissarides, Eds., NBER International Seminar on Macroeconomics 2008. Chicago, IL: University of Chicago Press for NBER, pp. 9-62

Rothenberg, A., Warnock, F., 2011. “Sudden flight and true sudden stops.” Review of International Economics 19(3), 509-524.

Schularick, M., and A.M. Taylor, 2012. “Credit Booms Gone Bust: Monetary Policy, Leverage Cycles, and Financial Crises, 1870–2008.” American Economic Review 102(2), 1029–1061

2 Rothenberg and Warnock (2011), Forbes and Warnock (2012) and Calderón and Kubota (2012) already provide a more accurate analysis of extreme movement in (net and gross) capital flows using quarterly data.

3 The “two-way capital flows” phenomena cannot be identified using net inflows.

4 Note that the identification of credit boom episodes underlying Figure 1 corresponds to the Gourinchas, Valdes and Landarretche (2001) criterion (GVL).

Join the Conversation