Access to formal financial services has been expanding in recent years. But as people start to use these services for the first time, it has become clear that the challenge is not only providing access to financial services, but also ensuring that people have the behaviors and attitudes to use financial products responsibly and to their advantage. If not, increased access to finance could potentially lead to over-indebtedness and even financial crises.

Two recent nationwide surveys of 1,526 adults in Colombia and of 2,022 adults in Mexico measure financial capability to provide insights on how people manage their finances. The term “financial capability” refers to a broader concept than financial literacy or knowledge alone. It covers a number of different behaviors and attitudes related to participation in financial decisions, planning and monitoring the use of money, and balancing income and expenses to make ends meet.

The financial capability surveys find for example that, in Mexico, many make financial plans, but far fewer adhere to them. Seventy percent of those surveyed say they budget, but just one-third reported consistently adhering to a budget. Similarly, just 18 percent knew how much they spent last week. In Colombia, while 94 percent of adults reported budgeting how income would be spent, less than a quarter of those surveyed actively monitored spending or had precise knowledge of how much is available for daily expenses.

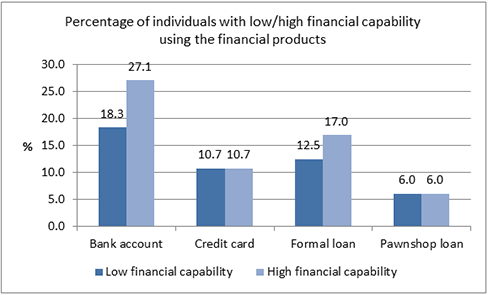

The surveys also include questions on use of common financial products, allowing us to examine how financial capability is related to financial access. To facilitate the analysis, we aggregated different capability components into an overall index of capability. Results from both Colombia and Mexico show that higher financial capability is related to a higher probability of using formal financial products (bank accounts, credit cards or loans from a financial institution). In Mexico, higher financial capability is also associated with a lower probability of getting a pawnshop loan.

Figure 1: Financial Capability and Usage of Financial Products in Mexico

Figures 1 and 2 illustrate these results by showing the percentages of individuals who have a bank account, credit card, formal loan, or pawnshop loan, by level of financial capability. Individuals classified as low (high) financial capability are those who have a financial capability index below (above) the median. Individuals with high financial capability are almost twice as likely to have a bank account as individuals with low financial capability. In Mexico, they are also twice as likely to have a credit card, and in Colombia they are more likely to have a formal loan. These relationships are not necessarily causal, but the analysis controls for a range of characteristics, such as income, education, and age.

Figure 2: Financial Capability and Usage of Financial Products in Colombia

The good news from these results is that since individuals with high financial capability tend to be the ones using formal financial services, they are probably using the services responsibly. However, the findings also highlight that individuals with low financial capability may be more likely to be excluded from using formal financial services.

Both Colombia and Mexico have in recent years introduced a number of measures with the objective of broadening access to formal financial services. One of these measures is the use of banking correspondents that provide new access points to services, such as deposits and credit card payments, through retail stores or similar establishments.

Our analysis for both Colombia and Mexico finds that the presence of banking correspondents in a municipality is associated with increased access to formal financial products, but only for individuals with high financial capability. For individuals with low financial capability banking correspondents are not associated with a use of formal financial products. These results suggest that the increase in access points through banking correspondents has not been sufficient to integrate individuals with low financial capability into the formal financial sector. Other initiatives may be needed, such as targeted financial education and improved design of financial products that encourage desired behaviors, such as savings.

Further Reading

Report on Financial Capability in Colombia

Report on Financial Capability in Mexico

Russian Trust Fund website www.finlitedu.org

Join the Conversation