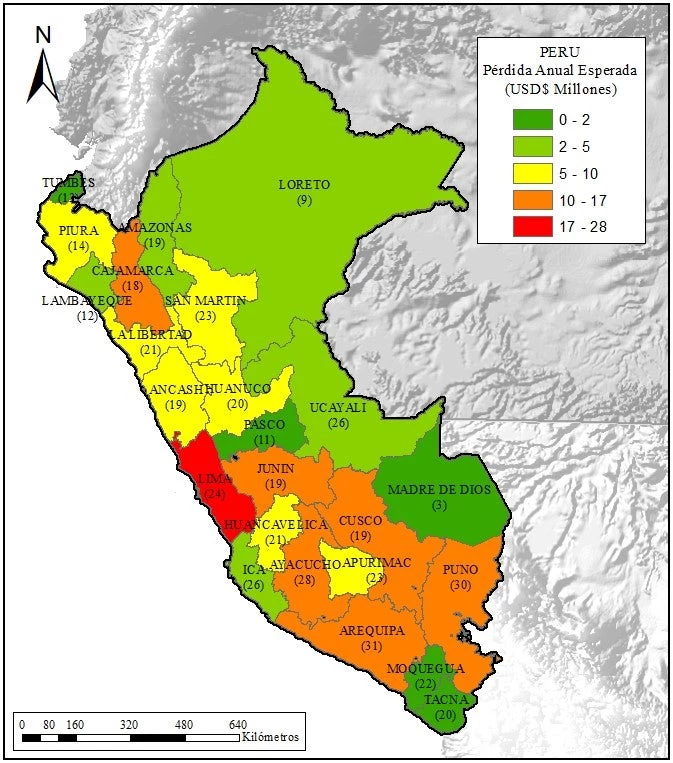

Helping African exporters survive in international markets should be a high-priority item on the agenda of development agencies. African exports suffer from high “infant mortality” compared to other regions of the world: Figure 1 shows that the life expectancy of export spells originating from sub-Saharan Africa is about two years (half the level for East Asia and the Pacific), with a median—not shown—around one year. That is, half of the continent’s exporters don’t make it past the first year. Such “hit-and-runs” on international markets cannot establish networks, relationships, and credibility.

Figure 1: Average Spell Survival, by exporting region

Source: Author's calculations, from COMTRADE data

Reducing this infant mortality is key to generating sustained export growth and job creation. It is also key to preserving the intangibles lost whenever a trade relation is interrupted, and to nurturing a class of capable, self-confident export entrepreneurs. Recent research shows why.

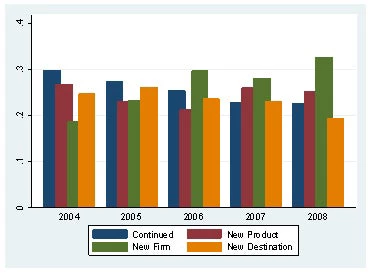

First, African countries, like most low-income countries, have dynamic export entrepreneurship. That is, the “extensive margin” of exports is highly active in terms of both new products and new markets, suggesting that the challenge is not so much to break into new markets as to survive there. As shown in Figure 2, in Tanzania more than two thirds of the trade flows every year are composed by new exporters or new products or new destinations. This experimentation or “self-discovery” process is healthy, and free markets should indeed be expected to generate creative destruction, the economic equivalent of Darwinism. But the excessive infant mortality of Africa’s exporters suggests that they are ill prepared for the tough competitive environment created by globalization, the elimination of quotas in textile and apparel, and preference erosion. Reducing the infant mortality of African exports means preventing potentially promising ventures from dying prematurely.

Figure 2: Decomposition of the Number of Trade Flows in Tanzania

Source: Author's calculations and Tanzania’s Customs Authority

Second, African firms learn from exporting, as they experience higher growth in earnings, employment, wages, workforce skill, and productivity than comparable firms after starting to export. This learning effect is particularly strong for firms that export to higher-income destinations. Raising export survival means enabling successful exporters to go through transformational processes that will make them better, tougher competitors—and, what is perhaps even more important, better employers.

Third, research produced as part of a World Bank project on raising African export survival shows that factors contributing to high infant mortality include poor access to credit, lack of information, and a gap between the capabilities of African producers and rising demands on the buyer side. Poor access to credit constrains size, which correlates with survival. Lack of information makes exporters aim at the wrong markets or fail to build on sufficiently strong comparative advantages. The “capability gap” includes the exporters’ ability to react to short lead times in the textile & apparel sector or to provide traceability and quality consistency in the agro-food sector.

Can something be done? What matters to guide policy and aid decisions is to identify market failures, the raison d’être of government intervention. Recent work by a joint World Bank/academic team focusing on four African countries (Tanzania, Malawi, Senegal and Mali) has identified what might turn out to be a key market failure—network effects between exporters of the same product from the same country. That is, when more firms export the same product to the same destination from the same country, the ability to survive of a new entrant goes up, as if they were helping rather than competing with each other. Failure to recognize this or lack of coordination—both likely to happen in the continent’s fragile, fragmented productive structures—may lead to a vicious circle where no one survives because too few try.

The authors offer several explanations for their findings. First, consistent with qualitative evidence and interviews with exporters, and drawing on the literature on information asymmetries and uncertainty, they argue that an exporter may obtain precious information through the network of competitors, potential buyers, relatives or friends involved in the same manufacturing activity and exporting to the same market. In fact, their results suggest that in products characterized by a higher degree of “quality heterogeneity”, measured by the dispersion in unit values, the importance of this “network effect” becomes larger. Second, they conjecture that access to credit may become easier when many exporters of the same product to the same destination are operating, because a larger number of exporters may provide signals about profitability to financial institutions and reduce constraints to access credit. On the opposite, an isolated exporter might have more difficulties convincing the financial institutions that the risks she faces are manageable given the uncertain environment of export relations. Correspondingly, they show that in products characterized by a higher degree of dependence from external finance as well as in sectors characterized by a lower degree of tangibility of their assets, where the needs to access finance and the risk of adverse selection are higher, the network effect is stronger.

Overall, these results suggest that these networks are stronger in the presence of informational asymmetries and dependence on bank finance, providing evidence towards their hypothesis that these “synergy effects” may indeed be driven by information spillovers. These results may help explain a finding highlighted in Easterly, Resheff and Schwenkenberg (2009), namely, that national export success often takes the form of `big hits', with one narrow export item suddenly growing rapidly. If a sufficient number of exporters target one market simultaneously, these results imply that their chances of surviving increase, possibly triggering a virtuous cycle of entry, survival and growth.

Encouraging, nurturing and coordinating exporters, in particular relatively inexperienced ones, may involve targeted interventions—strategic assistance, the provision of information, or matching grants—from government bodies like export-promotion agencies (EPAs). If the record of EPAs in developing countries, in particular in sub-Saharan Africa, is patchy at best, recent research shows that when such agencies involve the private sector in their management structures, they perform a lot better and can indeed make a difference. This is an example of new-generation, “soft” industrial policies that don’t cost very much while potentially doing a lot of good—and certainly no harm.

Citations/Further Reading:

Brenton, Paul, Denisse Pierola and Erik von Uexküll, 2009, `The Life and Death of Trade Flows: Understanding the Survival Rates of Developing-Country Exporters', Breaking Into New Markets: Emerging Lessons for Export Diversification, Shaw, Newfarmer, Walkenhorst (Edts.), The World Bank.

Van Biesebroeck J., 2005. Exporting raises productivity in Sub-Saharan African manufacturing plants. Journal of International Economics 67, 373-391.

“Success and Failure of African Exports”, by Olivier Cadot, Leonardo Iacovone, Denisse Pierola, and Ferdinand Rauch; World Bank Policy Research Working Paper #5184, 2011.

Easterly, William, Ariel Reshef and Julia Schwenkenberg, 2009, ‘The Power of Exports’, World Bank Policy Research Working Paper 5081.

Lederman, Daniel, Marcelo Olarreaga and Lucie Payton (2010), `Export Promotion Agencies: Do They Work?'; Journal of Development Economics 91, 257-265.

Join the Conversation